Greferendum:

“OXI!”

The Greek people have spoken, with a landslide win to the ‘no’ side, voting against accepting the austerity terms that their Eurozone creditors have offered. But in reality, the vote and the result is still nothing but a complicated mess that throws up just as many questions as answers.

Tsipras and his Greek government got the ‘no’ outcome that they wanted. The angle here was that this was never a referendum on whether Greece wanted to stay in the Eurozone, but rather perceivably adding to the indebted nation’s bargaining power once the inevitable re-negotiations with creditors take place.

I say inevitable because the reality is that for both financial and political reasons, (led by Germany) they would prefer to do everything they can to keep Greece in the Euro. But how they can go back to the negotiating table after Greek Finance Minister labelled his creditors as ‘terrorists’ over the weekend, I have no idea.

Keep an eye on the Vantage FX News Centre today as we go over what is next for Greece and what each scenario could mean for EUR/USD.

One interesting angle that maybe hasn’t got the run that it deserves amongst all these headlines and panic trading is that uncertainty now brings the chance of September rate hike from the Fed down significantly.

———-

On the Calendar Today:

The only news on the calendar that matters today is of course the Greek Bailout Referendum. Mark the ISM Non-Manufacturing PMI as the major tier 1 data release later tonight during the US session.

Monday:

EUR Greek Bailout Vote

CAD Ivey PMI

USD ISM Non-Manufacturing PMI

———-

Chart of the Day:

With a messy chart full of gaps to contend with, we take a look at EUR/USD from a technical point of view.

EUR/USD Daily:

Click on chart to see a larger view.

The confluence of resistance at the major bearish trend line we have been posting for a while has well and truly held and price has now broken through short term flag support. The problem with this break is that it’s a messy gap down through the level, something that we saw only last week which highlighted the lack of respect for technical levels during times of panic.

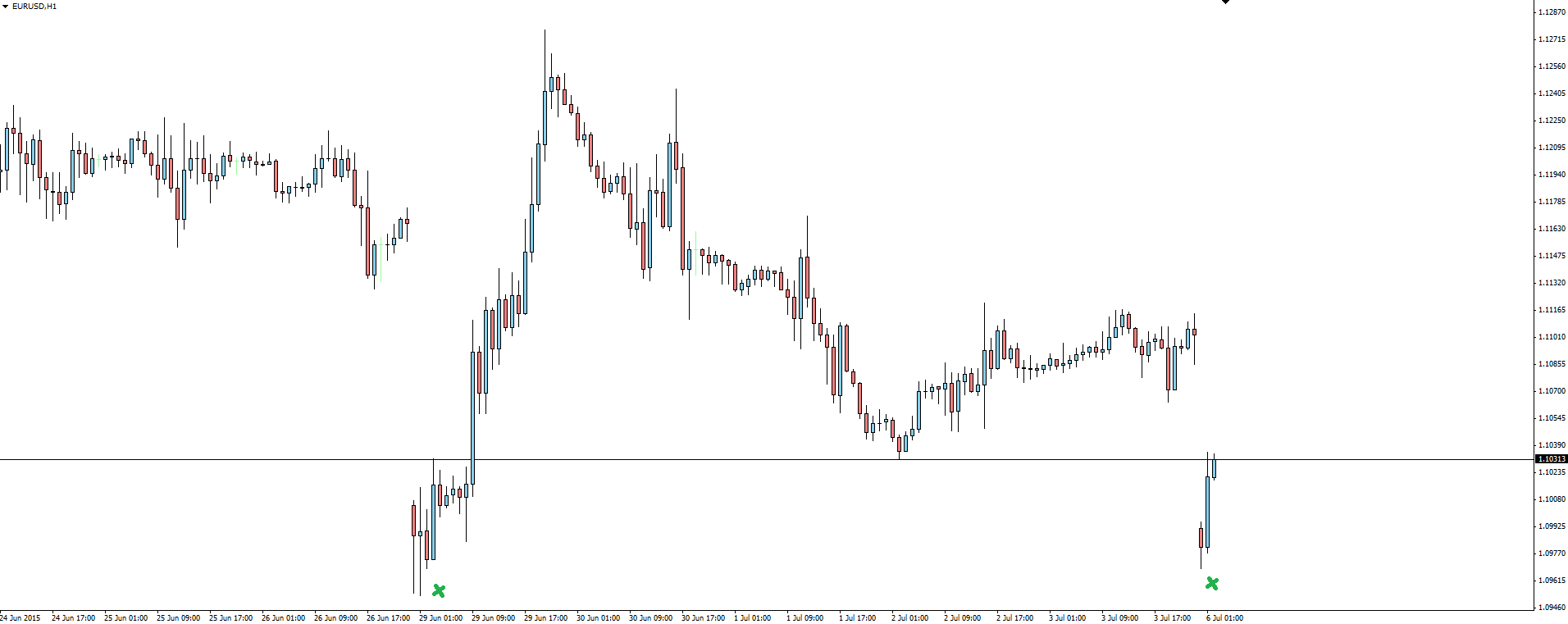

EUR/USD Hourly:

Click on chart to see a larger view.

If it seems like we’ve been here before, then it’s because we have. Last Monday on Greek rumours of a Eurozone exit, price actually pushed lower than where we have opened today after the actual referendum result.

With Europe still closed for the weekend, I can’t do anything with confidence but sit on the fence today. We really are into uncharted territory and I just don’t know which theme the market is going to interpret as the most important in determining the direction it takes. Stay safe out there!

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.