Analysis for February 17th, 2016

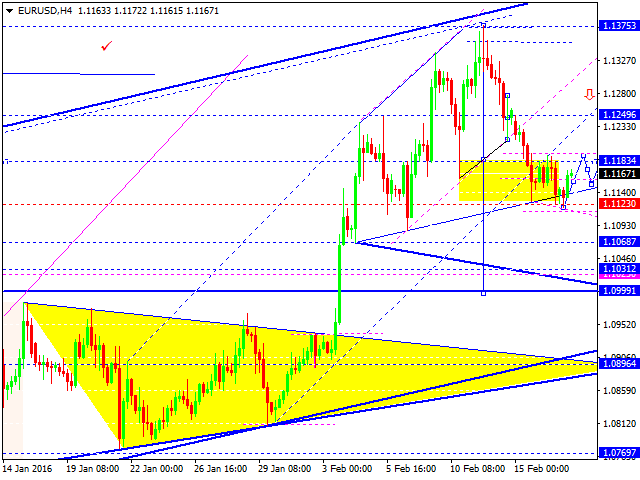

EUR USD, “Euro vs US Dollar”

Eurodollar is consolidating near the minimums of its descending wave. We think, today the price may expand the channel upwards to start a correction with the target at 1.1250. After that, the market may continue falling inside the downtrend to reach 1.1000.

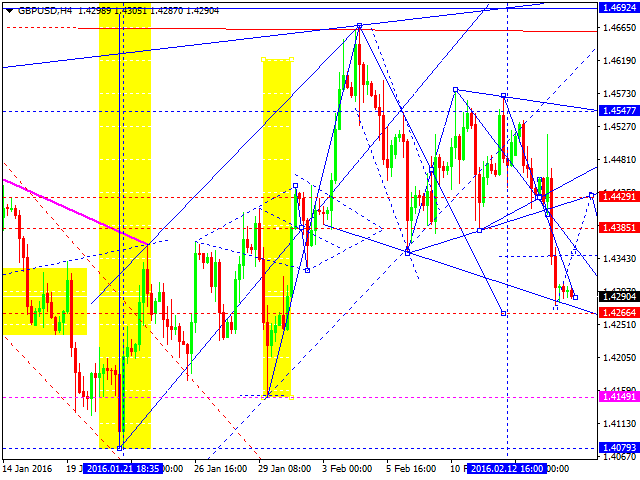

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today the price may reach 1.4266 and then return to 1.4430 to test it from below or even continue growing towards 1.4700. After completing this correction, the market may fall to return to 1.4385. An alternative scenario implies that the pair may continue falling inside the downtrend to reach the next target at 1.3850.

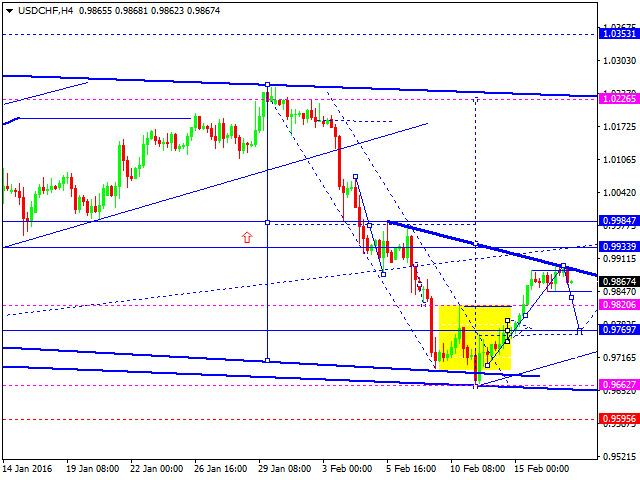

USD CHF, “US Dollar vs Swiss Franc”

Franc is consolidating. We think, today the price may break this channel downwards and start a correction to return to 0.9770. Later, in our opinion, the market may grow to reach 0.9940.

