Analysis for November 25th, 2014

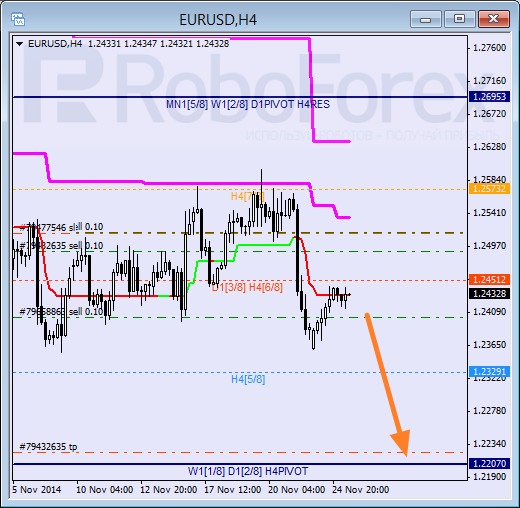

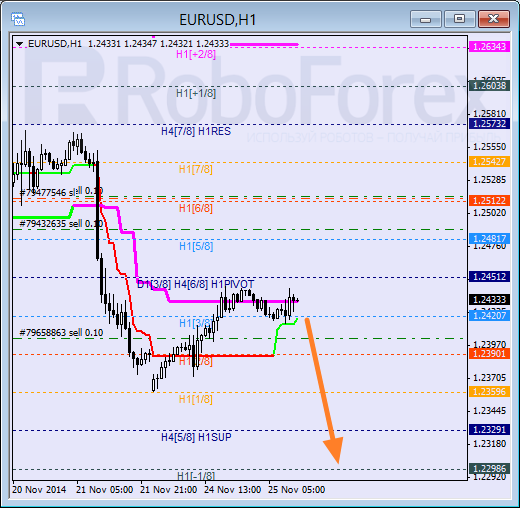

EUR USD, “Euro vs US Dollar”

Eurodollar is still being corrected. Earlier, the price rebounded from the daily Super Trend several times and stayed below it. The closest target is at the 4/8 level. After reaching it, the market may start a more serious pullback.

As we can see at the H1 chart, the price has rebounded from the 1/8 level. However, I haven’t closed my sell orders, because the targets on major time frames haven’t been reached yet. Super Trends are still influenced by “bearish cross”. I’m planning to increase my short positions as soon as the pair is able to stay below the 3/8 level.

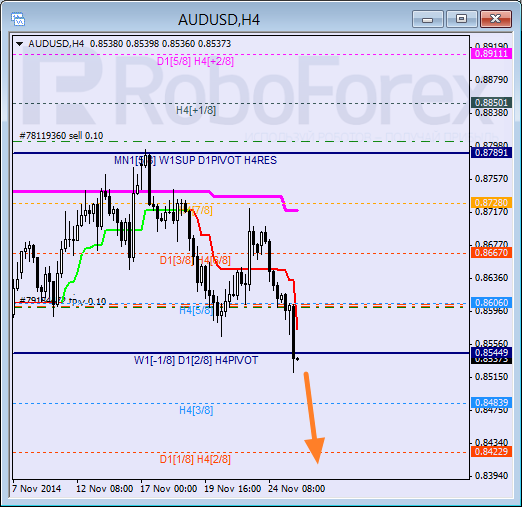

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar continues moving inside the downtrend; the market has broken the 4/8 level and is trying to stay below it. Earlier, during a local correction, I opened another sell order; the stop loss has already been moved to breakeven. If price is able to stay below the 3/8 level, the market will continue moving downwards.

As we can see at the H1 chart, the pair is moving inside “oversold zone” and supported by Super Trends. If later the price breaks the -2/8 level, the lines at the cart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.