Analysis for April 26th, 2016

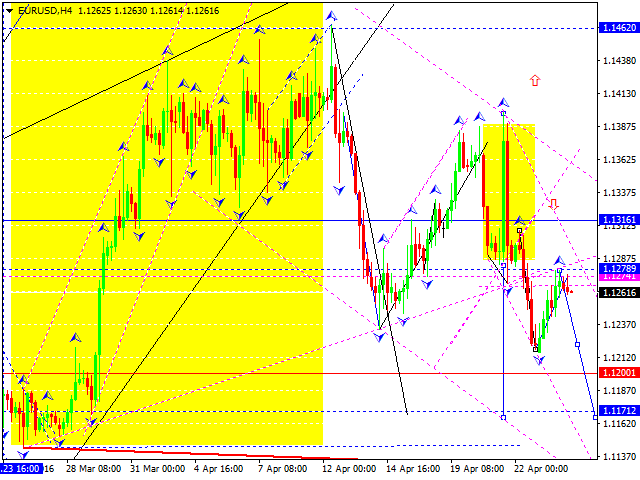

EUR USD, “Euro vs US Dollar”

Eurodollar continues moving downwards inside the fifth structure. We think, today the price may reach 1.1200 or even 1.1160. After that, the pair may be corrected to return to 1.1330.

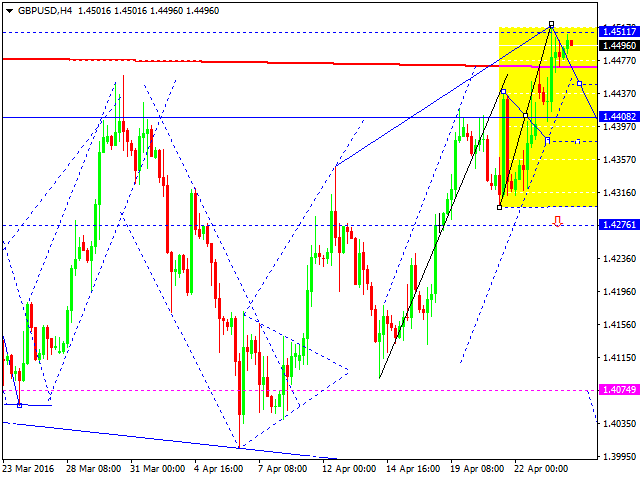

GBP USD, “Great Britain Pound vs US Dollar”

Pound is moving upwards; it has already reached another new high. We think, today the price may fall towards the downside border of the consolidation range at 11.4303 and then return to 1.4400. Later, after breaking the minimum, the market may continue moving downwards to reach 1.4076.

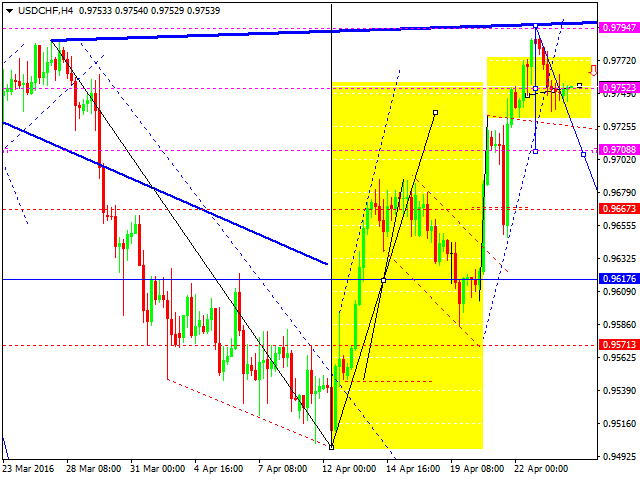

USD CHF, “US Dollar vs Swiss Franc”

Franc is consolidating without any particular direction. We think, today the price may break this narrow consolidation range upwards and then continue growing to reach 0.9970. However, if the consolidation channel is broken downwards, the pair may be corrected with the target at 0.9617 (an alternative scenario).

