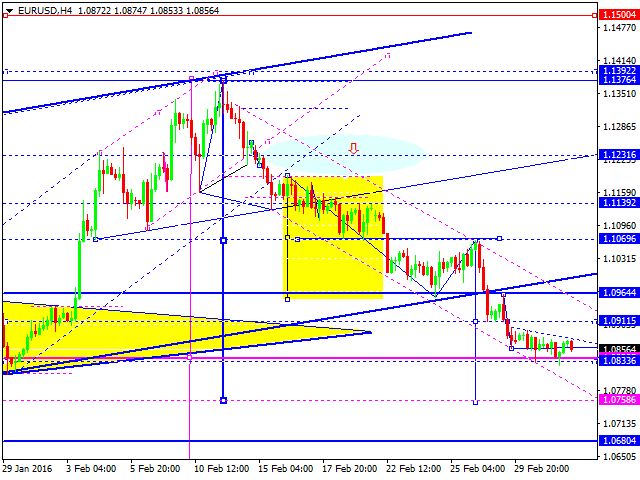

Pair Euro-Dollar is trading in the consolidation range with minimums updated. The main scenario considers the possible sliding to the level 1.0770. Actually, market has fulfilled the calculated target of the first wave in the fifth sliding wave. The possibility of further sliding is considered as sign of the trend with expansion. Goal – breakage of level 1.1000 down. After the testing of the target, correcting "Flag" with returning to the 1.1060 is anticipated. Test from the below.

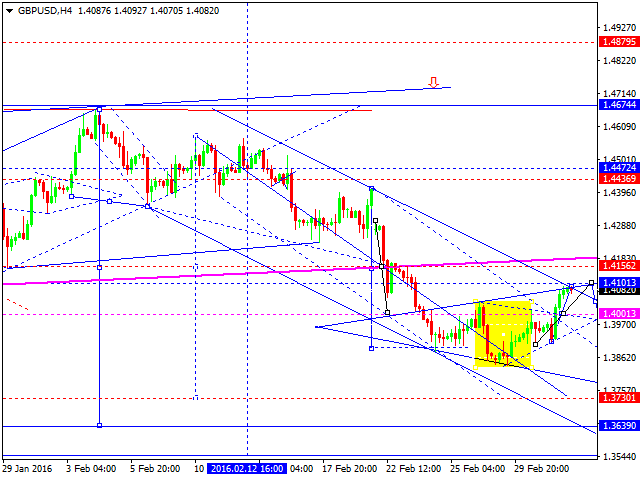

Pound to US Dollar is trading with rising. Actually, market offers to consider the possibility of correction to the level 1.4150. Test from the below. After – resuming of sliding to the level 1.3700 is expected.

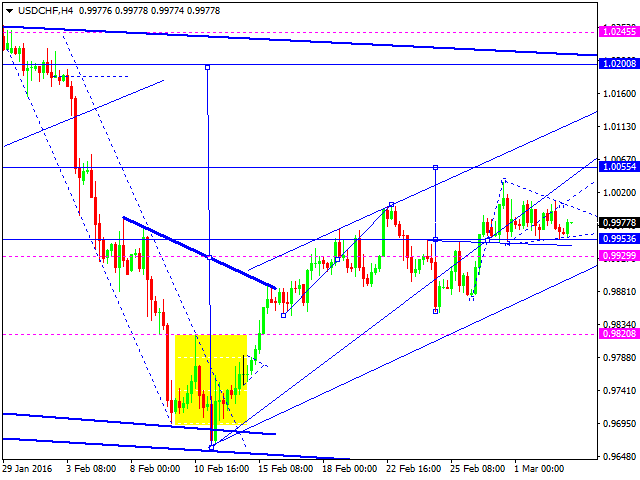

Dollar-Franc is trading in consolidation range of growth wave. Upward trend and test of the level 1.0055 are considered as the main scenario. Later the one more test of the level 0.9955 from above is not excluded. Later – growth to test the level 1.0200.

