Analysis for December 30th, 2015

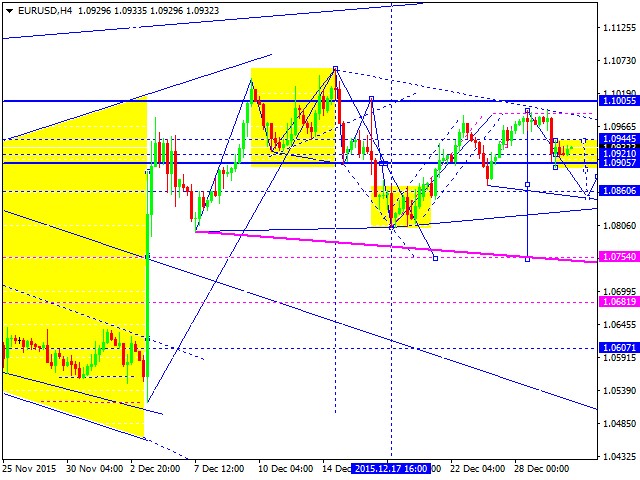

EUR USD, “Euro vs US Dollar”

Eurodollar has formed another descending impulse and right now is consolidating. We think, today, the price may continue falling to reach 1.0860. This decline may be considered as a part another descending wave with the target at 1.0754.

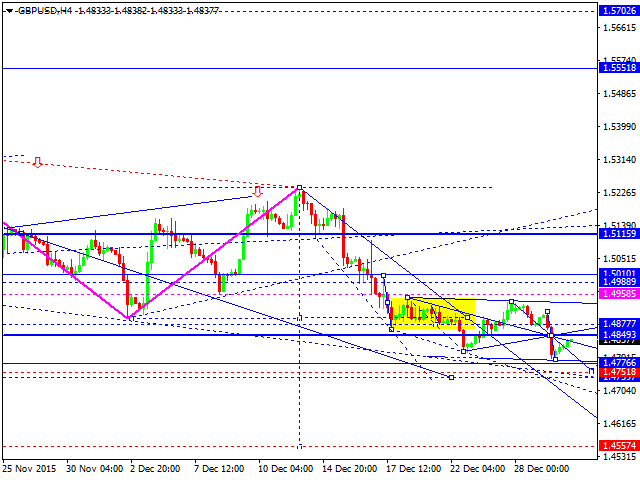

GBP USD, “Great Britain Pound vs US Dollar”

Pound is consolidating to reach new lows; the market has almost formed a downside continuation pattern. We think, soon the price may reach 1.47474, consolidate for a while, and then continue falling towards 1.4560. An alternative scenario implies that the pair reach 1.4750 and then form a new correction to return to 1.5120.

USD CHF, “US Dollar vs Swiss Franc”

Franc has formed another ascending impulse and right now is consolidating. The main scenario suggests that the price may continue growing to expand the channel towards 0.9920. Later, in our opinion, the market may form a continuation pattern and move upwards to reach 1.0037.

USD JPY, “US Dollar vs Japanese Yen”

Yen is still forming its ascending impulse with the target at 120.75. Later, in our opinion, the market may fall towards 120.45 and then continue the correction to reach 122.00.

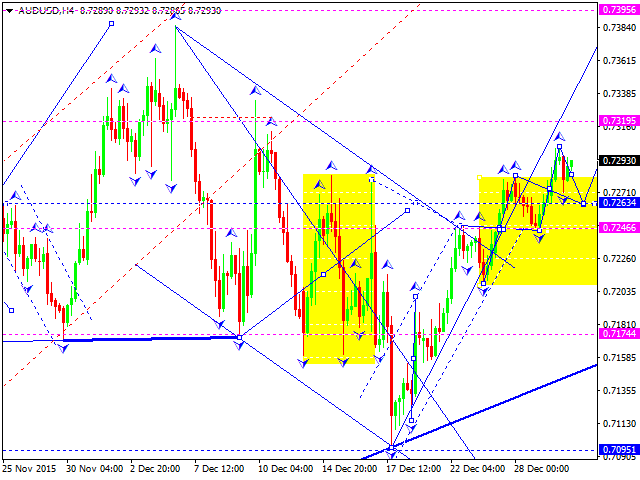

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has expanded its consolidation channel upwards. Actually, the market has formed an upside continuation pattern, which may continue up to 0.7400. We think, today, the price may return to 0.7263, then reach a new high and continue growing to reach the above-mentioned target.

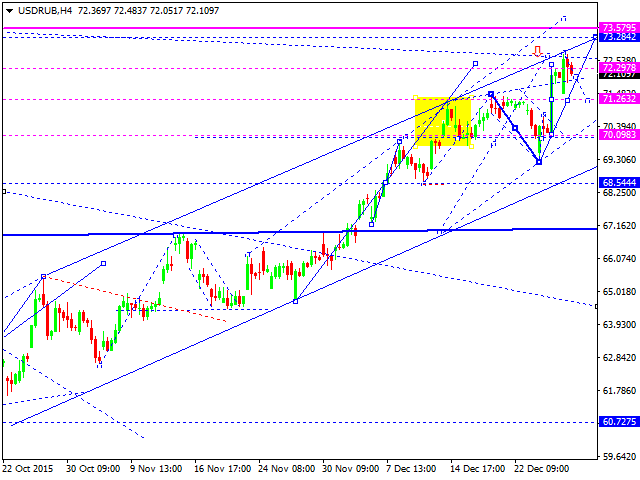

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is still growing. We think, the price may reach 73.30 and then return to 71.26.

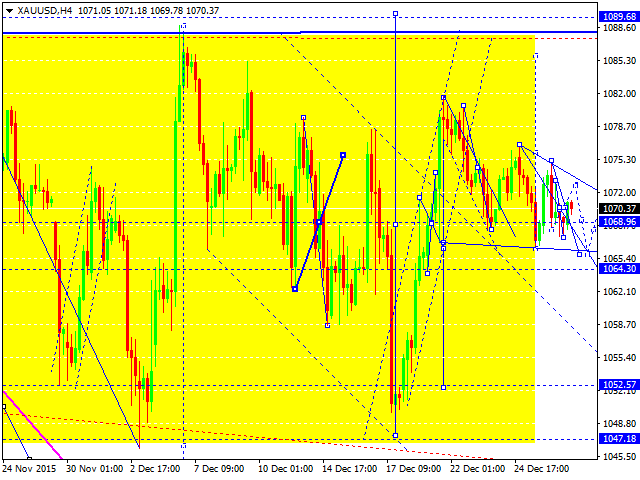

XAU USD, “Gold vs US Dollar”

Gold hasn’t been able to rebound from the center and grow towards 1090, and right now is consolidating in the rectangle trading range. We think, today, the price may fall towards 1064. Later, in our opinion, the market may form another consolidation channel and start a new decline to reach 1047.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.