Today at 14:30 (CET) we expect the release of two economic indicators: Core retail sales, CRS in Canada and the preliminary Q3 GDP in the US. CRS is released monthly by Statistics Canada and shows a relative change in the total value of sales at the retail level, excluding automobiles, which account for 20% of the total volume. CRS is a monthly measurement of all goods sold by retailers, based on the sampling of different types of retail stores. The index defines long-term trends in consumer activity. The quarterly US GDP is also of interest primarily for long-term investors. Let us remind you that GDP expresses the cost of manufactured goods and services and adjusted for inflation. The GDP indicator shows the change in values of the previous quarter (%).In our opinion, the greatest volatility is expected today from the US currency relative to other liquid instruments.

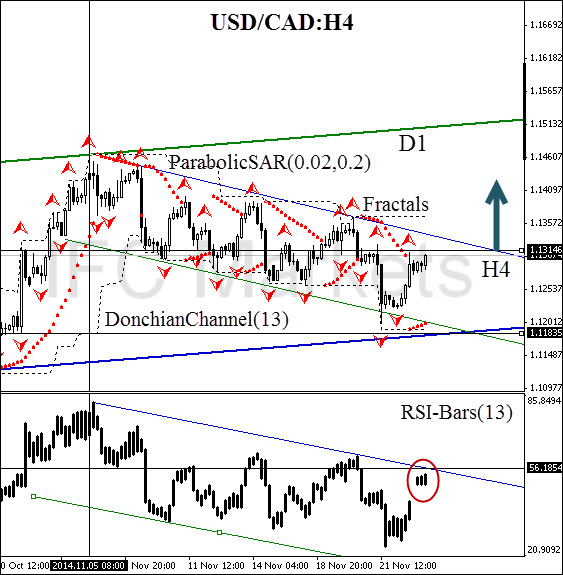

After position opening, Stop Loss is to be moved after the Parabolic values, near the next fractal low. Updating is enough to be done every day after a new Bill Williams fractal formation (5 candlesticks). Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Buy

- Buy stop above 1.13146

- Stop loss below 1.11835

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.