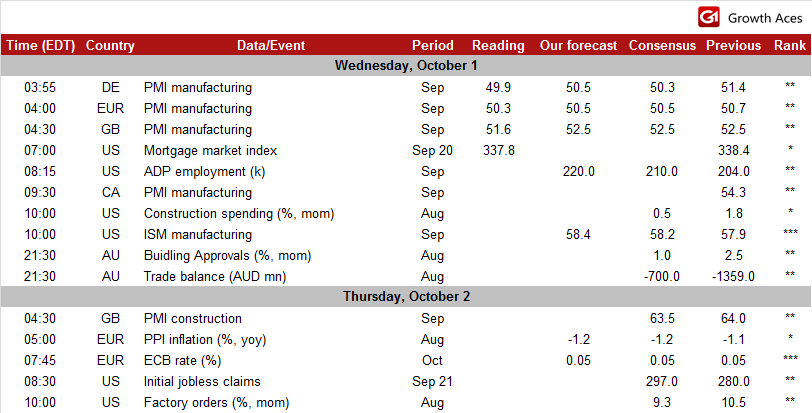

ECONOMIC CALENDAR

EUR/USD: No mercy for the EUR after PMIs

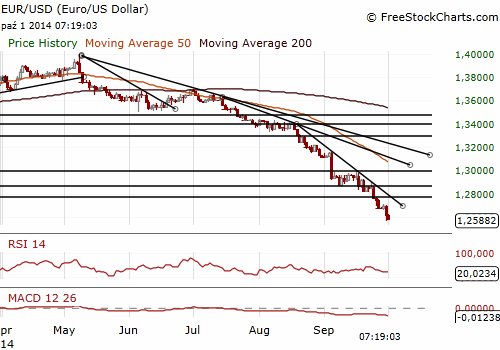

(looking to get short, next target 1.2502)

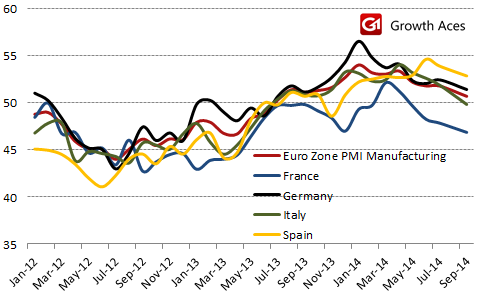

September manufacturing PMI came in at 50.3, the lowest since July last year and below both August's 50.7 and an earlier flash estimate of 50.5. New orders contracted for the first time in over a year on dwindling demand at home and from abroad suggesting output could start to fall as we move into the final quarter of the year. Factories also cut prices last month for the first time since April.

The German manufacturing sector was broadly stagnant in September, with the German PMI posting a shade below the 50.0 dividing line for the first time since June 2013. Output growth slowed to a 15-month low, while new orders fell for the first time since June last year and at the quickest pace in almost two years.

The weakening manufacturing sector will intensify pressure on the ECB to do more to revive the economy and no doubt strengthen calls for full-scale quantitative easing. In our opinion any additional action at tomorrow’s meeting is unlikely. However, the full-blown quantitative easing (adding government bonds to the ECB's shopping list) cannot be excluded around the turn of the year (after assessment of the second round of TLTROs).

Bear trend shows no signs of relenting. Key support is at 1.2502 (76.4% of 1.2042-1.3995), which in our opinion is the short-term target for the currency bears. We are looking to get short.

