Analysis for August 27th, 2014

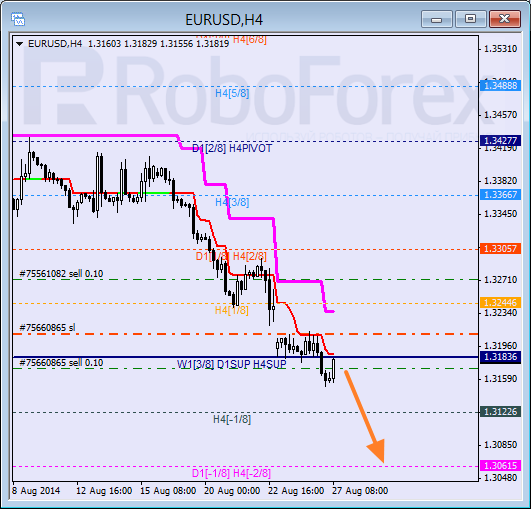

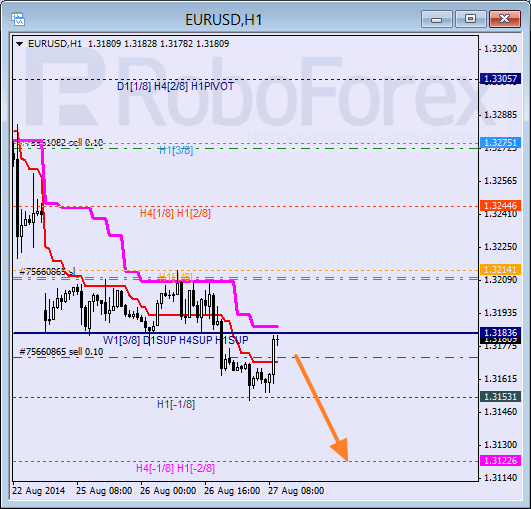

EUR USD, “Euro vs US Dollar”

Bears were able to enter “oversold zone” after all and now they have to keep the price below the 0/8 level. In addition to that, they are supported by the H4 Super Trend. If the market rebounds from these levels, the pair will start a new descending movement.

The situation at the H1 chart is quite typical for Murrey Math: after rebounding from the -1/8 level, the pair is testing the 0/8 one. Consequently, if the pair rebounds from the 0/8 level successfully, the market may reach the -2/8 one or even break it.

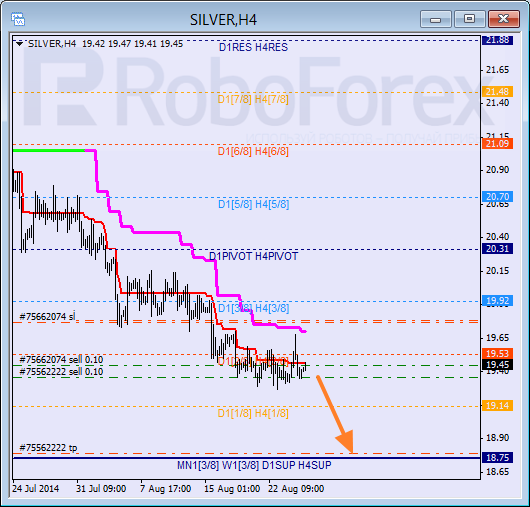

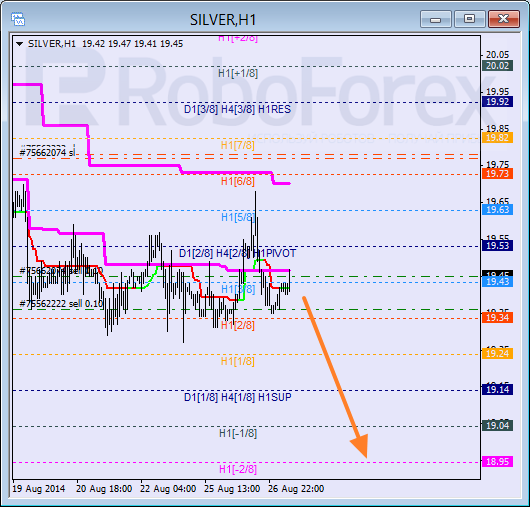

XAG USD, “Silver vs US Dollar”

Silver is still consolidating. The price wasn’t able to stay above the 2/8 level, which is an additional bearish signal. Considering that the market is again moving below the H4 Super Trend, I decided to open another sell order.

As we can see at the H1 chart, Super Trends formed “bearish cross”. Earlier, the market rebounded from the 5/8 level. If bears are able to keep the price below the 3/8 level after all, Silver may continue falling towards the 0/8 one or even lower.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.