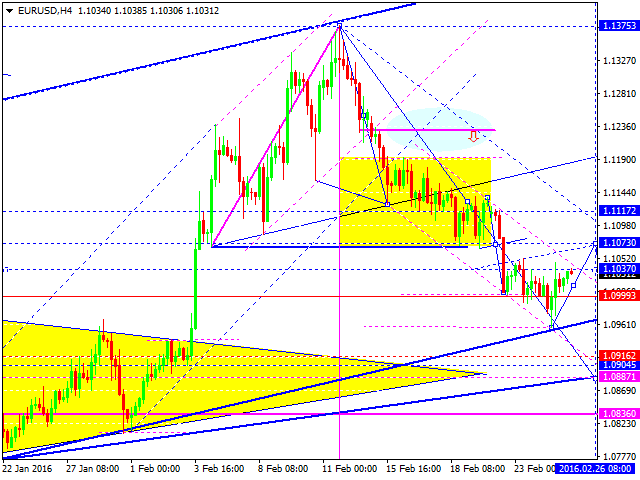

The euro dollar currency pair extended the consolidation down and returned back into the consolidation range. We do not rule out the market fulfilling the test from below 1.1070. Next, we consider the main scenario as a further decline to the level of 1.0900.

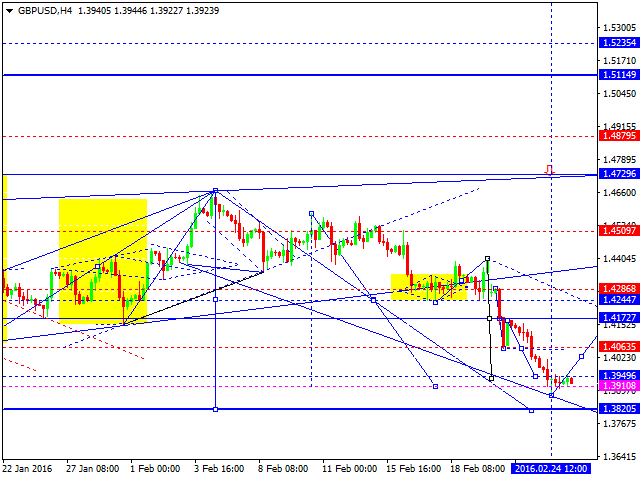

The pound against the US dollar currency pair has fulfilled another extension down. The next step - a correction to test the 1.4000 level from the bottom (as the minimum). The maximum correction can happen with a return to 1.4173. Then - again decrease to the level of 1.3850, with which we expect the completion of this wave. Then, we consider a higher correction to the level of 1.4288.

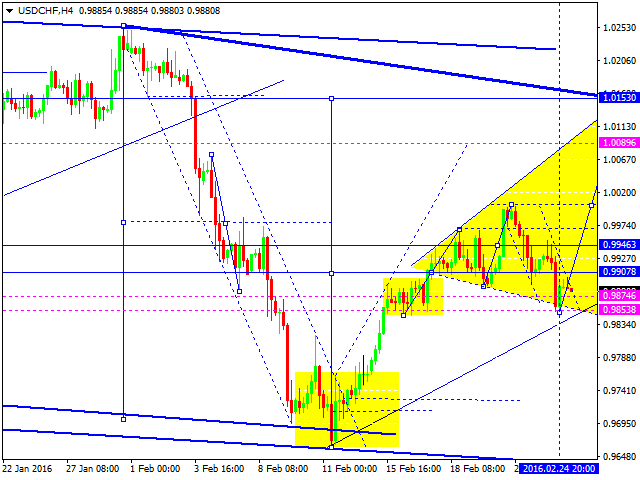

The USD CHF currency pair could managed to work the test of the lower boundary of the diverging "triangle". The next step - an increase of the upper limit of the test. We consider the matrix of growth to the level of 1.0150.

