PBOC RRR Cut. What Does it Mean?

On the back of a 0.5% cut in February, Sunday saw the People’s Bank of China cut their Reserve Ratio Requirement (RRR) by 1%, leaving it at 18.5%.

It is essentially a $1 trillion Yaun (or $208 billion) stimulus to the economy through the release of capital.

The RRR cut was larger than expected from the market and will look to boost the growth outlook of the Chinese economy. This is because it encourages banks to lend more with their new found liquidity.

This liquidity will find its way into the already strong Chinese equity market, with the AUD also being a beneficiary of potentially increased Chinese demand.

As you can see, AUD/USD gapped up on the news, but pulled back. How sustained this rally will actually be is another thing. This move from the PBOC could be seen as reactionary and a big vote of no confidence in the Chinese economy.

On the Calendar Today:

We’ve just had the New Zealand CPI release, with the -0.3% number missing the -0.2% expectation but Asia will be all about the weekend’s Chinese news explained above.

A bit strange to see the RBA’s Stevens speaking during the US session. He’s currently in New York at the American Australian Association luncheon hosted by Goldman Sachs.

Monday:

NZD CPI

CAD BOC Gov Poloz Speaks

AUD RBA Gov Stevens Speaks

Chart of the Day:

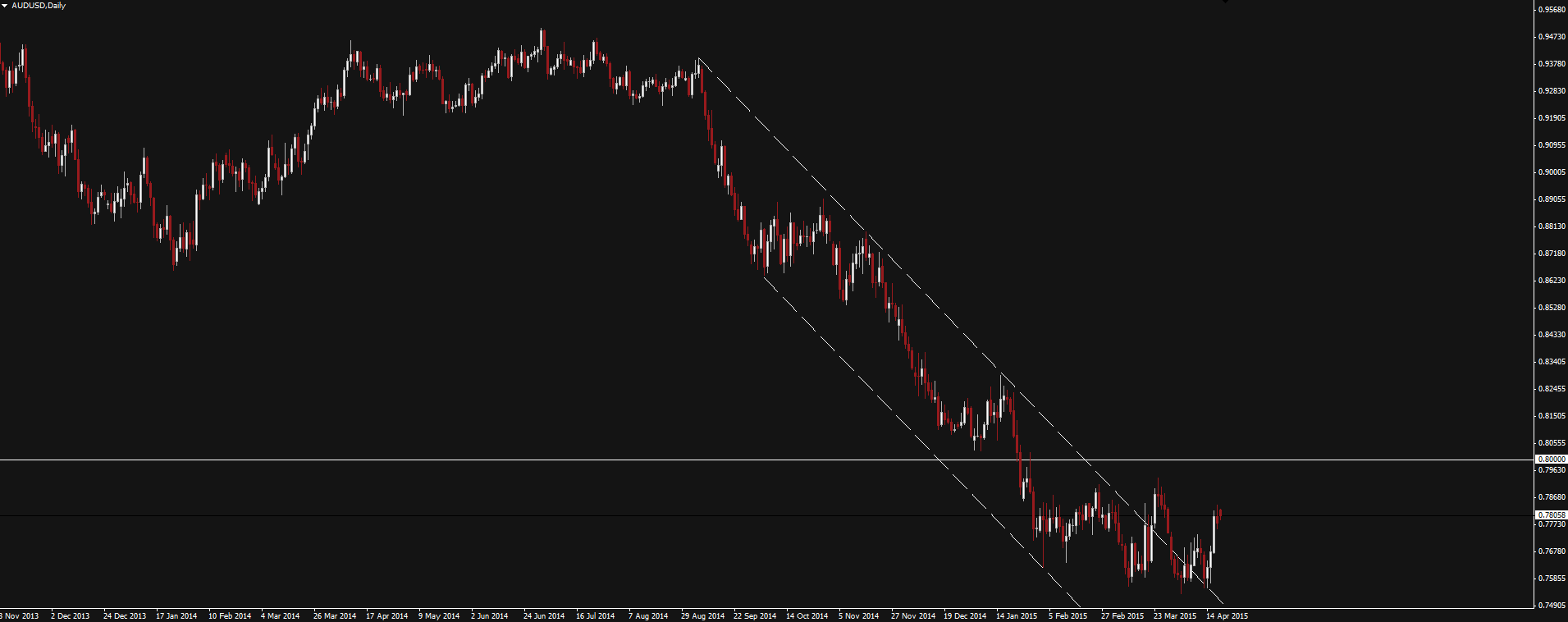

This PBOC news doesn’t change the fact that the Aussie charts all still look very bearish.

AUD/USD Daily:

Click on chart to see a larger view.

Price has bounced off the bottom that it tested 3 times, pushing it out of that downward channel. But a channel that steep cant last forever, and although it’s broken out, price still hasn’t made a new higher low or confirmed any sort of strength above that 80c psych level.

AUD/NZD Daily:

Click on chart to see a larger view.

Likewise the AUD/NZD chart also doesn’t look very inviting for bulls.

Last week I posted a AUD/NZD short setup in our new Technical Analysis section of the Vantage FX News Centre, speaking about shorting into the zone marked with the green ‘x’. Price re-tested the level on news and was instantly rejected.

I still really like this setup, Chinese RRR cut or not.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.