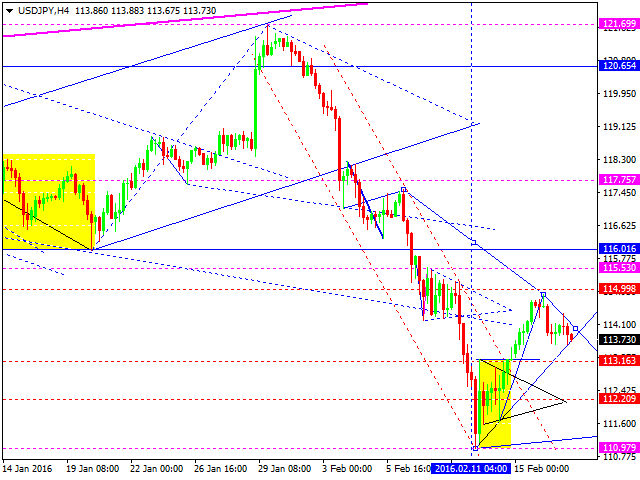

USD JPY, “US Dollar vs Japanese Yen”

Yen is moving back to 113.16. After reaching it, the price may grow towards 115.50 and then return to 113.16, thus defining the border of another consolidation channel. If the channel is broken upwards, the correction may continue up to 120.70; if downwards - the market may continue falling inside the downtrend to reach 109.00.

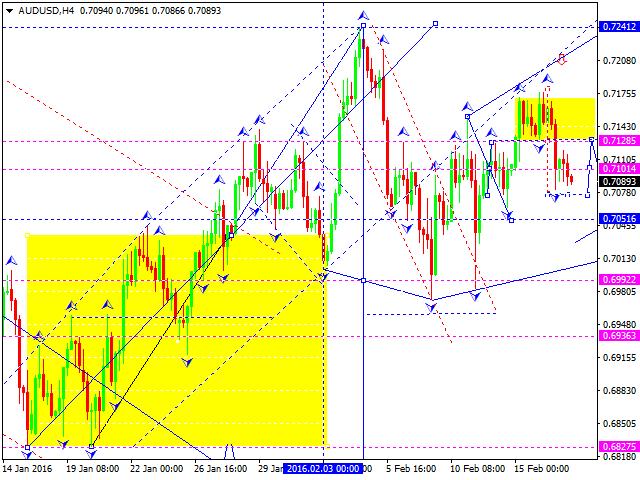

AUD USD, “Australian Dollar vs US Dollar”

Being under pressure, Australian Dollar is still falling; the target is at 0.7052. Possibly, after that the price may test 0.7128 from below and then continue falling to reach a new low. Later, in our opinion, the pair may continue falling inside the downtrend with the target at 0.6660.

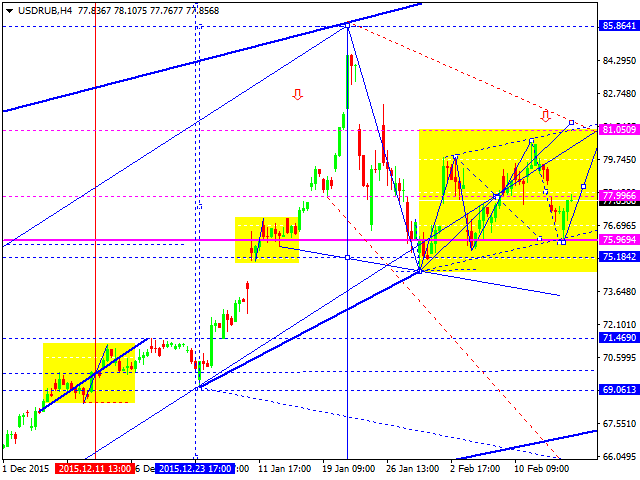

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is moving upwards. Possibly, it may reach 81; this structure may be considered as the last one of the flag correctional pattern. After that, the market may start forming another descending wave with the target at 76. Later, in our opinion, the pair may form a continuation pattern to continue falling inside the third wave with the target at 69.

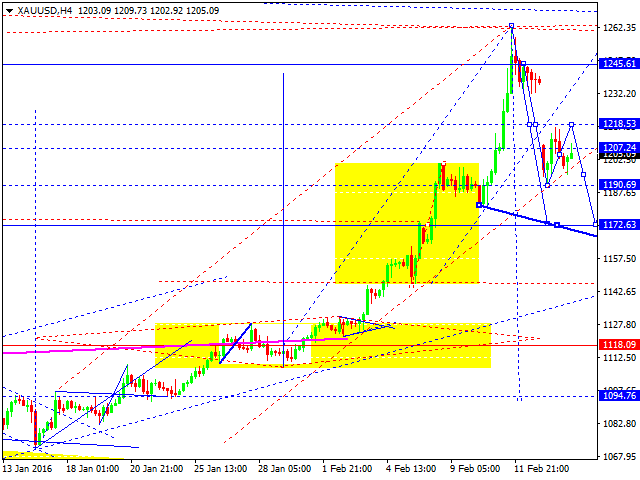

XAU USD, “Gold vs US Dollar”

Gold is consolidating. We think, today the price may grow to reach 1219.00. Later, in our opinion, the market may continue falling towards 1172.60.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.