Good afternoon, dear traders. Here we consider the XAU/USD behavior on the daily chart. Optimistic data on the U.S. Unemployment Claims came out last week: 284,000 claims compared to the estimated 307,000. This positive data allows continuing the Fed monetary policy tightening by making the U.S. currency more attractive for investment. Investors anticipate the results of the Fed meeting today, and keep getting rid of defensive assets (gold, silver) by investing in the U.S. stocks and currency. This leads to the fact that at the moment the bearish trend on gold prevails, which has all of the fundamental background for its maintaining: the U.S. economy indicators are steadily improving.

At the moment, we can see on the daily chart that the price is consolidated close to the monthly downtrend line. There is a high probability of a weekly support breach, especially when the Parabolic SAR moves along the D1 trend line. DonchianChannel also made a reversal into the red zone. The oscillator signal movement can be considered as the only alarming factor: the model is circled in red on the chart. We expect that you should wait for the RSI-Bars support breach in order to open a short position on XAU/USD with confidence. The mark at 1287.61 dollars an ounce serves as the key level, which is confirmed by the DonchianChannel support and fractal. Risk limitation is to be placed at 1325.53. This value is strengthened by the trend line, Parabolic historical values and Fractals.

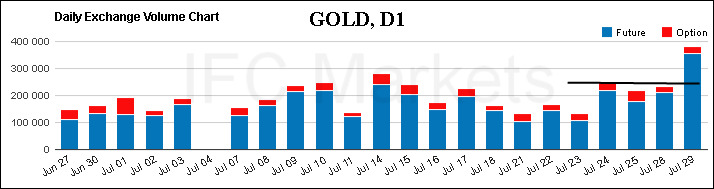

The daily volumes of the gold futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. We can observe the confirmation of the downtrend: trading volumes rose and outperformed the mark of 300,000 claims. You can monitor trading volumes for this currency pair by clicking here.

The bearish trend has a possibility to reverse due to unexpected fundamental factors. The U.S. Federal Open Market Committee (FOMC) is going to make a prearranged statement in the evening. If the monetary policy tightening is not confirmed despite the expectations for it to be established, then, of course, we can expect the price reversal into the weekly trend channel area. A long position can be opened above the resistance at 1345.37. After one of the orders being executed, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.