Analysis for April 5th, 2016

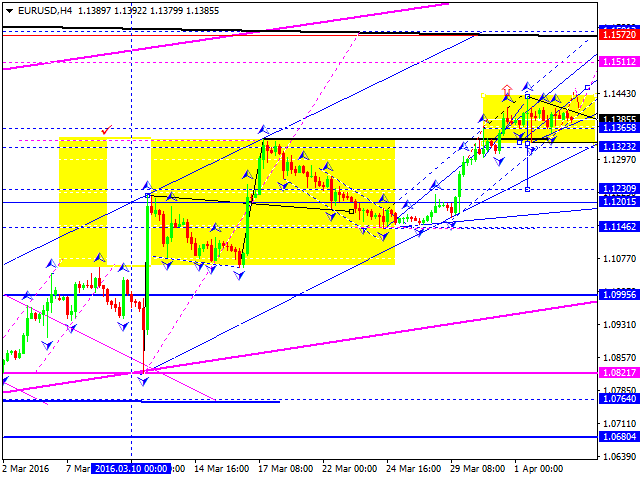

EUR USD, “Euro vs US Dollar”

Eurodollar is moving inside the narrow consolidation channel at the top of its ascending wave. If the pair breaks the channel downwards, it may fall towards 1.1200; if upwards – continue growing to reach 1.1570 (an alternative scenario). Later, in our opinion, the market may continue falling with the target at 1.1000.

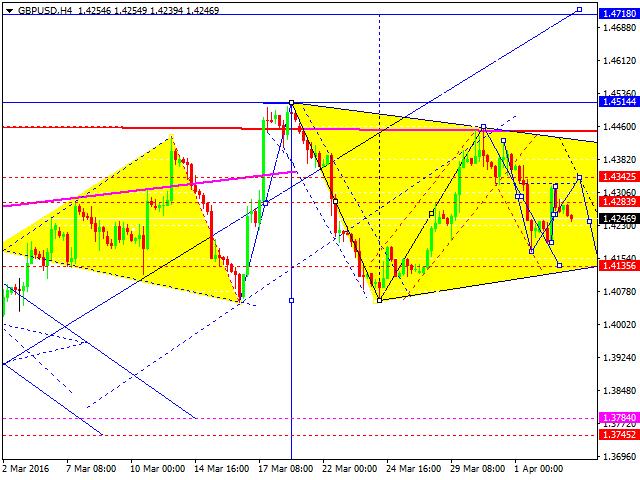

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is moving downwards. Although the market attempted to start a correction, we think the price may reach 1.4340. However, the main scenario suggests that the pair is expected to move downwards to reach 1.4135. Possibly, it may form a large triangle pattern.

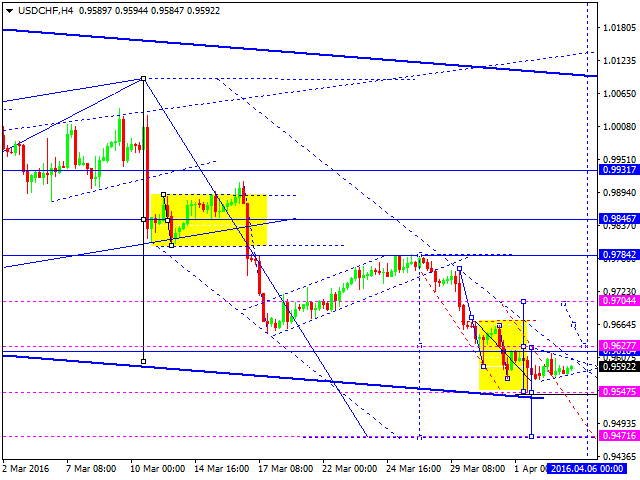

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving inside the consolidation channel at the lows of its descending wave. If the pair breaks the channel downwards, it may reach 0.9475 (an alternative scenario); if upwards – grow towards 0.9700.

