The bulls of the Dollar took chance to fight back as yesterday’s UK inflation data and German ZEW Economic Sentiment was weaker than expected. The Dollar index rose to day-highs of 85.80. The fundamental difference between Europe and the US makes investors continue betting on a stronger Dollar.

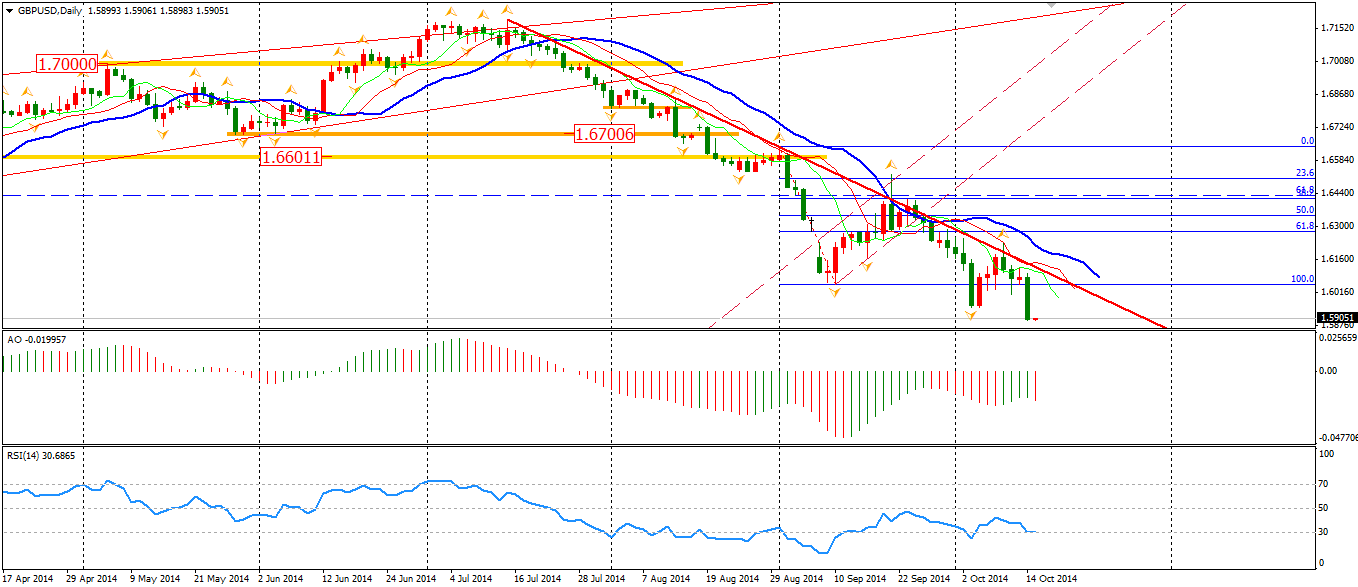

UK CPI fell to 1.2%, the lowest level since September 2009 further closing the possibility of the BOE’s interest rate hike. The inflation level, along with unemployment rate, will be the data that the BOE is closely monitoring. The Pound plummeted below 1.60 integer level after the data release and finally stopping around 1.5920 mark.

