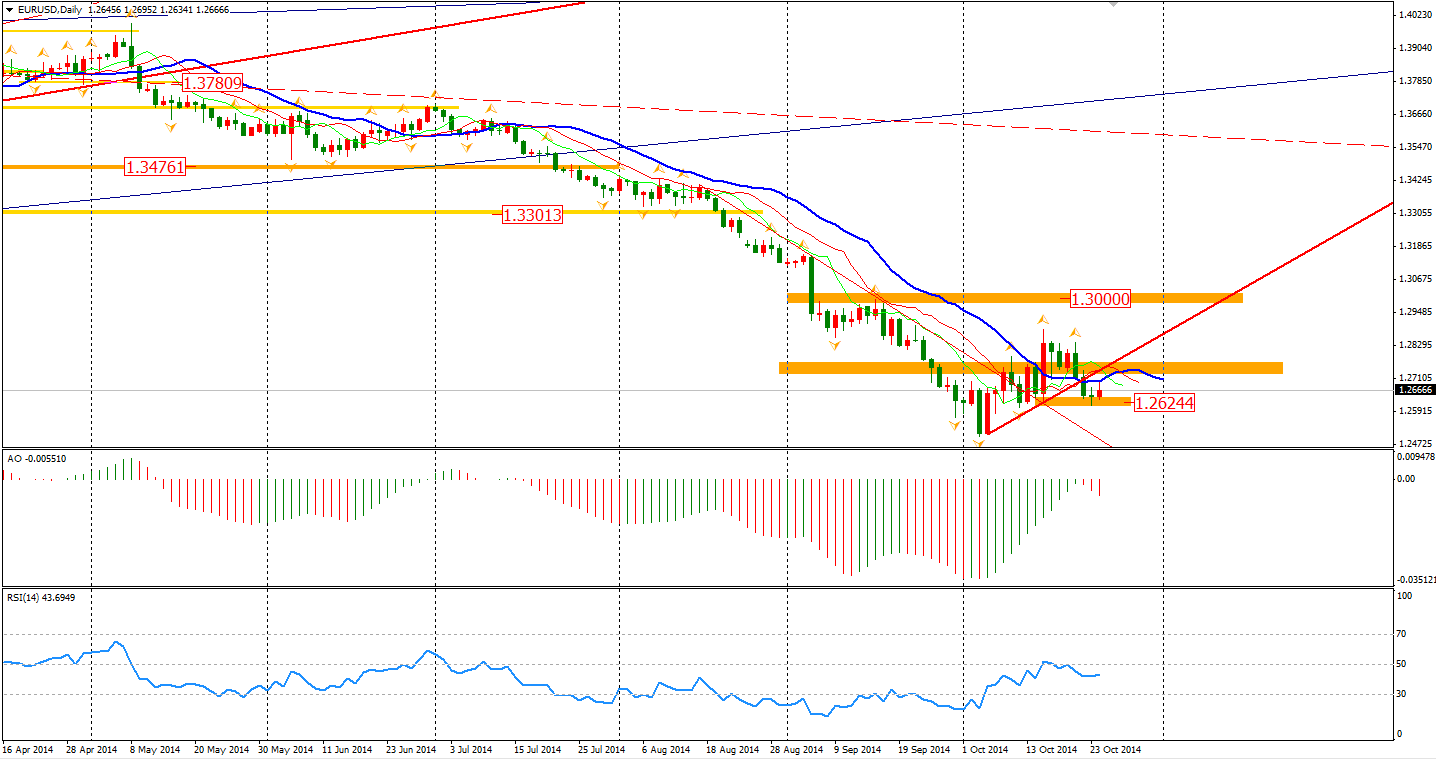

After two weeks of trading on light data releases, we will soon experience a busy week with the next FOMC meeting to be held this Thursday morning. The US Dollar has retreated in these recent two weeks – a correction of its 11-week climb. Having said that, the bull trend is not yet over and the retracement most probably was a short adjustment. Fundamentally, there will be a great chance of the Fed ending the QE3 this week, whilst European and Japanese policy makers may look to introduce more stimulus programs over the next two years. Also, the bets are on for a stronger Dollar by hedge funds and other large speculators are still increasing, implying the Dollar may soon be back to rally again.

Recent weak data showing Germany’s slowdown and record low inflation level places more pressure on the ECB to consider additional categories of assets for its purchase program, even though it has just started to purchasing covered bonds.