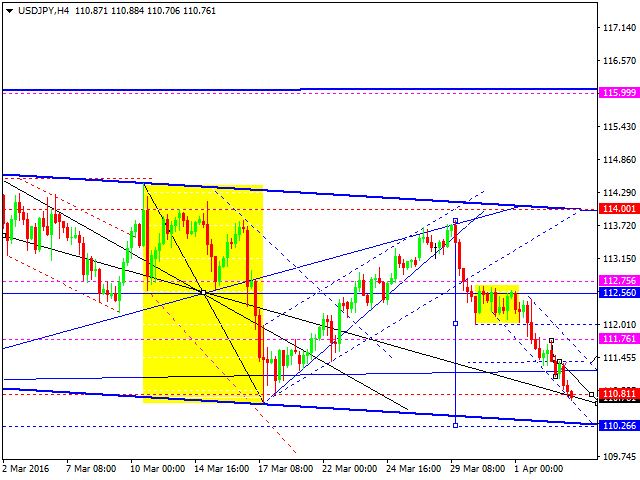

USD JPY, “US Dollar vs Japanese Yen”

Yen continues falling with the target at 110.30. After reaching this level and completing the structure, the market may return to 112.50.

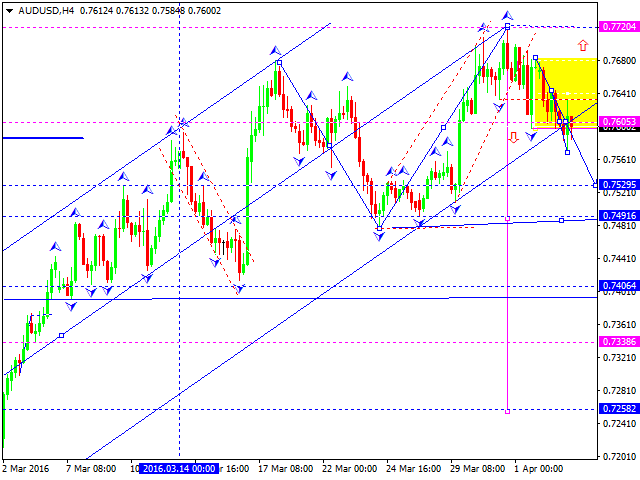

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has almost completed a downside continuation pattern. The local target is at 0.7530. After that, the pair may test 0.7605 from below and then fall to reach 0.7491.

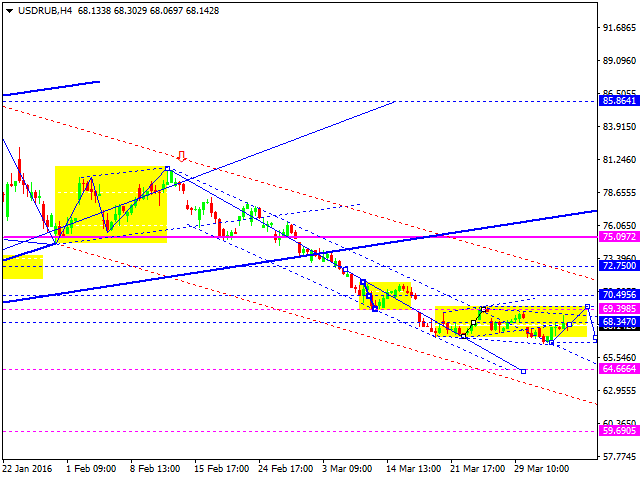

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is consolidating at its lows. Possibly, the price may grow to reach 70.50. However, the main scenario implies that the market may continue forming the third descending wave with the target at 65.00.

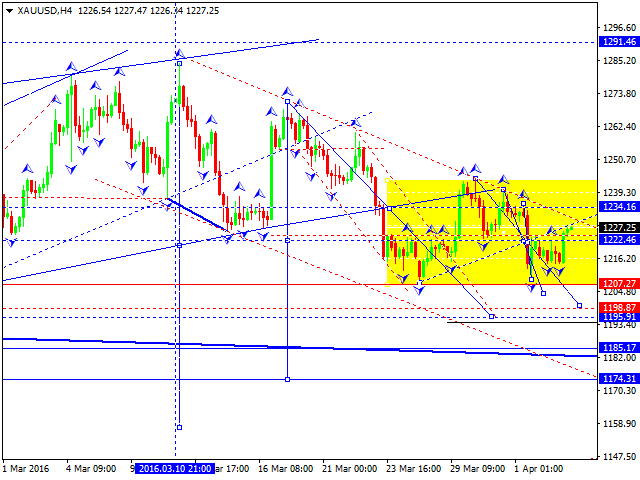

XAU USD, “Gold vs US Dollar”

Gold is forming the third descending wave. Possibly, the price may try to reach 1234 once again and the return to 1196. In this case, later the market may form a continuation pattern near 1222. The predicted target is at 1174.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.