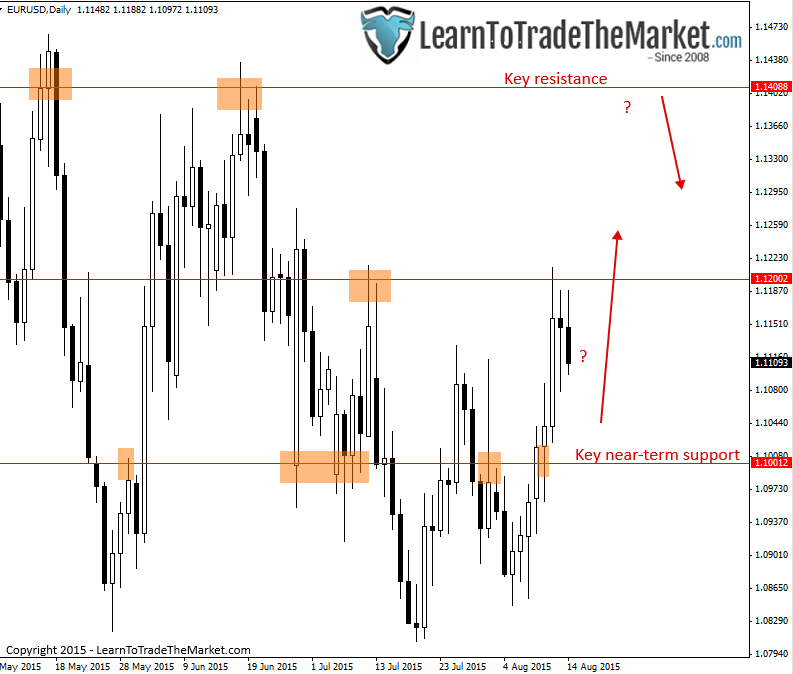

EURUSD - Euro/dollar potential for upside movement continues

We are currently mildly bullish on the EURUSD and will consider a long entry if we get a clear 4 hour or daily chart buy signal.We are watching support down near 1.1000 and slightly above for a price action buy signal if price rotates lower. A move up above resistance at 1.1200 could ignite short-covering and a larger rally back up to 1.1400 key resistance area.A sell signal up near 1.1400 resistance could then be a potential shorting opportunity if price does get back up to that level.

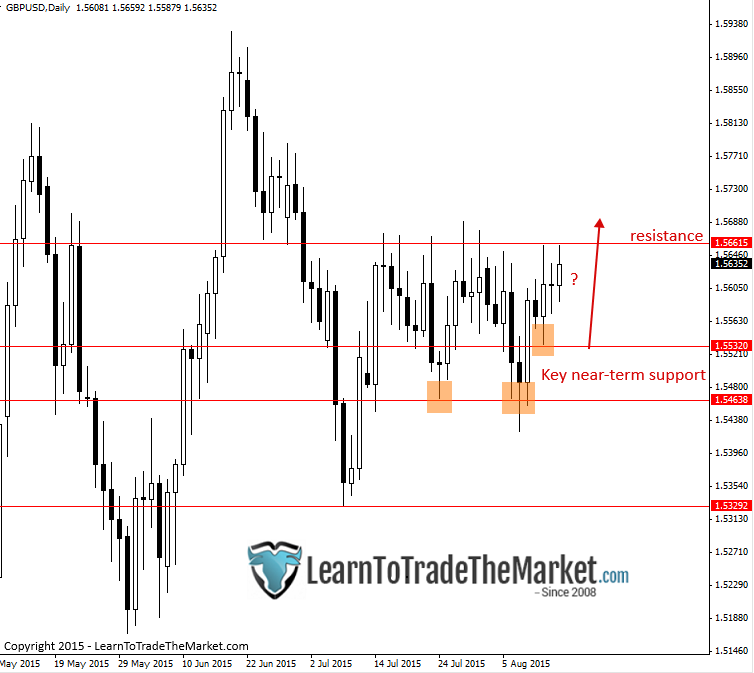

GBPUSD – Sterling/dollar remains strong

We remain bullish biased on the GBPUSD and we will continue looking fora buy signal to get long. There’s near-term support down between 1.5535 – 1.5465and we can look for buy signals there this week if price rotates lower. We may also see a bullish fakey pattern form following Friday’s inside bar pattern, this could also be an opportunity to get long. We aren’t expecting huge movement here, but buying the dips (rotations lower) has been working lately and that remains our strategy of choice in the coming days.