Significant technical analysis' levels:

Resistance: 1.2635 (hourly high Sep 3), 1.2664 (low Sep 29), 1.2715 (high Sep 29)

Support: 1.2571 (low Sep 30), 1.2561 (low Sep 6, 2012), 1.2502 (76.4% of 1.2042-1.3995)

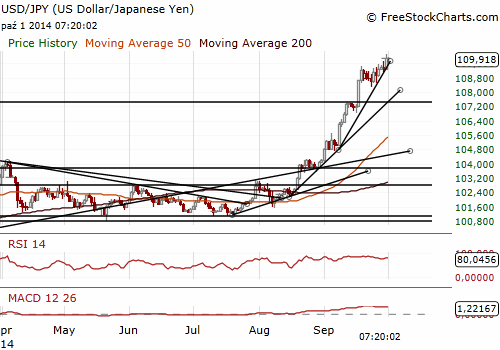

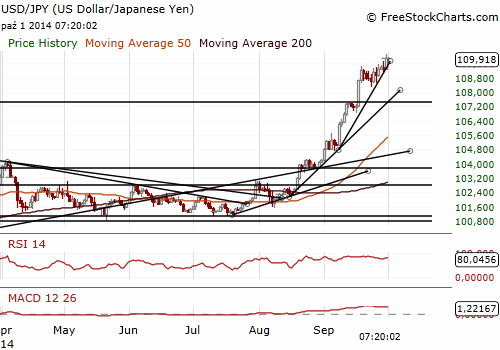

USD/JPY broke above 110.00 after Tankan survey

(still long)

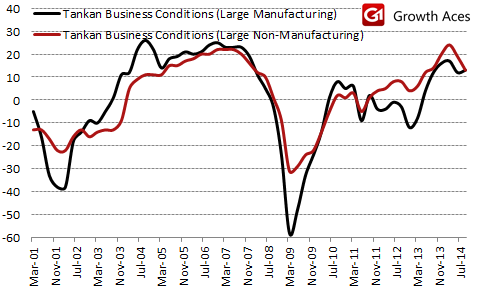

The results of Tankan survey was the most important Japanese reading for JPY traders this week. The headline index of business conditions for large manufacturers in the Q3 Tankan survey edged up from 12 to 13, above the median forecast of 10. However, this reading was overshadowed by a significant deterioration in business conditions in the non-manufacturing sector. The index for large firms fell to +13 from +19 (vs. the median forecast of +17), the sharpest decline since the second quarter of 2011.

Large manufacturers expect conditions to remain unchanged this quarter, while large non-manufacturers predict a small improvement of 1 point. The consensus expected a more upbeat outlook.

Today's survey suggests that the labour market continues to tighten. The employment index fell to -14, the lowest level since early 90s. Tight labour market does not, however, reflect in inflation pressure. The index for output prices was unchanged in the third quarter and suggests that price pressure may be not enough to meet the BoJ’s target.

A Japanese government spokesman Katsunobu Kato said that the Bank of Japan's Tankan survey of business sentiment showed that the pullback in demand following the sales tax hike is easing and the economy is continuing moderate growth. He added the country needs to monitor the JPY’s weakening carefully because of its impact on prices in addition to the positive effect it can have on the economy.

Japan's Cabinet Office issued estimates showing heavy rains and unusually cool weather this summer have shaved anywhere from 0.2 to 0.6 pp. from Q3 GDP. Economics Minister Akira Amari said heavy rain has probably pushed the GDP down by 1.6 pps. on an annualised basis in July-September.

Bank of Japan Governor Haruhiko Kuroda said that the central bank would make policy adjustment without hesitation if judged necessary to achieve its price target. The central bank expects continuation of moderate recovery trend and that effects of decline in demand following sales tax hike will wane gradually.

The USD/JPY broke above the level of 110.00 and hit the day’s high at 110.09 after the Tankan but then went back near 109.75 on profit taking. We see USD/JPY at higher levels soon and maintain our long position with the target of 110.50. In our opinion the likelihood of further easing from the BoJ is rising after another series of weak macroeconomic data. We have gone long also on the EUR/JPY. The EUR/JPY went up to 138.80 after the Tankan but fell again during European session after weaker Euro zone PMI releases.

Significant technical analysis' levels:

Resistance: 109.97 (hourly high Oct 1), 110.09 (high Oct 1), 110.33 (high Aug 19)

Support: 109.56 (session low Oct 1), 109.19 (low Sep 30), 109.15 (10-dma)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.