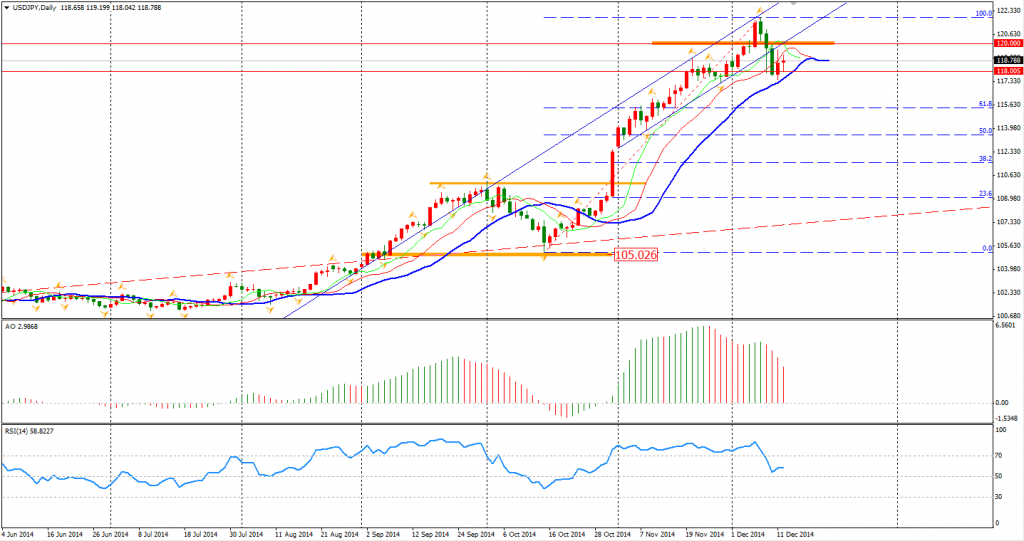

The first news to wrap up for our traders regards Japan’s elections. Shinzo Abe won the re-election in the lower house of Japan last night, meaning that ‘Abenomics’ is sure to continue. The Dollar Yen and Nikkei Index may be back to the rally even though the market may continue to question the usefulness of QQE. As we can see in the daily chart, the Dollar Yen left a doji beyond the 118 level. A potential reversal may happen today and the pair may shortly stand upon the 120 mark.

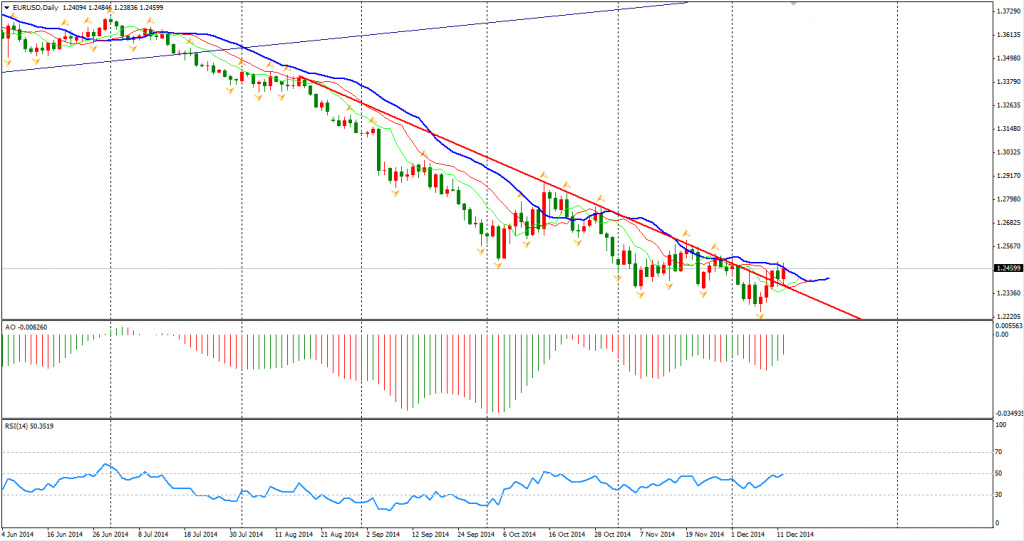

As to other the majors, the Euro is the only major currency rising against the Dollar, although the Fitch has downgraded France to an AA rating. A mid-term bullish reversal sign seems to have formed as Friday’s bull body covered the whole body of Thursday confirming the breakout of the four-month bearish trendline. Before this sign, we can see a differential between the price movement and AO in the daily chart. Also, Alligator is turning into bullish order. Technically, a midterm rebound may probably happen.

The US consumer sentiment surprisingly increased to 93.8 in December, helping the Dollar strengthen against most currencies. However, traders are being prudent keeping in mind the FOMC meeting to be held this Thursday. The broad is expected to be more hawkish with the strong economic data confirming a solid US economy recovery.

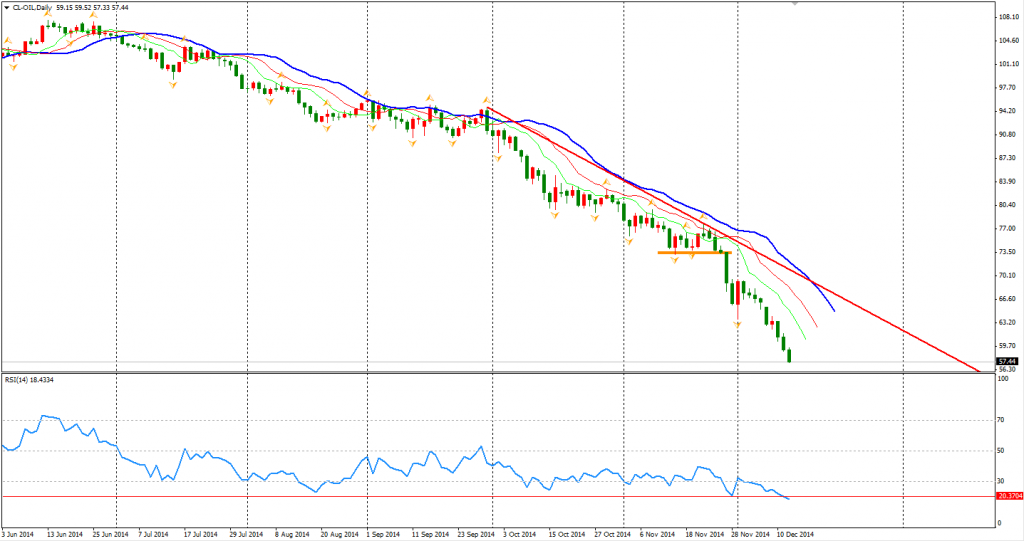

WTI Oil prices slumped to $57.5 per barrel, losing 12.4% last week, as Saudi Arabic has no intention to decrease its production and IEA lowered the expectation of 2015 global oil demand. Traders closed their long positions not willing to hold them through the weekend.

The slump also triggered concerns on weaker global growth and dragged down the stock markets worldwide.

In European markets, the UK FTSE lost 2.49%, the German DAX and the French CAC Index plummeted by 2.7%. The US market experienced its biggest weekly loss since 2011. The S&P 500 closed 1.62% lower to 2002. The Dow dropped 1.77% to 17280, and the Nasdaq Composite Index lost 1.16% to 4653. Back to the Asian stock markets, the Shanghai Composite gained 0.42% to 2938. ASX 200 lost 0.22% to 5219. The Nikkei Stock Average was up 0.66%.

On the data front, Australia New Motor Vehicle Sales will be released at 11:30 AEDST. At midnight, traders will eye the US Empire State Manufacturing Index and Industrial Production.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.