In the 24 hours following the FOMC statement and Yellen’s speech, the global market went on a roller-coaster ride. The USD Index once plummeted from 100 to 94.88, but now it has recovered most of its loss standing above 99. The Euro recorded a 15-year best performance but could not maintain it for long. On the side, oil prices jumped up 6% and then fell by 4% yesterday as the output cut is still far from sight.

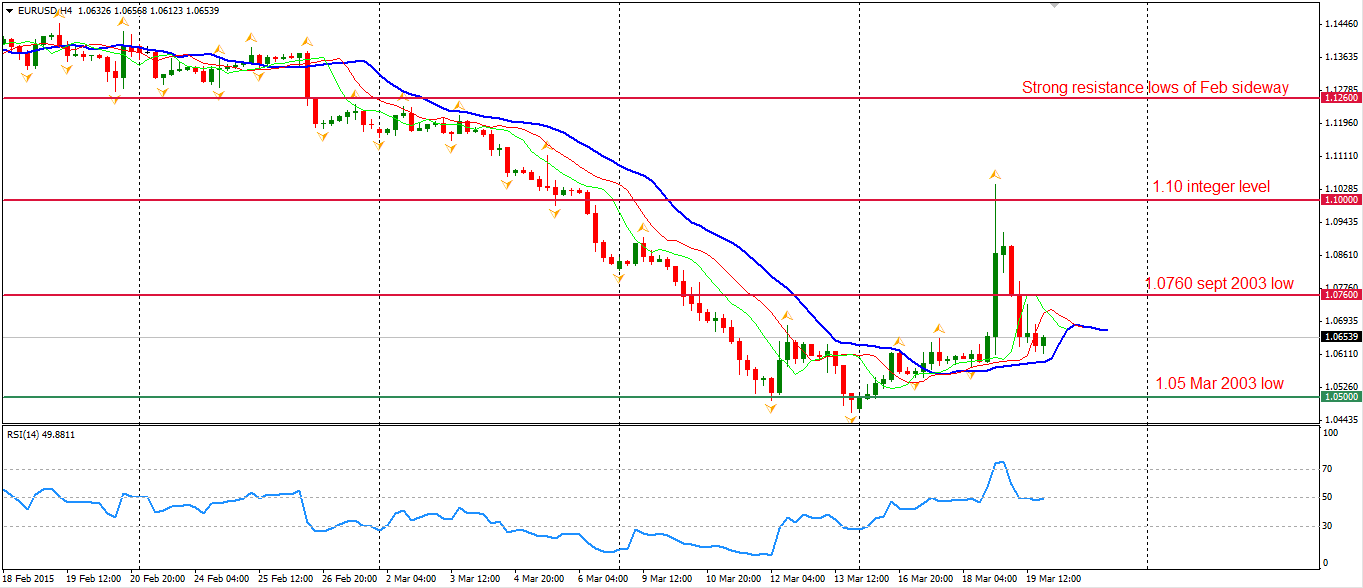

It seemed to be a bull’s trap for EURUSD with many stop orders triggering a surprising rally to 1.10. The FOMC committee downgraded their forecasts of US GDP growth and inflation, which does affect the market expectation. However, the fundamental aspect of theEuro has not been changed yet. Greece debt talks are still on a rocky road and the QE program is set to continue until 2016. Euro Dollar is still in the bearish channel and probably won’t stand beyond the 1.10 level in the short run.

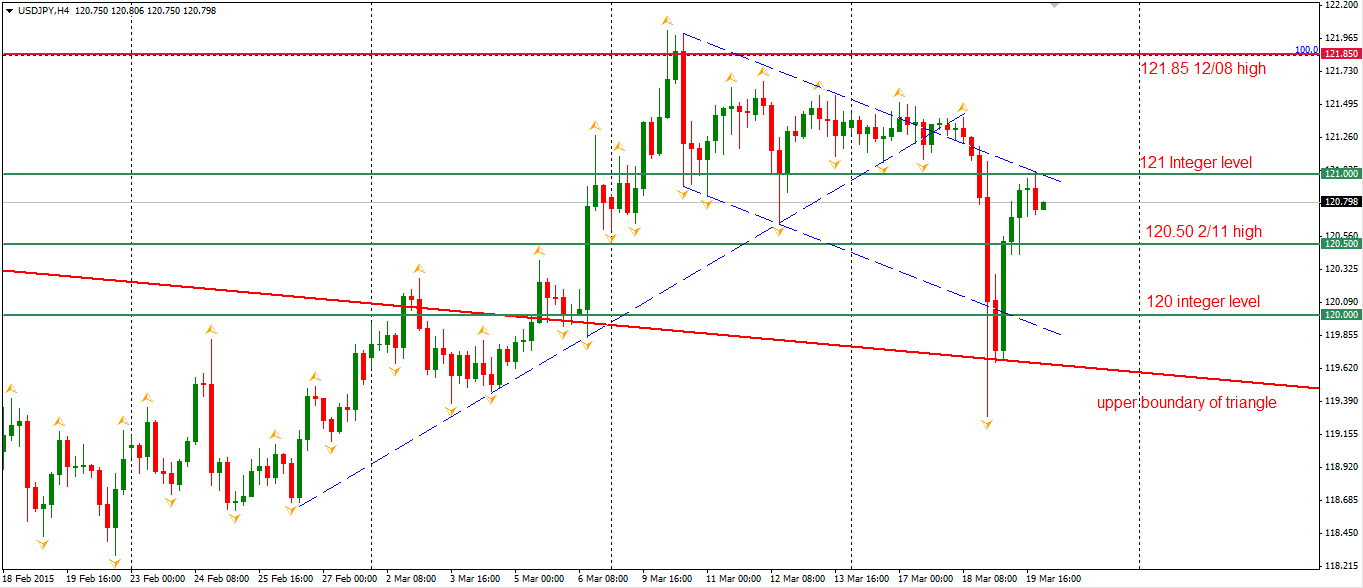

The Dollar Yen once touched 119.20 but rebounded shortly after. Technically, the breakout of a triangle pattern has been confirmed as effective, therefore the bullish view remains in the intermediate term. The pair now is approaching the 121 integer level which is also the upper boundary of the recent downward trend. If USDJPY can stand beyond this level, it may challenge 121.80 again.

Looking to stock markets, the Shanghai Composite gained 0.13% to 3582. The Nikkei Stock Average lost 0.35%. The Australian ASX 200 surged 1.86% to 5951. In European markets, the UK FTSE climbed 0.25%, the German DAX retreated 0.2% and the French CAC Index gained 0.1%. The US stock indices fell after the rally yesterday on Fed’s dovish statement. The S&P 500 closed 0.49% lower at 2089. The Dow slid 0.65% to 18076, and the Nasdaq Composite Index climbed 0.2% to 4992.

On the data front, Canada CPI and retail sales will be released at 23:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.