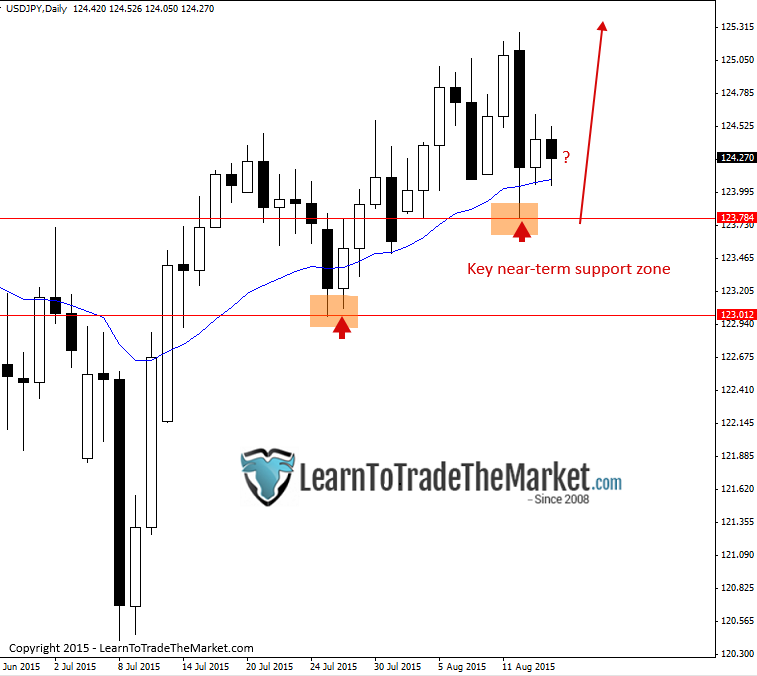

USDJPY – Dollar/yen uptrend continues, looking to buy

The USDJPY bullish trend remains intact and we are looking for evidence it initiate a long entry. Price is currently down near ‘value’ or support, and will probably show its hand early this week. We see two inside bars that formed late last week, these could see a false break to the downside and possibly form a bullish fakey buy signal. Watch the daily and 4 hour chart for obvious buy signals.

GBPJPY – Sterling/yen inside bar pattern

The GBPJPY remains in a clear uptrend and we can see price has been holding its own among its yen counter parts lately. Late last week, we can see inside bars formed (see chart below), we could see price breakout to the upside from these and continue the uptrend. If price breaks lower from them first however, we can watch for a bullish fakey pattern to form, which could be a good buy signal. Note also that on the 4 hour chart there pin bar signals still in play from last week; potential buy signals.

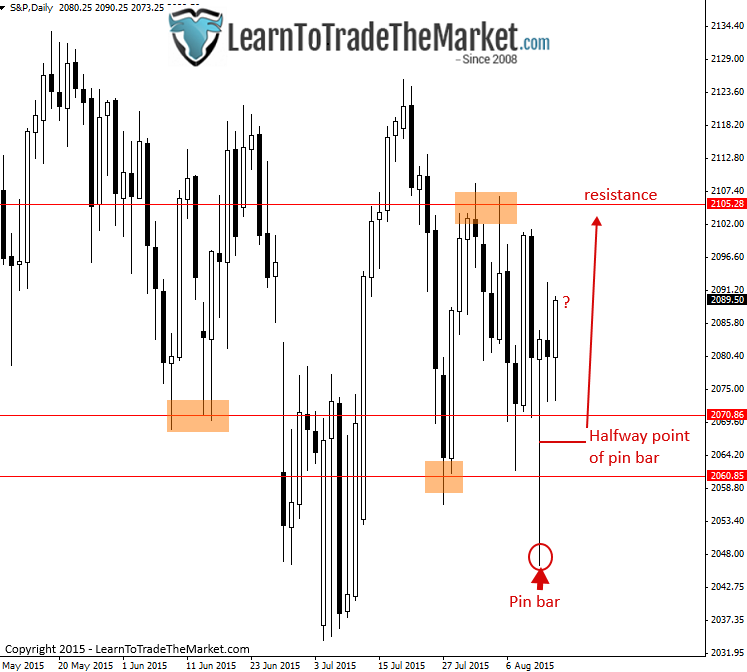

S&P500 – S&P500 pin bar signal still in play

In our recent commentary on the S&P500 we discussed a large bullish pin bar signal that formed on August 12th. This pin bar is still in play and we will look to get long, ideally on a retrace back to or near the pin bar’s halfway point (see chart below). Whilst above 2070.00 – 2060.00 key support zone, this market is looking very bullish with potential to at least test 2105.00 resistance.

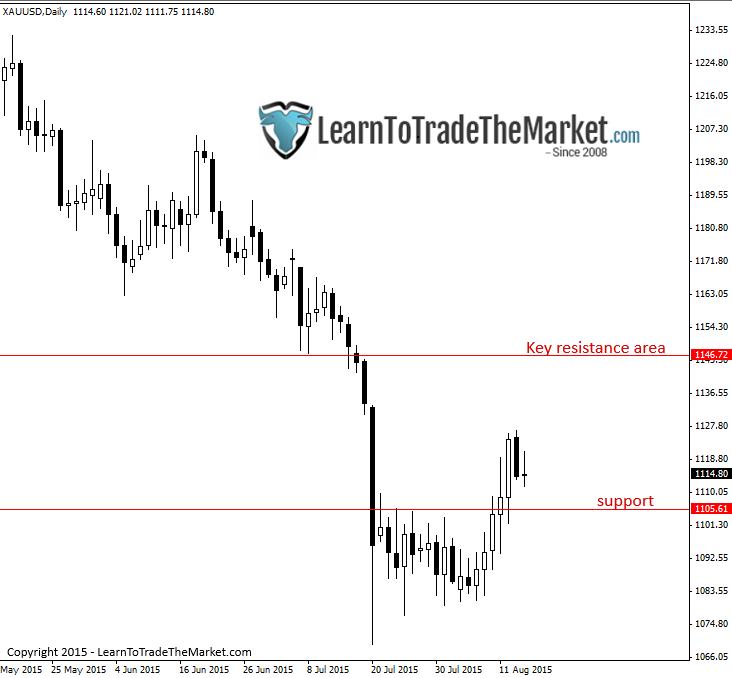

Gold – Gold remains buoyant but overall trend still down

Gold moved above 1105.00 last week but stalled into the week’s end. Still, that 1105.00 level remains important for active traders this week; whilst above it we see potential for mildly higher prices, perhaps back up to 11400.00 – 1150.00 region. If 1105.0 fails however, there is massive risk to the downside. If we do get up to that 1140.00 – 1150.00 resistance zone we will look for 1 hour, 4 hour or daily chart price action signals to sell,in-line with the overall downtrend.

Copyright Learn To Trade The Market 2015

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.