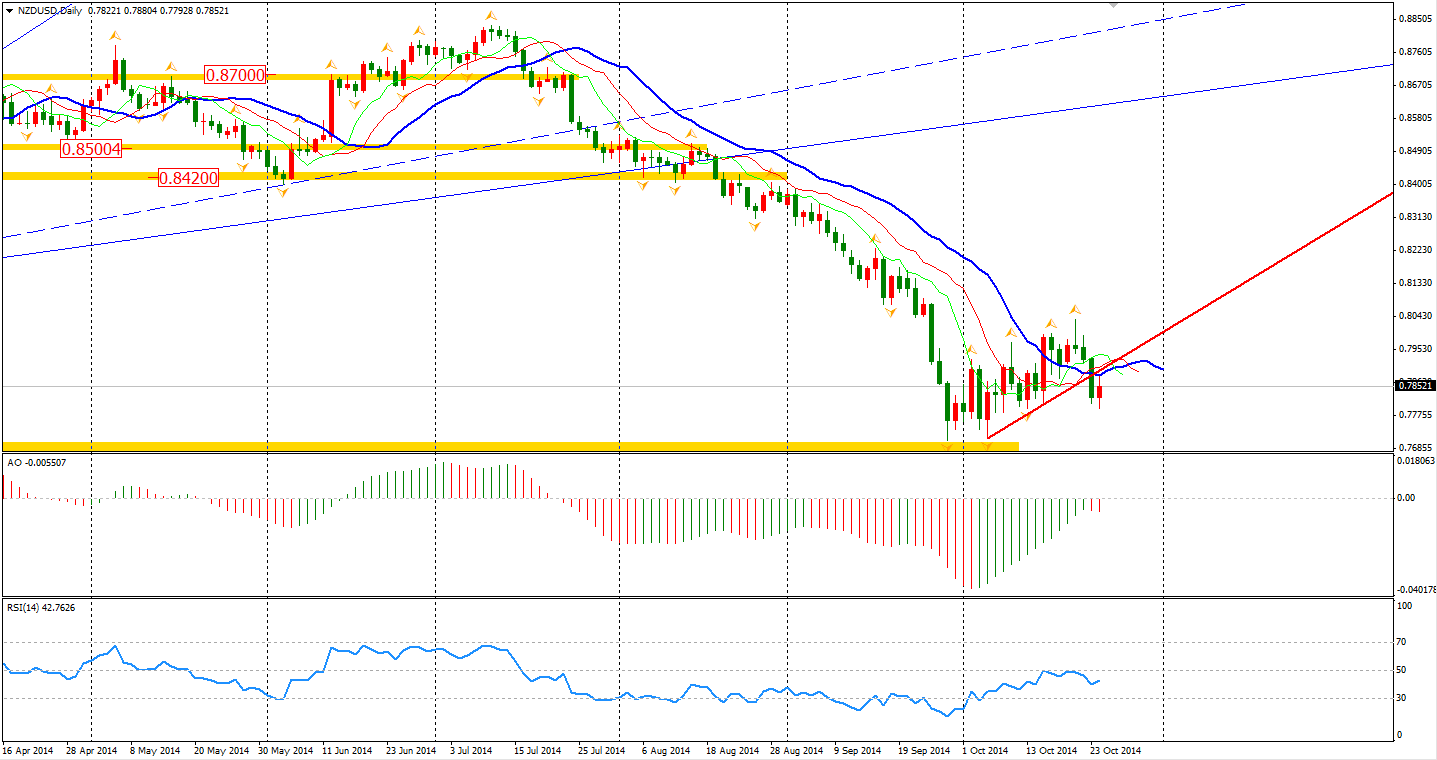

The outlook of commodity currencies is also bearish. The Kiwi Dollar has broken the upward channel and is heading to the month low of 0.77. The highest interest levels amongst Western nations have curbed the space of economic growth of this export-oriented country. The export data showed that New Zealand’s exports to China fell 30% year on year in the last month, which was the biggest decline since July 2005. This fact may cause the NZDUSD to fall to a lower level.

Led by a surging Japanese market, the Asian stock markets rallied on Friday. The Nikkei Stock Average pushed up 1% – the third large rise last week. The Shanghai Composite was flat at 2302, as domestic investors worry about new rounds of IPOs. The ASX 200 gained 0.54% to 5412. In European stock markets, the UK FTSE was down 0.47%, the German DAX lost 0.66% and the French CAC Index slid 0.69%. The US market rose on bright earnings, halting a four-week slide with the S&P 500 capping its best week since 2013. The S&P 500 rose 0.7% to 1965. The Dow once gained 0.76% to 16805, while the Nasdaq Composite Index edged up 0.69% to 4484.

On the data front, the German Ifo Business Climate will be out at 20:00 AEST and US Pending Home Sales is out at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.