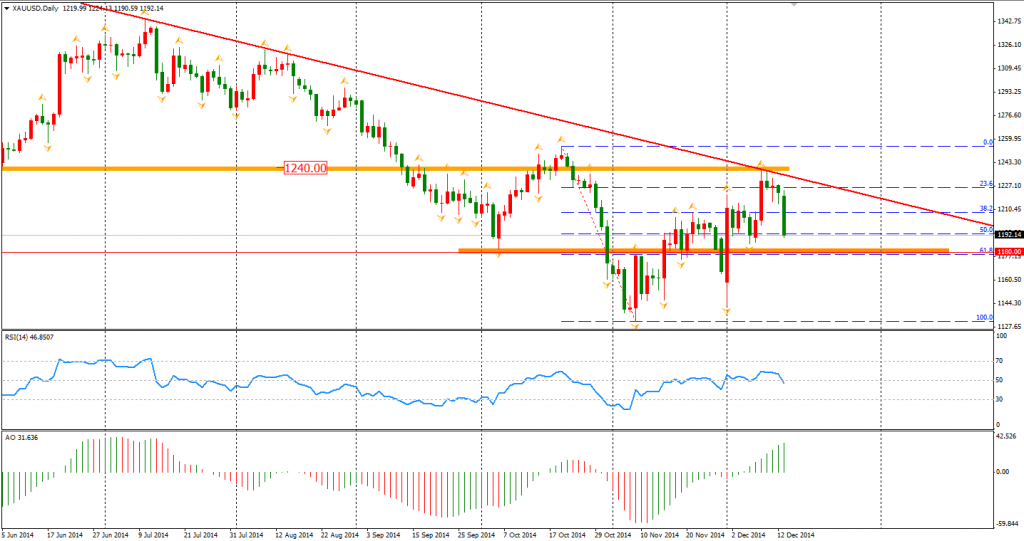

The fears of potential collapse of emerging markets like Russia, continues to spread encouraging last night’s selloff of commodities. The recent fall of oil prices caused the Ruble to plummet last night by 13% to 66 per Dollar. Even with the data showing US industrial output as better than expected – the dampening could not be relieved. The WTI slumped again by over 3% to $55.3 per barrel. The Brent North Sea crude settled at $US61.06 a barrel in London, down 79 cents from Friday’s closing level reaching a new 5 year low. The price of gold fell below the $1200 mark to $1193.50. As I have previously mentioned, $1240 is the critical resistance and the bearishness of the gold price will remain as long as the trendline is not broken. A bearish reversal has formed and the $1180 level below is the next bears’ target.

