The rebound of majors against the Dollar continued on Tuesday. As the events within Eurozone have mostly settled, the focus of the market now has moved to FOMC statement that would be released tomorrow morning AEDST, which is Wednesday afternoon in the US session. Participants are wondering, in the background where global central banks are pouring funds into the market, will Fed delay raising its interest rate?

One of the key factors that the committee thinks highly of is wage growth. Even though President Obama said in last week’s State of the Union that US has ‘turned the page’, the wage still fell 0.2% in December, telling us the job market is still weak.

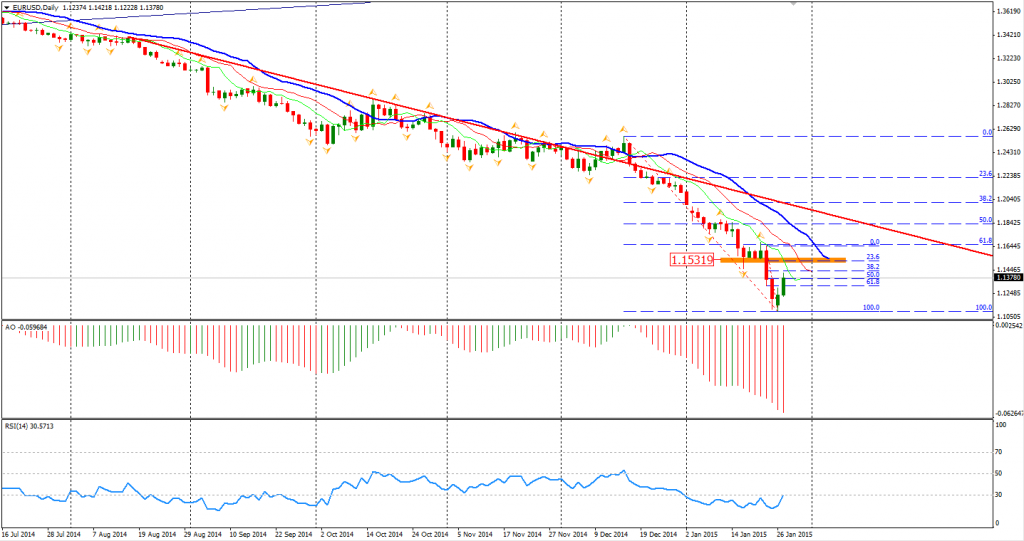

Euro bounced 200 pips and once it touched 1.1420 since European session yesterday. Finally, we see a strong rally of Euro and half of the loss since the QE decision has been recovered. It may continue to rise, but it will depend on the FOMC statement.

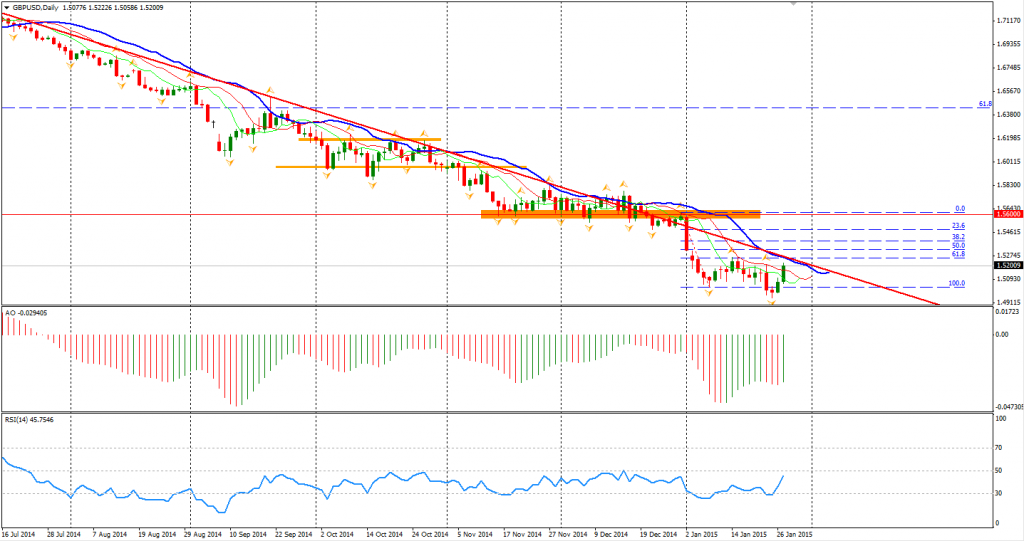

UK Q4 GDP expanded 0.5%, slower than expected 0.6%, giving more evidence to the speculation that Bank of England will not raise interest rate until 2016. The data dragged the currency right after the release, but later Sterling chose to rally against the Dollar instead and closed at a day high of 1.5190, highest since January 16.

Back to stock markets, the Shanghai Composite fell 0.89% to 3353. The Nikkei Stock Average surged 1.72%. Australian stock market rose 0.83% after the holiday. European markets were dragged by the news that anti-austerity party Syriza totally controlled Greek cabinet, the UK FTSE was down 0.60%, the German DAX lost 1.57% and the French CAC Index fell 1.09%. The sentiment of US market was also affected. The S&P 500 closed 1.34% lower to 2030. The Dow lost 1.65% to 17679, and the Nasdaq Composite Index slumped 1.89% to 4681.

On the data front, Australian CPI will be released at 11:30 am AEDST. German Consumer Climate will be at 18:00 AEDST and market is waiting for the FOMC statement at 6 am tomorrow morning.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.