Analysis for April 8th, 2014

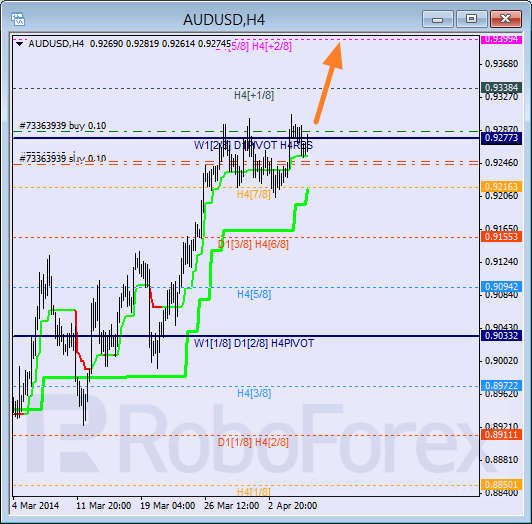

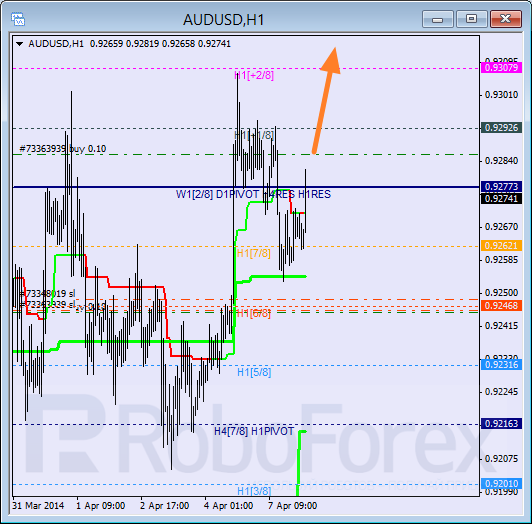

AUD USD, “Australian Dollar vs US Dollar”

Bulls’ first attempt to keep price inside “overbought zone” failed; they are supported by H4 Super Trend. If Australian Dollar rebounds from it, instrument will move upwards to break the 8/8 level and then continue growing up towards the +2/8 one.

As we can see at H1 chart, Super Trends are still influenced by “bullish cross”. Possibly, bulls may break the 8/8 level during Tuesday. If later market breaks +2/8 level, lines at the chart will be redrawn.

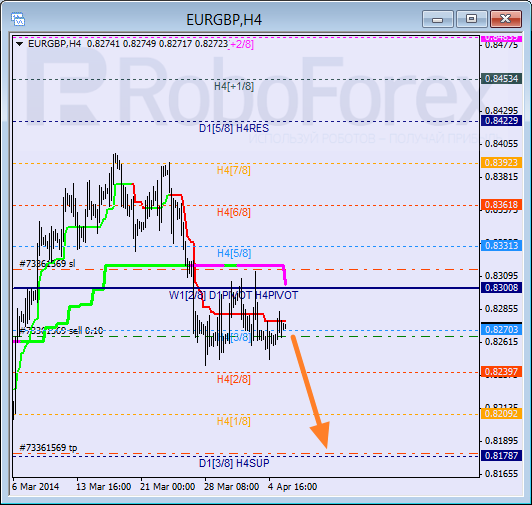

EUR GBP, “Euro vs Great Britain Pound”

Pair is still consolidating; bears are supported by H4 Super Trend. If later bears are able to rebound from it and keep price below the 3/8 level, instrument may continue falling down towards the 0/8 level.

At H1 chart, pair is moving between Super Trends. Earlier price rebounded from the 8/8 level several times. Closest target for bears is at the 4/8 level: if they break it, market will fall down much lower.

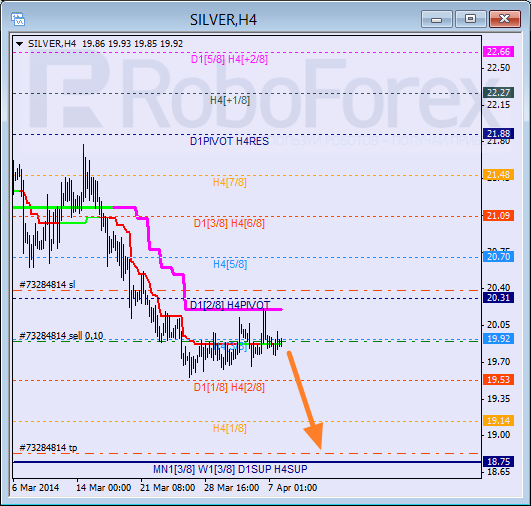

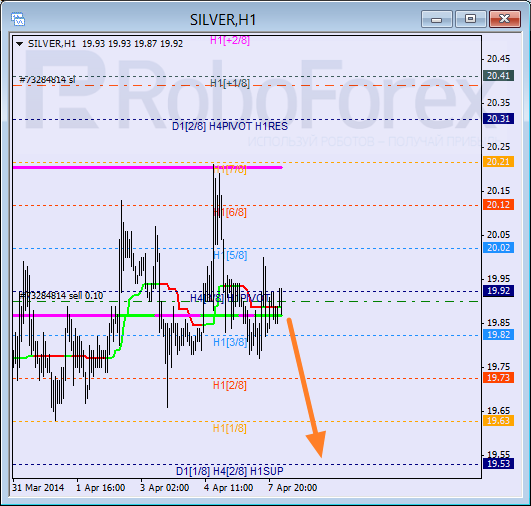

XAG USD, “Silver vs US Dollar”

Silver is still consolidating below daily Super Trend, from which price rebounded last Friday. If price is able to stay below the 3/8 level, instrument will continue falling down towards the 0/8 one.

Silver is moving in the middle of H1 chart. Possibly, in the nearest future Super Trends may form “bearish cross”. Closest target is at the 0/8 level; bears may break it quite soon.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.