EURJPY: Yen expected to continue to move sideways against the euro

EURCHF: Volatility in financial markets can lead to appreciation pressure

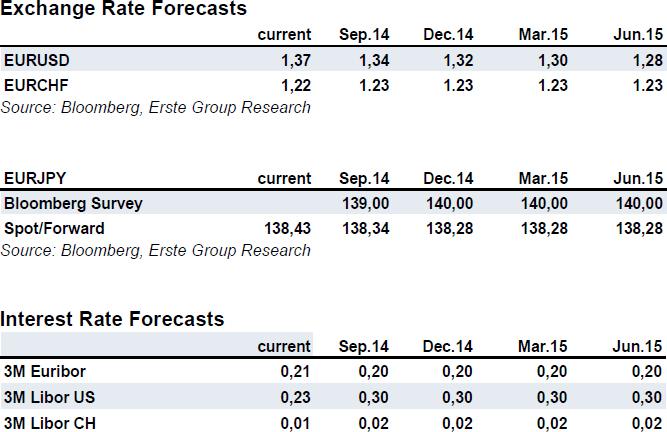

EURUSD: Dollar to strengthen further

The euro has weakened slightly against the dollar since the beginning of May and currently trades close to levels last seen at the beginning of the year. The main reason for this was the predictable further loosening of monetary policy by the ECB, which was announced in early June. The Federal Reserve on the other side of the Atlantic has reduced its securities purchases further, but continues to increase the provision of liquidity. Overall, the Fed's balance sheet has grown further, while that of the ECB has shrunk. From this perspective, the Fed's monetary policy is actually still more expansive than the ECB's, which is probably preventing a stronger showing by the dollar for now. However, economic developments make a change in this trend foreseeable. The US economy is already exhibiting significantly more momentum than that of the euro area. The Federal Reserve is therefore highly likely to discontinue its securities purchases in October, while the ECB is going to provide additional liquidity to starting autumn. Consequently, monetary policy in the euro area is going to become more expansive, while the time for an interest rate hike in the US is coming closer, which means the interest rate differential is sooner or later going to increase. Moreover, considering that the euro is fairly richly valued relative to the dollar on a long term basis, we expect the dollar to gradually strengthen. Compared to our previous forecast we now expect a faster firming of the euro.

Yen expected to continue to move sideways against the euro

Japan's economy has grown quite strongly in the first quarter of 2014, firming up by 1.6% compared to the previous quarter. This development was however also facilitated by the effect of pulling consumption forward, which was triggered by a hike in the sales tax from 5% to 8% in April. Therefore a significant decline in economic growth can be expected in the 2nd quarter. In the third quarter, the growth rate should normalize again (the IMF expects economic growth of approximately 1.4% in 2014). In order to improve growth prospects, the government has recently presented a new reform package. This encompasses a gradual lowering of corporate taxes and strategies to increase the participation of women in the labor force, as well as attracting more foreign workers in order to counter the threat of a shortage of skilled professionals.

After the sales tax hike in April, the inflation rate has, not entirely unexpectedly, increased significantly from 1.3% to 3.2% and has thereby markedly exceeded the price stability target for the moment. Adjusted for the increase in the sales tax, the inflation rate has however only risen to 1.5%, according to the Bank of Japan. This means that the normalized inflation rate continues to remain below the price stability target of 2%. The Bank of Japan expects that “the inflation rate, adjusted for the direct effects of the sales tax increase, is likely to remain at approximately 1.3% for some time”. In light of its goal of achieving a price stability target of 2%, the Bank of Japan has confirmed that it is going to continue to pursue its quantitative (expansion of the monetary base by JPY 60-70 bn. per year) and qualitative measures at an unchanged pace.

The yen has strengthened slightly against the euro in recent weeks, and has recently traded near EURJPY 138. According to Bloomberg consensus estimates, analysts expect the trend to remain stable over the coming year at around EURJPY 140.

EURCHF: volatility in financial markets can lead to appreciation pressure

In Switzerland, growth picked up somewhat in the first quarter. However, production capacities are still not fully utilized. According to the Swiss National Bank (SNB), ‘there are still substantial risks attached to the global economic recovery’. As inflation in Switzerland was somewhat higher than expected in May, the SNB revised its inflation forecast for the current year up to 0.1% (0.1 percentage points higher than the forecast from March). Due to the modest global economic outlook and unexpectedly low inflation in the Euro Area, the SNB has adjusted its medium-term conditional inflation forecast downwards by 0.1 percentage points compared to the Monetary Policy Assessment from March. With the new figures, the SNB expects an inflation rate of 0.3% in 2015 and 0.9% in 2016. The forecast is based on the assumption that the Swiss franc will weaken over the forecast period. The SNB expects in the coming quarters a continuation of the moderate recovery, with a growth rate for 2014 of around 2%.

The SNB has once again confirmed that, with the three-month Libor close to zero, ‘the minimum exchange rate continues to be the right tool’ to avoid an undesirable tightening of monetary conditions.' Given the current risks (e.g. geopolitical conflicts), vulnerability of the financial markets at any point still cannot be ruled out, which can lead to further appreciation pressure upon Swiss franc. We expect the EURCHF exchange rate to move within the bandwidth of 1.20-1.25 francs per euro, with the forecasted rate staying in the middle of this range at about 1.23.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.