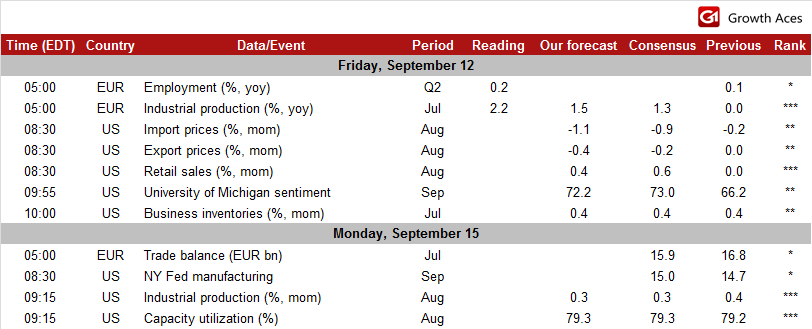

ECONOMIC CALENDAR

EUR/USD: Waiting for guidance on Fed interest rates

(bullish outlook in the medium term)

Industrial production rose in the Euro zone by 1.0% mom and 2.2% yoy vs. the median forecast of 1.3% yoy. Today’s data confirmed that German industrial production rose by 1.9% mom. Moreover, French industry recorded another increase in output after June’s large rise. Substantial rises were recorded also in Portugal and the Netherlands, while production stagnated in Spain and fell in Italy.

The rebound in industrial production provided hope that industry would contribute better to Q3 GDP growth after making a negligible contribution in Q2. On the other hand, PMI manufacturing readings remain still weak.

The Fed is facing perhaps its most pivotal meeting of the year next week. We expect a further USD 10bn reduction in the pace of monthly asset purchases. The focus, however, will be on the updated economic and interest rate projections (including forecasts for 2017) and possible changes to the statement.

Investors will parse the central bank's words closely for any clues on the timing of the first US rate hike in more than eight years. A strong run of US economic data has led Fed Chair Janet Yellen and other top officials to acknowledge the possibility they may need to raise rates sooner than they thought just a few months ago. We do not think that last week’s employment report has fundamentally changed this assessment.

If the Fed wants to send a message to market participants it may drop the “considerable time” in the guidance that the first rate hike will only come “a considerable time after the asset purchase program ends.” The Fed is also likely to drop the “significant” word in the sentence: “a range of labor market indicators suggests that there remains significant underutilization of labor resources.”

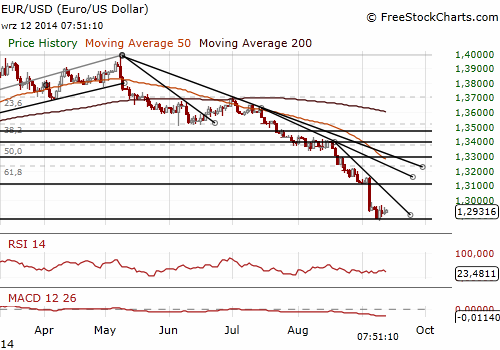

The EUR/USD remains near recent lows and holds within 1.2859-1.2963 range. Further consolidation in this range is possible ahead of the FOMC meeting on Wednesday.

GrowthAces.com is bullish on the EUR/USD in the medium term. We will be looking to get long on this pair.

Significant technical analysis' levels:

Resistance: 1.2963 (high Sep 10), 1.2990 (high Sep 5), 1.3030 (recovery high Sep 4)

Support: 1.2859 (low Sep 9), 1.2788 (61.8% of 1.2042-1.3995), 1.2755 (low Jul 9, 2013)

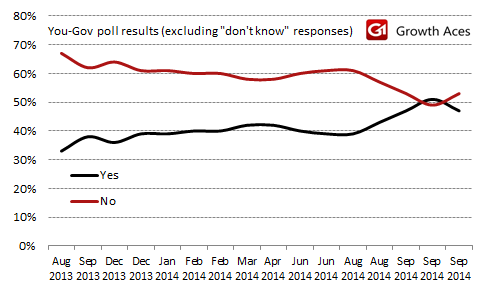

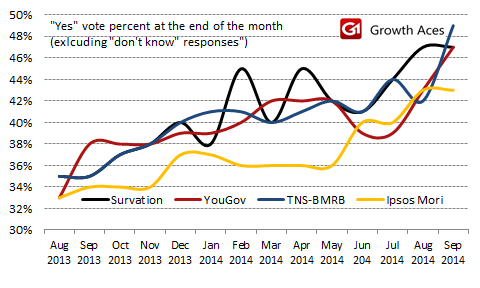

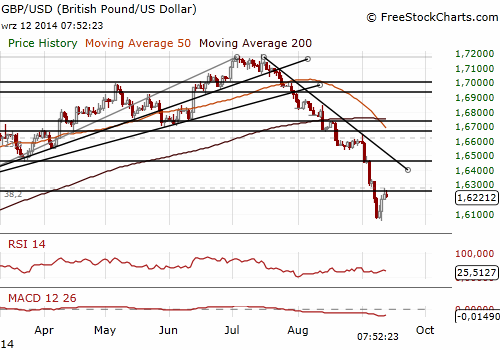

GBP/USD: Scots to decide: “Aye” to the independence?