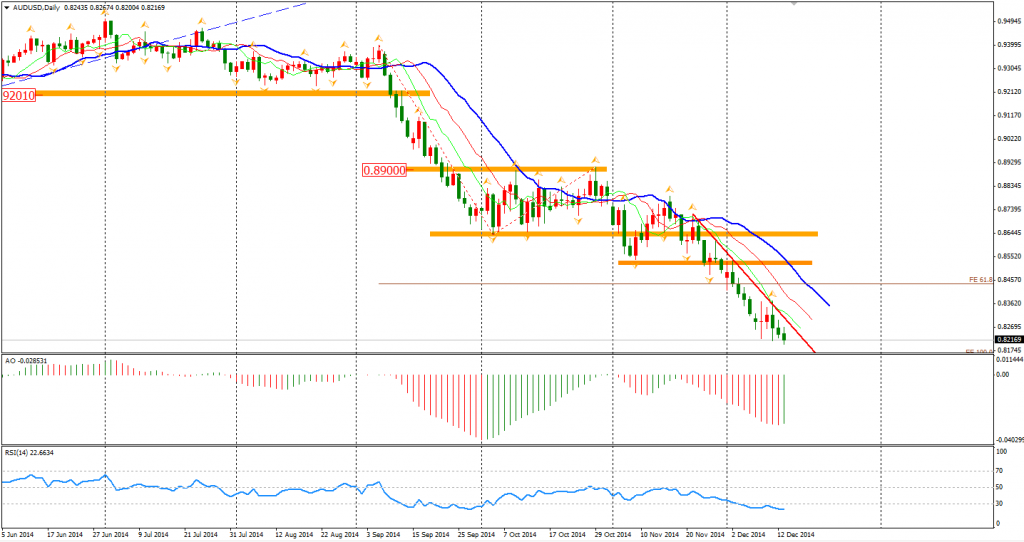

The Aussie Dollar again refreshed recent lows down to 0.8200 – largely attached to pessimistic views on commodity demands. The Aussie may have also been affected by the hostage situation which occurred in Sydney’s CBD yesterday and overnight. Major financial institutions and businesses were evacuated from the vicinity with many not returning to work today.

The Chinese data released last week is of major concern. Weak data including electricity output, industrial production and fixed asset investment showed that the Chinese economy has slowed again for November. As such, the Australian Treasurer has predicted that the price of iron ore may fall to $60 per tonne, and so the bearish trend of Aussie Dollar will most likely continue.

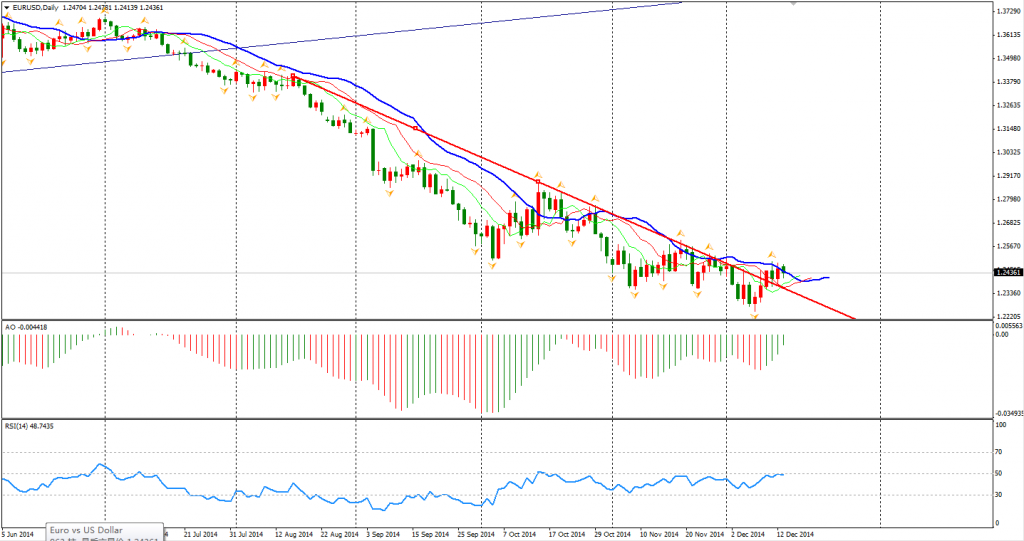

Euro’s rally temporally stopped at the 1.25 mark, but the short term bullish trend remains. The recent strength of the Euro comes from the profit-taking of bears. According to the position report of CFTC, the net short position of the Euro has dramatically dropped by 14%. The trend may keep going for the next couple days before the FOMC meeting.

Looking back to the Asian stock markets, the Shanghai Composite gained 0.52% to 2953. ASX 200 lost 0.64% to 5186. The Nikkei Stock Average was down 1.57%. In European markets, the UK FTSE lost 1.87%, the German DAX and the French CAC Index plummeted 2.7% and 2.5%, respectively. US market keeps falling on concerns of global economic slowdown. The S&P 500 closed 0.62% lower to 1989. The Dow dropped 0.58% to 17180, and the Nasdaq Composite Index lost 1.04% to 4605.

On the data front, Australia Monetary Policy Meeting Minutes will be released at 11:30 AEDST. HSBC Flash Manufacturing PMI will be at 12:45 am. Euro area PMIs and UK CPI and BOE report will be the major events in the Eur

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 as US yields push lower

Gold price trades in positive territory above $2,310 in the American session on Monday. The benchmark 10-year US Treasury bond yield stays in the red below 4.5% after weaker-than-expected US employment data, helping XAU/USD hold its ground.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.