Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair formed a consolidation area around 1.1808 and broke it away upwards. Practically, the market suggested the extension on the wave of growth. Today the market has reached the local goal of this extension at 1.1877. We expect a new consolidation are to form under 1.1877, which might extend to 1.1880. Then the price might escape this range downwards, correcting to 1.1803 (a test from above) and then grow to 1.1909.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair formed a consolidation area under 1 3911 and with an escaped downwards corrected to 1.3804. Today another link of growth to 1.3936 might develop. Then we expect a decline to 1.3804.

USD/RUB, “US Dollar vs Russian Ruble”

The currency formed a consolidation area around 76.46 and with an escape upwards practically suggests the development of another wave of growth to 77.77. After this level is reached, we expect a decline to 75.15.

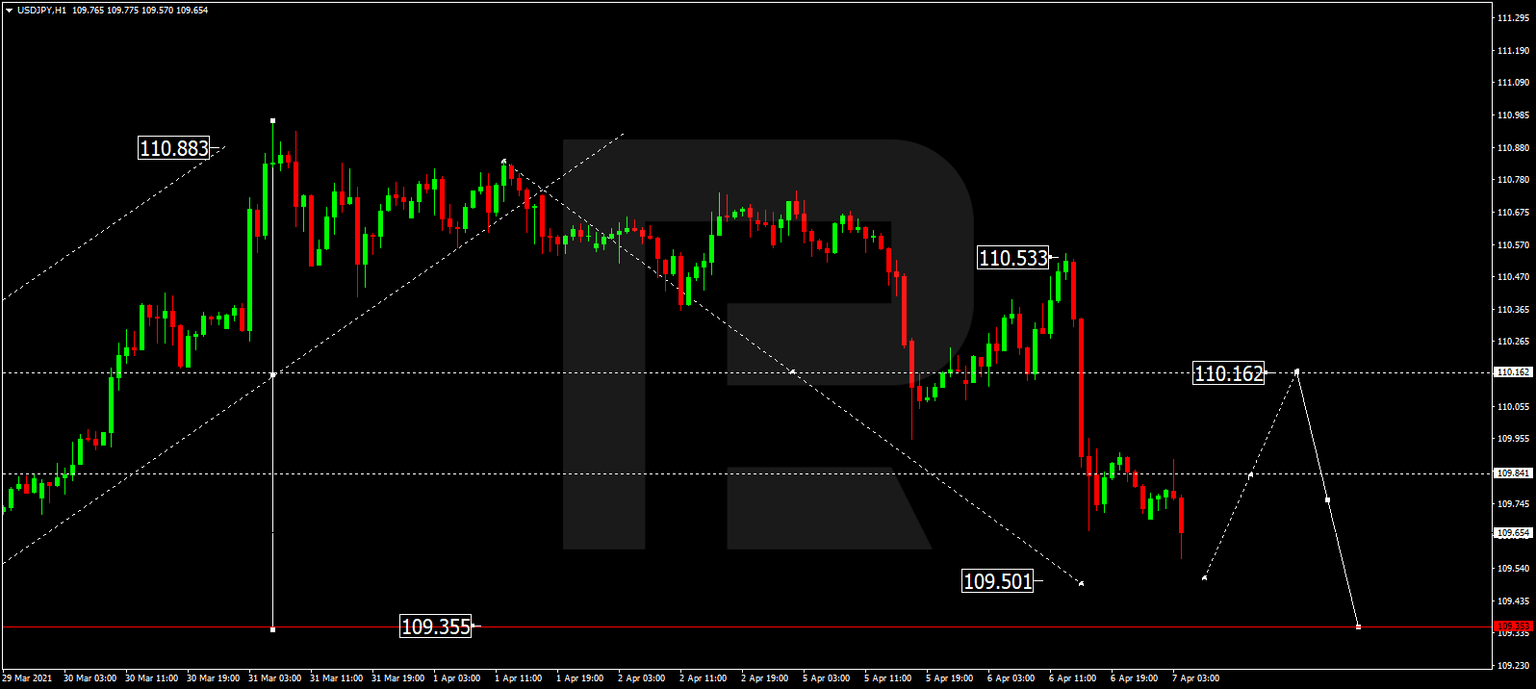

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair completed the structure of a declining wave towards 109.84. Today the market is forming a consolidation range under this level. A decline to 109.50 is possible, followed by growth to 110.16 and another decline to 109.35.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair completed a structure of growth to 0.9395. Then the market completed the fifth structure of a declining wave to 0.9307. Today we expect a consolidation range to develop around this level. The main scenario is an escape upwards to 0.9395.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair keeps developing a consolidation range under 0.7657. Today we expect it to escape the range downwards to 0.7454 and then — grow to 0.7727.

