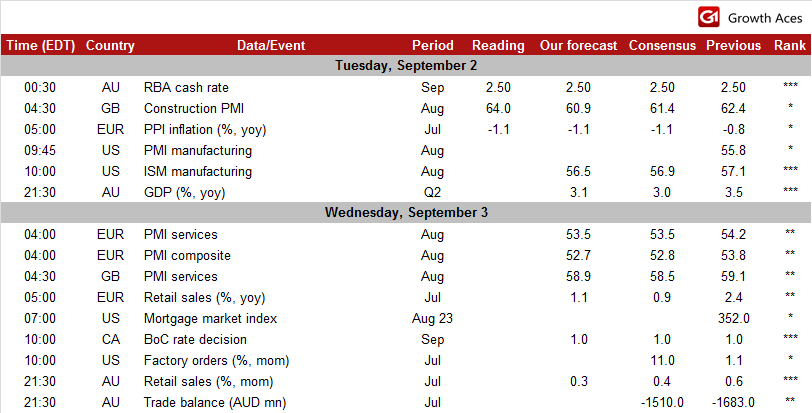

ECONOMIC CALENDAR

AUD/USD: No surprises from the RBA

The Reserve Bank of Australia bank kept its cash rate steady at a record low of 2.5%, as widely expected. The central bank is the opinion that the AUD remains above estimates of its fundamental value and is offering less assistance to economy than it otherwise might. The RBA said recent data suggested moderate growth. The central bank expects inflation to be consistent with the target over next two years. The RBA is the opinion that labor market has degree of spare capacity and it will take some time before jobless rate declines. In our opinion the statement of the RBA was neutral for the AUD.

Australia's current account deficit widened sharply in the three months to June to USD -13.742 bn as export growth stalled and imports rebounded. The Australian Bureau of Statistics said that net exports could detract 0.9 percentage point from GDP growth. Fortunately that was balanced by businesses rebuilding inventories, which looked to have added a whole percentage point to GDP growth.

Australian approvals to build new homes in July (seasonally adjusted) went up by 2.5% mom and 9.4% yoy vs. median forecast of 1.5% mom.

Australian government consumption and investment spending fell 0.6% qoq in the second quarter. Government spending for consumption rose 0.3%. Investment spending by the government and public enterprises fell by 3.9%.

The AUD/USD fell prior to Australian data and was little changed after macroeconomic releases. The AUD barely moved after the RBA decision. The most important event this week for the AUD/USD is Q2 GDP release scheduled for Wednesday (GMT). Our estimate is slightly above the median market forecast, however, recent poor foreign trade data are worrying. Our short-term outlook for the AUD/USD remains bullish. However, in the medium-term the outlook is balanced.

Significant technical analysis' levels:

Resistance: 0.9352 (high Sep 1), 0.9356 (50-dma), 0.9374 (high Aug 28)

Support: 0.9272 (low Aug 26). 0.9235 (low Aug 21), 0.9229 (low Jun 3)

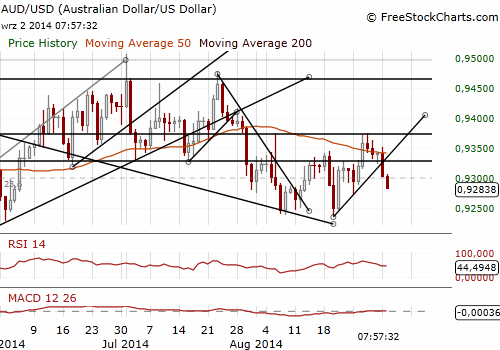

USD/JPY hits 105.00, for first time in 8 months.

The Bank of Japan will take its decision on monetary policy on September 4 (GMT). No policy change is expected. The BOJ will maintain its existing stimulus policy and optimistic economic view, preferring to take more time to gauge whether a run of weak data is sufficient to threaten a fragile recovery. The BOJ is likely to cut its economic growth projection for the current fiscal year when it reviews its long-term forecasts on October 31. The BOJ hopes that increase in wages, driven by a tightening job market, will support household spending and encourage companies to raise prices of goods and services. That, in the opinion of the central bank, will allow Japan to meet the inflation target of 2% next fiscal year.

Japanese Finance Minister Taro Aso said that the economy remains in a recovery trend, following a slew of economic indicators that cast some doubt about the strength of a rebound from April's sales tax hike.

The USD/JPY hit its highest since January at 105.00 against the JPY. The level is the nearest strong resistance and the next one is at 105.42 (high Jan 10).

We have taken profit from our long position. We are now looking to go long again on dips. Our trading strategy is to buy near 104.40.

Significant technical analysis' levels:

Resistance: 105.42 (high 10), 105.45 (high Jan 1), 105.50 (high Oct 6, 2008)

Support: 104.30 (low Sep 2), 104.08 (low Sep 1), 103.66 (low Aug 29)

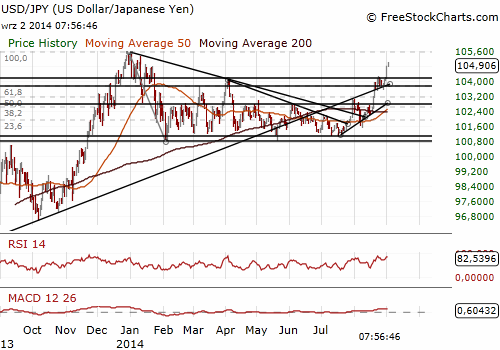

GBP/USD hit by growing support for Scottish independence.

A poll for the Sun and the Times newspapers showed support for Scottish independence at its highest ever level. The poll by YouGov showed the unionist lead had shrunk to 6 percentage points from 22 a month ago. When respondents were asked how they would vote in the referendum, 42% said they would vote for independence while 48% said they would vote against. Eight percent said they did not know and 2% did not intend to vote. By excluding those not intending to vote or undecided, the poll showed support for keeping the union at 53% against 47% seeking independence.

PMI index for construction climbed to 64.0 in August from 62.4 in July, exceeding forecasts. Output grew in each of the housing, commercial and civil engineering markets. Employment growth in construction remained strong, falling only slightly from a record high reported in July.

The GBP/USD dropped significantly due to growing support for Scottish independence. The rate reached our stop-loss level at 1.6535. We remain flat.

Significant technical analysis' levels:

Resistance: 1.6615 (high Sep 2), 1.6645 (high Aug 20), 1.6680 (high Aug 20)

Support: 1.6501 (trendline), 1.6460 (low Mar 24), 1.6425 (low Feb 12)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.