Today at 14:30 CET Unemployment Claims will be released in the US. The data is published weekly by the US Department of Labor. This indicator measures domestic demand dynamics and the consumer lending potential for the US economy stimulus. It is of considerable interest for long-term and medium-term investors. We deem the news released today would cause volatility momentum of the US dollar against the most liquid currencies.

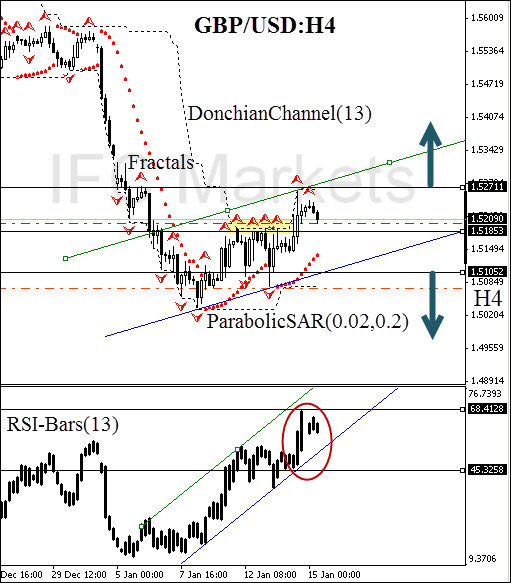

Here we consider GBP/USD on the H4 chart. The price crossed a triple top pattern (marked in yellow) and returned to the support level at 1.51853. For this reason, this mark can be used for placing Stop Loss when opening a long position. Since ParabolicSAR values move along the trend line and Donchian Channel has reversed in negative direction, there is every reason to believe that bulls are gaining strength. There is no contradiction on the part of the RSI-Bars oscillator: it confirms the trend. The next volatility momentum can be expected after resistance level overcoming at 68.4128%. We expect it will accompany the price level intersection at 1.52711, which can be used for placing a pending buy order. After your order was being opened, Stop Loss is to be moved after Parabolic values near the next fractal low. Thus, we are changing the probable profit/loss ratio to the breakeven point. Conservative traders may also consider the alternative case, which is possible to happen if positive US data is released. Thus, a pending sell order may be placed at the support breakout below 1.51052.

- Position Buy

- Buy stop above 1.52711

- Stop loss below 1.51853

- Position Sell

- Sell stop below 1.51052

- Stop loss above 1.52711

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.