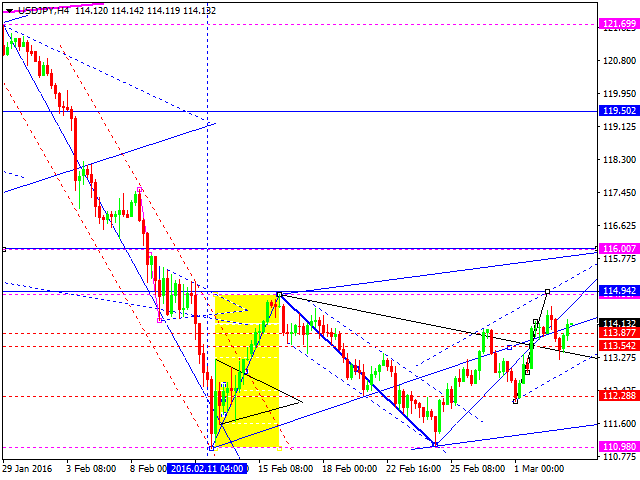

Pair Dollar-Yen offers to the market to consider the possibility of continuation of the correction. Today, we consider the possibility of the test of the level 114.95. Later as the forth wave – returning to the level 113.54 (as minimum). After – we will consider the possibility of the growth in the fifth wave to test 116.00. So the correction in the form of "Flag" is expected. Later – downtrend is continuing with the next target at the level 110.30.

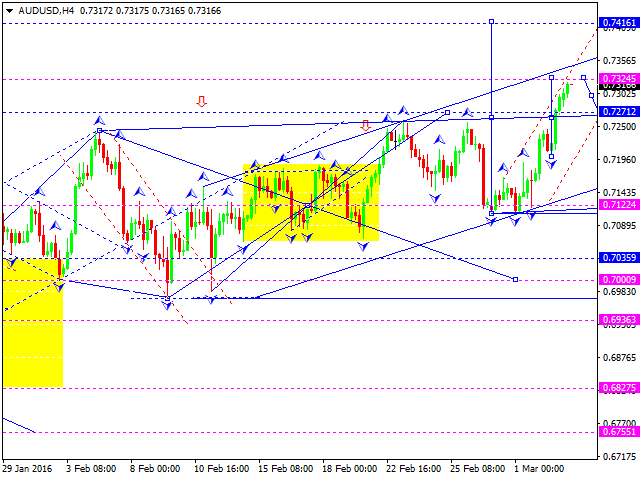

Pair AUS Dollar to US Dollar keeps the expansion of the growth structure. Test of the level 0.7330 is considered. Later – test from the above 0.7270. After that we will consider the possibility of the growth to the level 0.7416.

Today, Russian Rouble is trading to continue the developing of the third downward wave. Target – on the level 72. Later – consolidation. When there will be breakage down, we will consider the possibility of continuation of the third sliding wave. The next target – to intersect the level 69.

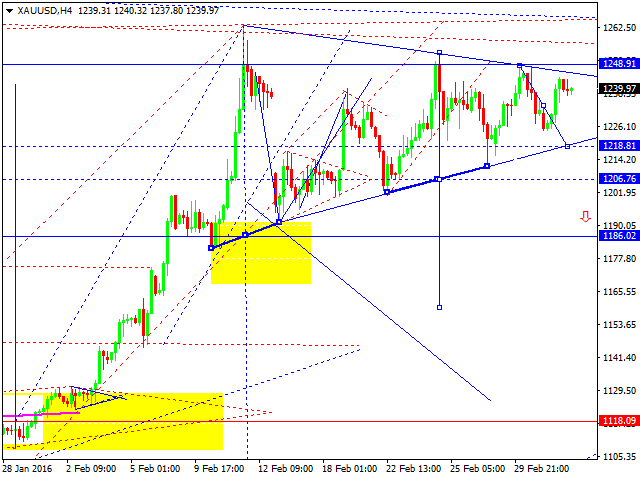

Gold keeps trading in the consolidation "Triangle". Sliding to the level 1218 is considered as the main scenario. When that level will be break to test the level 1186 is possible.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.