Dollar: ECB enters stage

Yen continues its depreciation against the euro

Minimum exchange rate remains ‘very important’ for SNB

US dollar

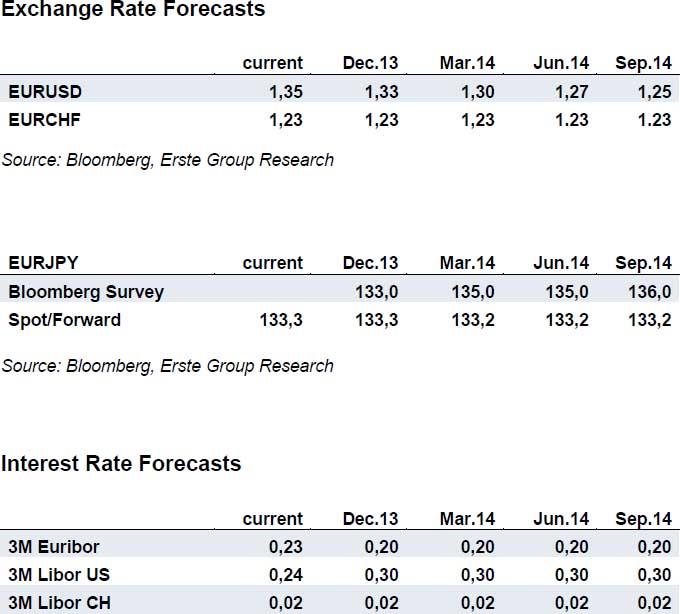

After the EURUSD exchange rate had reached 1.38, speculation about a potential ECB rate cut led to a countermovement. Eurozone inflation decreased to 0.7%, well below expectations, while the unemployment rate has been revised upwards, such that the likelihood for further action by the ECB has increased significantly. A rate cut would lower the euro’s attractiveness for short-term investments and thus weaken the currency. At the same time, the Fed’s monetary policy remains important. If the next US labor market reports were to disappoint, a slowdown of asset purchases would definitely be postponed until March (see Week Ahead). The larger balance sheet expansion (more liquidity) would in turn continue to weigh on the dollar. Overall, we have slightly revised our forecast, but the medium-term trend for a stronger dollar remains unchanged.

Yen continues its depreciation against the euro

In the course of the previous weeks the yen continued its depreciation against the euro and is currently at levels close to a four-year low. In the meantime, the economic and monetary measures in Japan seem to continue to unfold their effects. The core inflation rate (excluding energy and food) left negative territory in September for the first time since 2008. Indicators like the purchasing managers index and the Tankan index also reached levels which have not been observed for years. The Bank of Japan continues with its expansive monetary policy, which supports the development of the economy and price levels. However, the increase of sales taxes which is planned for April 2014 might have negative effects for the economy and inflation and could lead to new measures by the BoJ. This would tend to weaken the yen.

According to analysts, inflation rates in Japan should increase in the quarters ahead ant the BoJ should stick to its expansive monetary policy. Increasing differences in yields and in money supply (Fed vs. BoJ) would then tend to contribute to a weakening of the yen against the dollar. Surveys among analysts indicate that in the year ahead the yen should continue to depreciate, with the depreciation expected to be more distinct against the USD than against the EUR (cf. table on p. 4).

Minimum exchange rate remains ‘very important’ for SNB

In the previous weeks the Swiss franc proved its status as a safe haven and appreciated slightly in the course of the political tensions in Italy. Overall, it remains on levels around 1.23 EURCHF. The Swiss National Bank continues to emphasize that the enforcement of the minimum exchange rate remains important. According to President Thomas Jordan, the policy of the SNB remains the right one and the SNB will maintain the lower bound in the foreseeable future. There was thus ‘no reason at all for adjustments‘.

With its assessment the SNB confirms our view that while the situation on financial markets has stabilized, there remain risks for Switzerland. The SNB should continue to defend its minimum exchange rate, in particular to be able counteract a fast and distinct appreciation of the franc if tensions in the international environment emerge. The Swiss economy is developing well, however inflation rates are still on very low levels (-0.1% as of September). A flight into francs could thus increase deflationary pressure in Switzerland and increase economic risks. We continue to expect an exchange rate at levels around 1.23 EURCHF in the medium term.

Depending on the news flow larger fluctuations might occur.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.