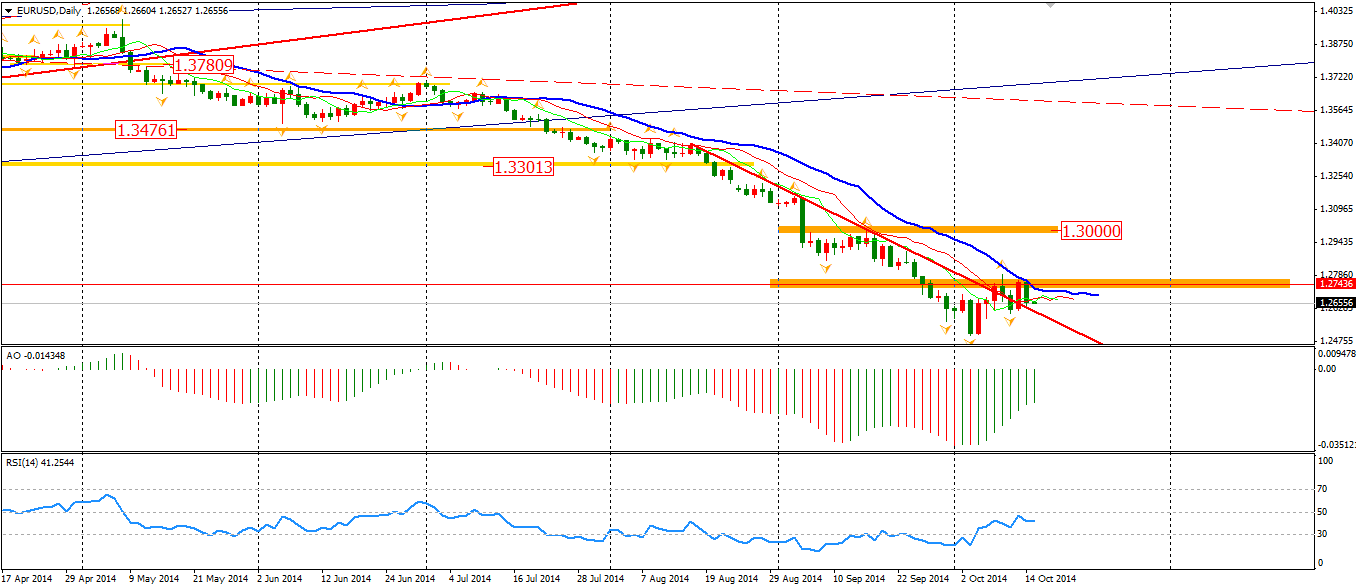

The Euro was pared by the news that the largest economic growth engine of the Eurozone may not be as strong as it once was. The German ZEW Economic Sentiment was -3.6 – the first negative reading since November 2012. The German government also cut the 2014 growth rate from 1.8% to 1.2% and cut the 2015 forecast to 1.3% in response to mild global expansion and geopolitical fears. The slowdown of Germany may be confronting the Eurozone with a three-bottom recession, rounding out the GFC and Euro crisis.

The Dow edged down 1.35% to 16321, while the Nasdaq Composite Index slumped 1.46% to 4213. The S&P 500 declined by 1.65% to 1874. We can see the index has broken the trend line and the August low near 1900. The next target may be the 1800 integer level.

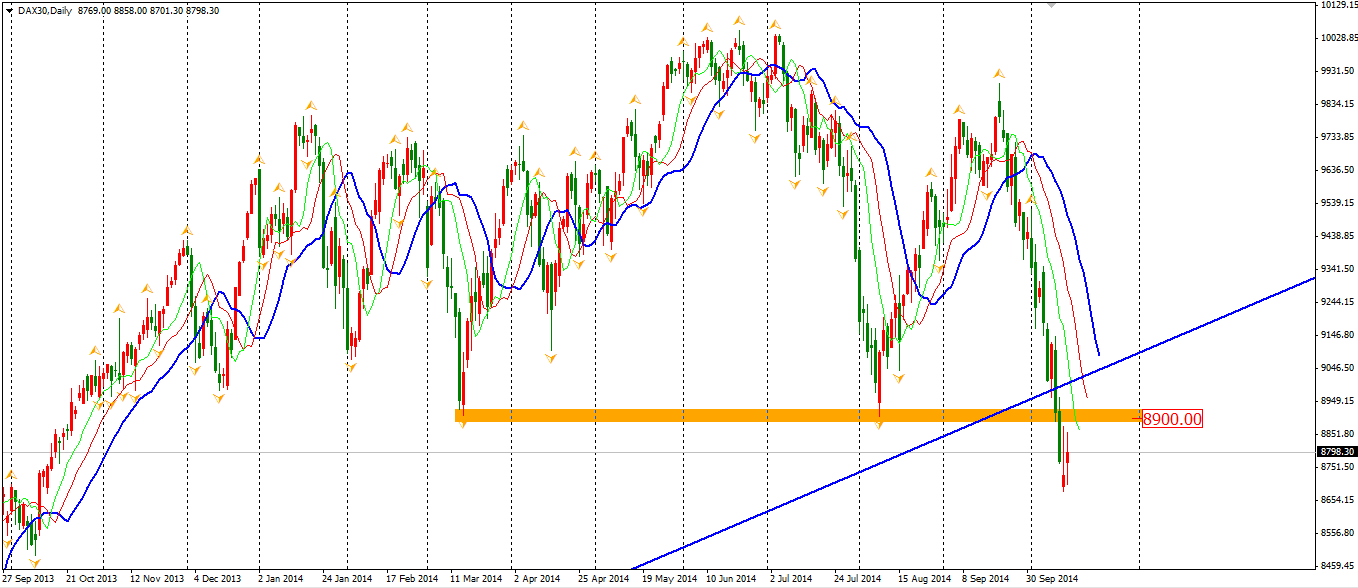

Asian stock markets remained weak yesterday. The Nikkei Stock Average slumped by 2.38%. The ASX 200 rebounded 1.03% to 5207. The Shanghai Composite also fell by 0.28% to 2359. In European stock markets, the UK FTSE was up 0.42%, the German DAX gained 0.15% and the French CAC Index rose by 0.23%. The DAX index has erased all the gain of this year and has broken the bullish trendline since 2011 and 8900 integer level. Traders may short the index again if it bounces back to this area.

The US market closed with a mild rebounding day. The Dow edged down 0.04% to 16315, while the Nasdaq Composite Index gained 0.32% to 4227. The S&P 500 recovered 0.16% to 1877.

On the data front, Chinese inflation data will be released at 12:30 AEST. ECB President Draghi’s Speech will begin at 18:00 AEST. UK job market data will be out at 19:30 AEST and US Retail Sales and PPI will be at 23:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.