More rains forecast is bullish for soybean

Wet weather forecast for key soybean producer states in US for October may result in lost harvest. Increased harvest loss risks are bullish for soybean. Will soybean continue rising?

Wet weather conditions in US Midwest and Plains are likely to continue in October, the main month for US soybean harvest. This increases risks for soybean yield and quality loss, which is bullish for soybean. Moderate rain is expected to continue till the end of September after abundant rains in July and August produced the wettest period in more than 30 years for key producer Illinois as well as Iowa, Minnesota and Indiana. Last week US Climate Prediction Center (CPC) released wet weather forecast for October for western Midwest and Plains. This may result in lower US soybean harvest, just like the loss in recent Argentine harvest. Estimates indicate Argentina, world’s third biggest soybean producer may have lost as much as 4 million tonnes of soybeans harvest due to rains in April, the main harvest month. This amounts to approximately 3.5 % of what the United States expects to harvest this fall.

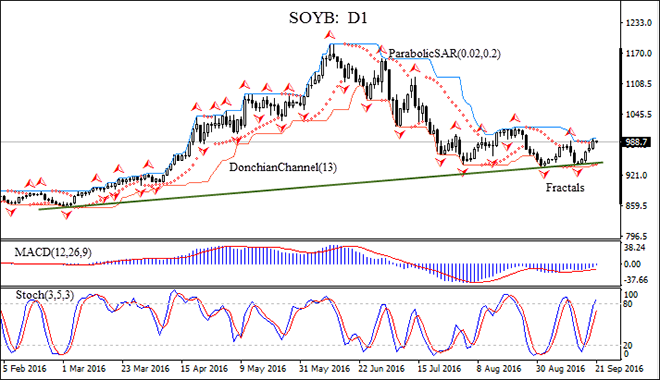

On the daily timeframe SOYB: D1 has been declining after hitting ten month high in mid-June. The price has breached the resistance line after retracing from ten-year low.

The Donchian channel is tilted upward indicating uptrend.

The Parabolic indicator has formed a buy signal.

The MACD indicator is below the signal line which is rising and the gap is narrowing, which is a bullish signal.

The stochastic oscillator is crossing into the overbought zone, which is a bearish sign.

We believe the bullish momentum will continue after the price closes above the upper Donchian channel at 996.5. It can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the last fractal low at 942.9, confirmed also by the lower Donchian channel and Patabolic signal. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (942.9) without reaching the order (996.5), we recommend cancelling the position: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Buy stop Above 996.5

Stop loss Below 942.9

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.