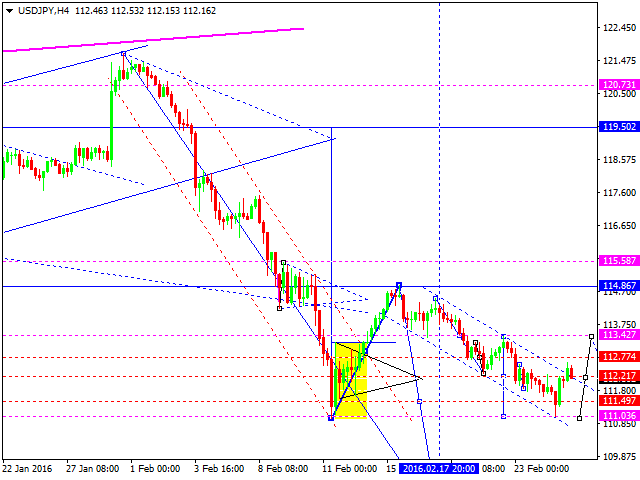

The USD JPY currency pair is trading at the lower boundary of a retreat from the consolidation range. For today, we consider the possibility of growth to the level of 113.43.

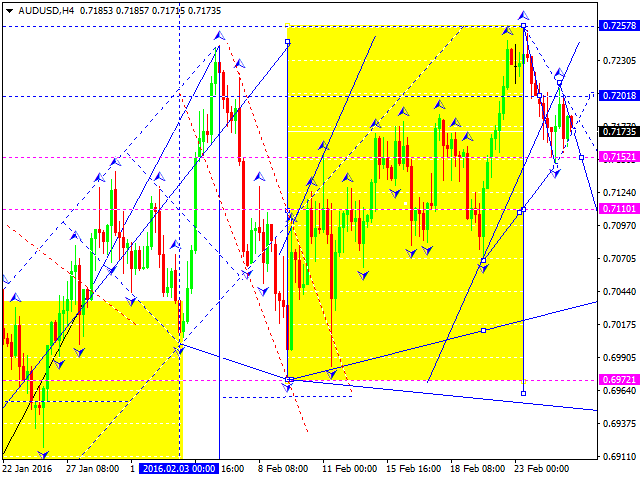

Australian dollar against the US dollar has worked the correction to the impulse to decline and traded in another structure to reduce to the level of 0.7100. Next - the test level below 0.7150. Then - the continued decline in the level of overlap of 0.7047.

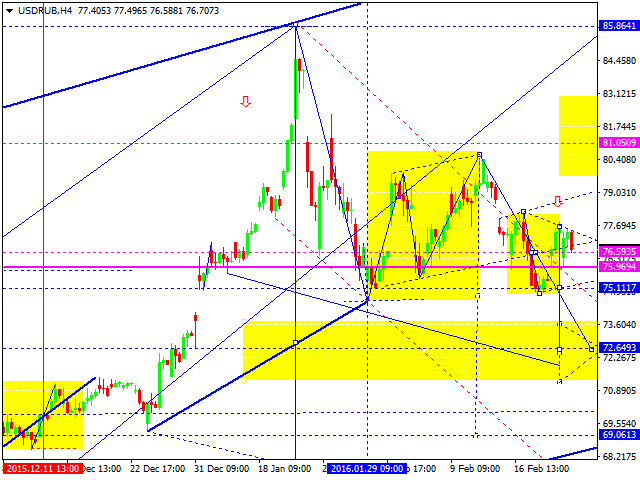

The Russian ruble is now trading under pressure to decline. We consider the possibility of a break of the level down to 75. The next step - development of the target at the level of 72.

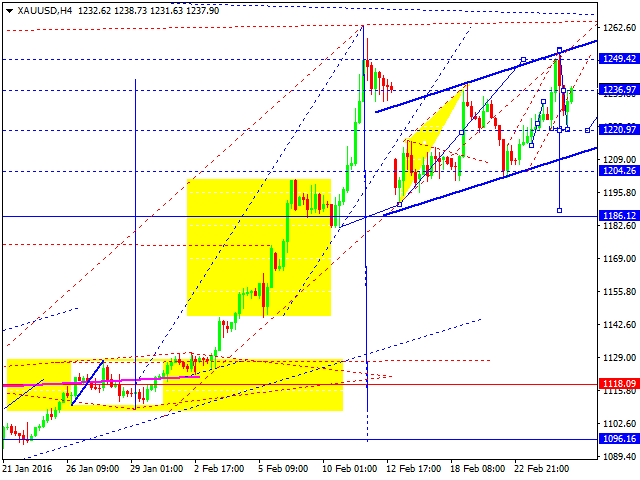

Gold struck the channel of growth of the fifth structure. The next pulse to decrease and its correction are worked through. Today we expect a break through the minimum of this impulse and a continuation to decline to the level of 1204. Then - a return to the level of 1220.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.