Brent

Oil keeps developing a consolidation range around 63.00. Today it might fall to 60.00. After this level is reached, we expect a new wave of growth to 65.50 to start.

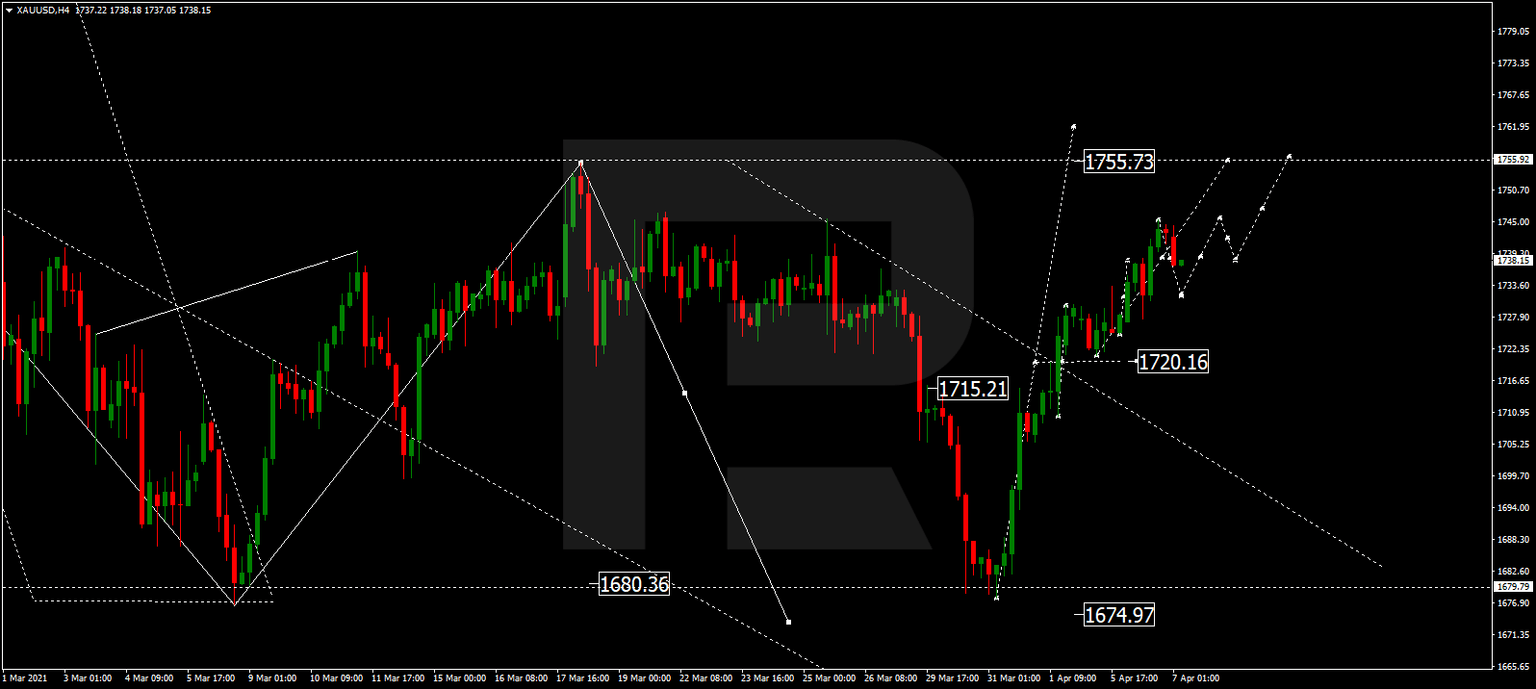

XAU/USD, “Gold vs US Dollar”

Gold keeps developing a wave of growth to 1755.73. After this level is reached, we expect a link of correction to 1720.20. After the correction is over, we expect growth to 1900.00.

S&P 500

The stock index has completed a wave of growth to 4077.0. Today the market is trading in a consolidation range around this level. We expect a correctional decline to 3960.3. The goal is first.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.