(long position as we expect “no” vote on Thursday)

Scots are to decide whether their future lies within the United Kingdom or as an independent country next Thursday. For a long time, a “yes” vote was seen unlikely. Over the last few weeks, opinion polls have narrowed significantly. GrowthAces.com expects that Scots will vote ‘no’ but it is a very close call.

Today the ICM survey for the Guardian newspaper put supporters of the union on 51% against 49% for those in favour of independence, excluding people who said they did not know how they would vote.

What would an independent Scotland look like? No one knows. The Scottish National Party which heads the “yes” campaign wants to keep sterling in a currency union with the rest of the UK. In such case the BoE would continue to take into account the needs of the Scottish economy in its monetary policy as well as would be the lender of last resort for Scottish banks. The problem is that the UK government have categorically ruled out such a solution.

It is also unclear what share of the UK public debt Scotland will take, if any. While the continuing UK would expect an independent Scotland to take its fair share of the UK debt, this is by no means guaranteed. A rise in a debt-to-GDP ratio increases the likelihood that the state will default on its debt. Therefore, borrowing costs for the continuing UK can be expected to rise if Scotland becomes independent.

The GBP value could also be hit by Scotland’s independence. The first reason for GBP depreciation in is that high uncertainty that independence would create. The second reason is a chance that an independent Scotland prints its own currency. In this case some oil revenues will not be converted back into GBP for the payment of taxes or wages.

A substantial uncertainty may push undecided voters towards the status quo and that is why GrowthAces.com does not expect “aye” vote on Thursday.

The GBP/USD reached its 10-month low on Wednesday when Scottish independence fears were at their height. The fears have abated on the back of Survation poll suggesting 53% of Scots want to stay in the UK and the GBP/USD strengthened to 1.6277. In our opinion long position on the GBP/USD is more justified now. We have taken long position on the GBP/USD at 1.6220.

Significant technical analysis' levels:

Resistance: 1.6279 (38.2% of 1.6645-1.6052), 1.6312 (10-dma), 1.6340 (high Sep 5)

Support: 1.6187 (low Sep 11), 1.6052 (low Sep 10), 1.6003 (50% of 1.4814-1.7192)

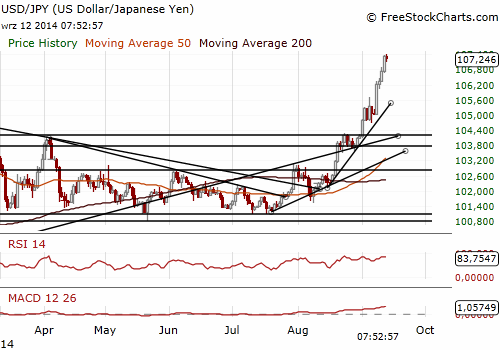

USD/JPY: BOJ’s Kuroda: Current JPY falls do not hurt Japan’s economy

(we keep our long position on the USD/JPY)

Bank of Japan Governor Haruhiko Kuroda said he did not see current JPY declines as negative for Japan's economy, adding that exchange rates should move in a way that reflect economic fundamentals. He also said that the central bank is ready to act if it feels that Japan is not making steady progress towards meeting its 2% inflation target. He added the BOJ sees no immediate need to ease monetary policy further.

Japanese Economics Minister Akira Amari said he cannot comment on whether or not the JPY's level is appropriate, one day after the currency slumped to a six-year low. He added Bank of Japan Governor Haruhiko Kuroda's comments in a meeting with the prime minister Thursday about easing policy if needed were part of the central bank's standard language on policy.

Industrial output grew in July by 0.4% mom and fell by 0.7% yoy in line with final data. Preliminary data showed growth of 0.2% mom.

The USD/JPY touched a high of 107.39, its strongest level since September 2008. For the week, the USD gained more than 2% vs. the JPY. The USD/JPY is getting closer to our target of 107.50. We have moved our stop-loss to 106.50 (from 105.90 previously)

Significant technical analysis' levels:

Resistance: 107.39 (high Sep 12), 108.04 (high Sep 19, 2008), 108.42 (high Sep 9, 2008)

Support: 106.64 (low Sep 11), 106.04 (low Sep 10), 105.95 (low Sep 9)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.