Amazon Spikes:

A fun one to start your Friday Asian session (…well if you didn’t buy the high and sell the low within a single morning’s trading), with a crazy spike in the Amazon stock price. Amazon again reported a loss amid rapidly rising sales numbers.

The market was obviously confused as to whether the headline number or the future prospects was the important factor, and there were sure to be a few daytraders who either profited a LOT of money as well as a few who would have been equally CRUNCHED by the move.

The Stocktwits account covered the swings well here:

Stocks huh!

Euro Growth:

In an already unsettled Eurozone thanks to the complete failure to even progress toward a solution to the Greek debt crisis, they weren’t helped last night by a raft of PMI misses across the board.

I said in yesterday’s Morning View that it’s sometimes a punt as to which one of these PMI figures, if any at all, will actually move the market. But you would think that a clean sweep of misses across the board would put the Euro under pressure, however it seems optimism trumped reality.

A dangerous premise, but something that markets are built on.

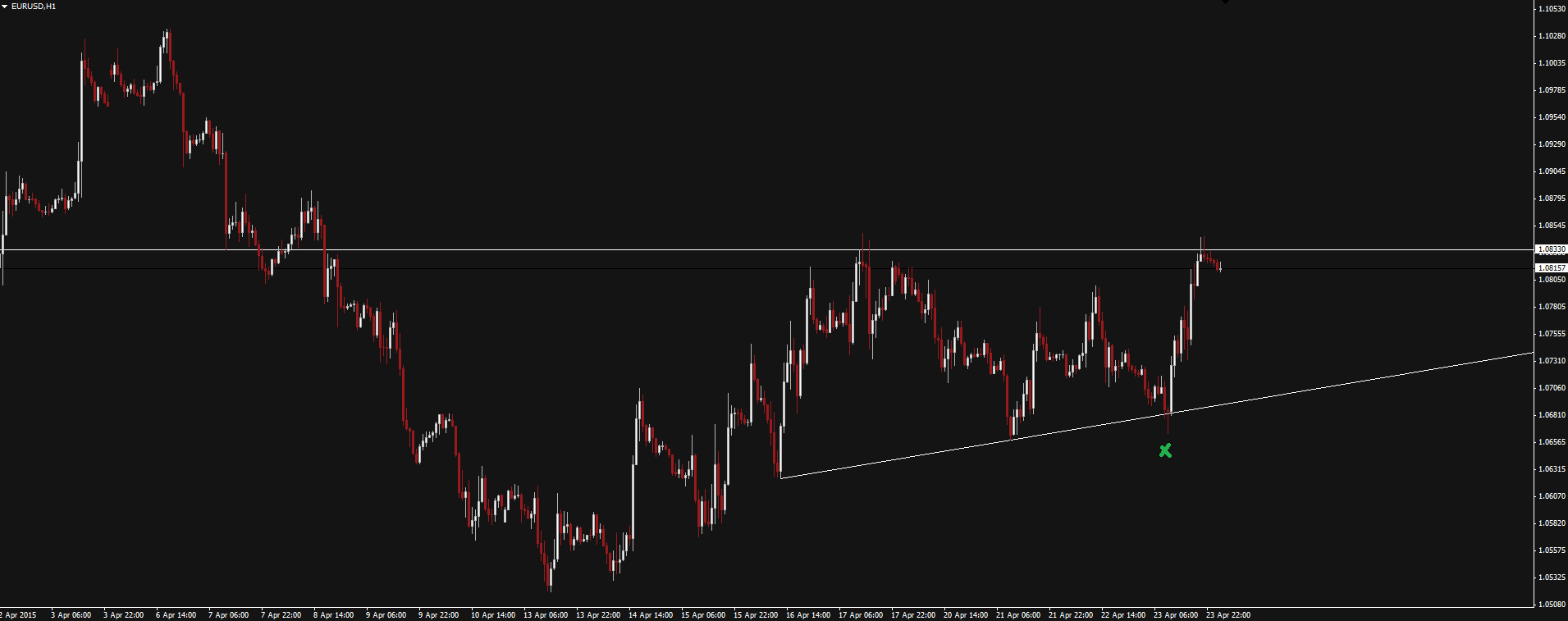

On the European open, EUR/USD printed a nice little pin bar on short term trend line support that price kicked up off throughout the evening. Was a nice trade if you were on your toes and happy to fade the news.