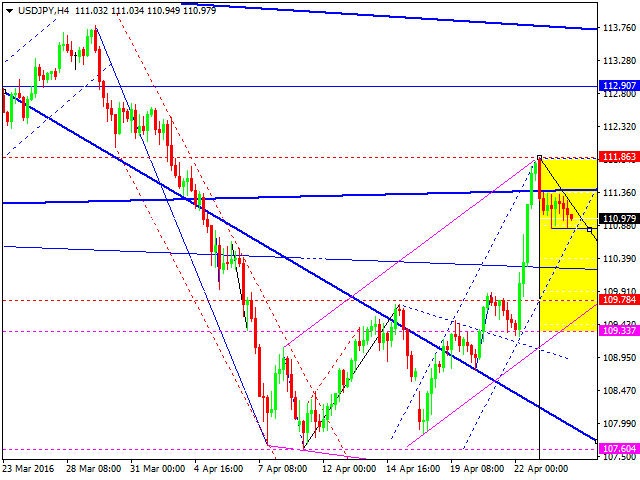

USD JPY, “US Dollar vs Japanese Yen”

Yen has broken the minimum of its descending impulse. We think, today the price may reach 109.78. After that, the pair may test 111.00 from below.

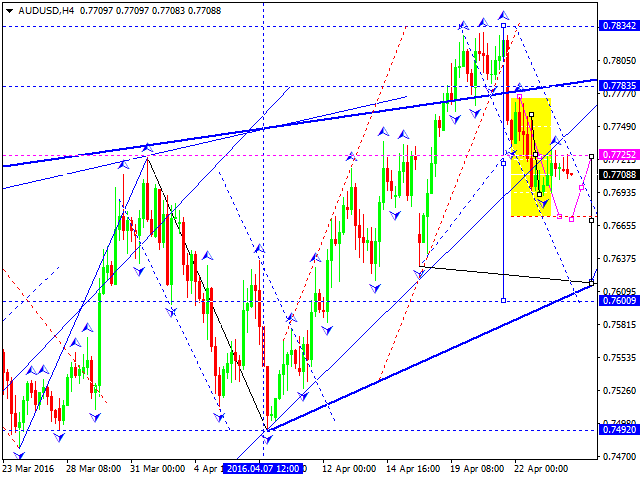

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is consolidating. We think, today the price may fall to reach the target at 0.7600 and then start a new correction to return to 0.7725.

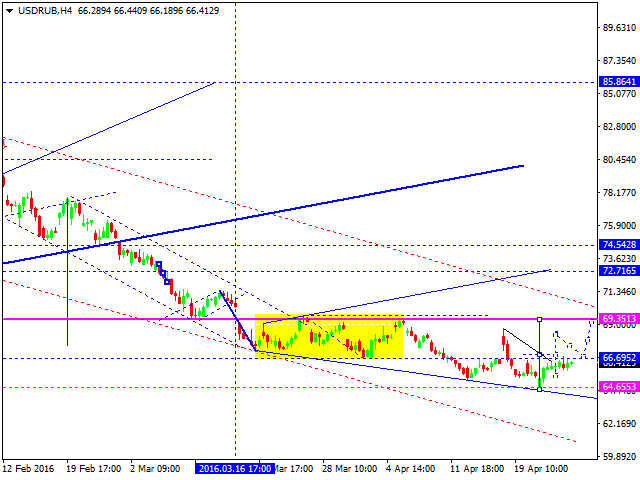

USD RUB, “US Dollar vs Russian Ruble”

Being under pressure, Russian Ruble is moving upwards. We think, today the price may stays above 66.70 and even expand the trading range up to 68.30. Later, in our opinion, the market may test 66.70 from above and then grow towards 69.35.

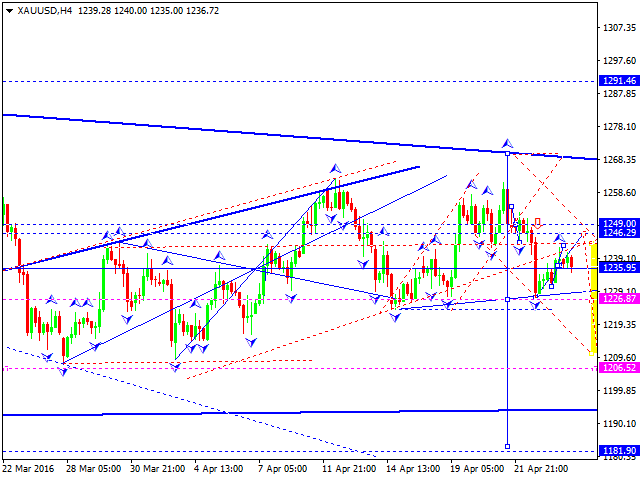

XAU USD, “Gold vs US Dollar”

Gold is growing towards 1246. Possibly, the price may test 1249 from below. Later, in our opinion, the market may break the ascending channel and form another descending wave towards 1226. The local target of the third wave is at 1206.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.