I take a wider look at the EUR/USD technicals in the Chart of the Day section below.

On the Calendar Today:

Quiet on the Asian Calendar but another round of Eurogroup meetings tonight should throw up a few headlines throughout the evening.

We also have the US Core Durable Goods Orders once we hit the New York session. This is the change in the total value of new purchase orders placed with manufacturers and is seen as a leading indicator to production numbers.

Friday:

EUR Eurogroup Meetings

EUR German Ifo Business Climate

USD Core Durable Goods Orders

CAD BOC Gov Poloz Speaks

Chart of the Day:

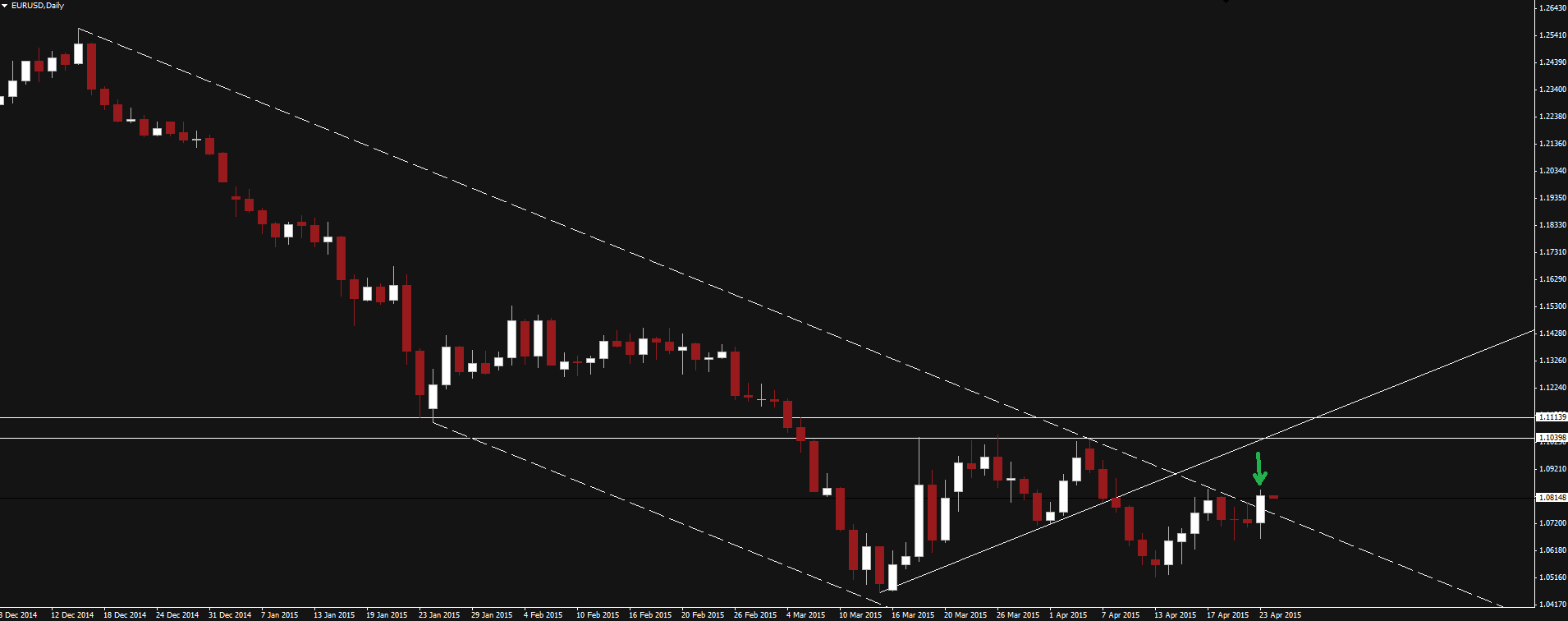

EUR/USD Daily:

Click on chart to see a larger view.

Taking a look at the EUR/USD daily chart, we can see that price is trying to form a bottom and now pushing through descending channel resistance. Price printed a lower high but has not given any sort of conformation that this is anything other than a consolidation at lows.

That 1.10 to 1.11 resistance zone is capping price pretty hard still and as long as we are still below that, I wouldn’t be paying too much attention to this channel break.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.