The July FOMC meeting minutes showed that the committee has almost reached an agreement regarding quitting the easing policies. Some members think the labour market is improving and inflation is rising, therefore suggesting that the Fed should raise interest sooner. These suggestions boosted the Dollar across the board, and its strength may continue in the midterm.

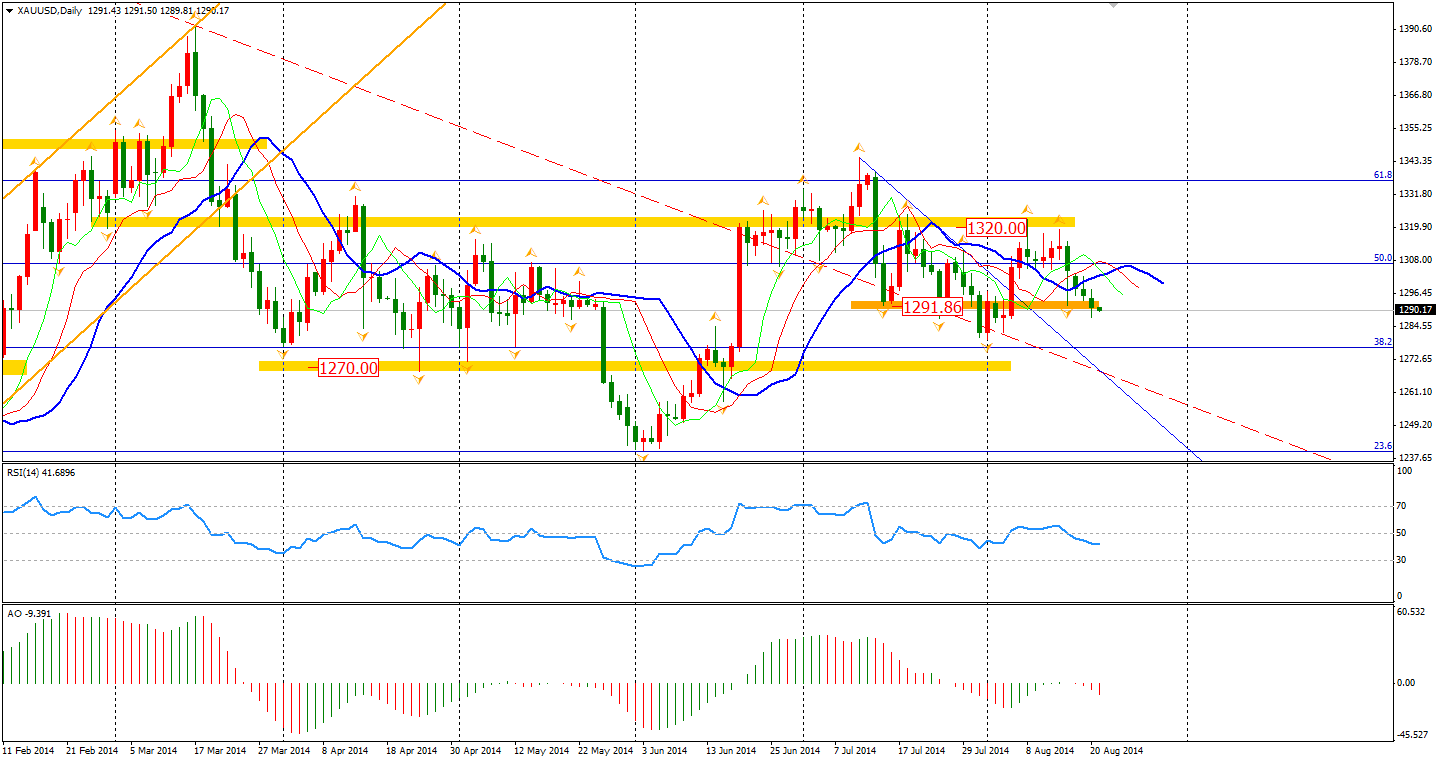

Gold waved up and down ahead of the Fed Minutes with uncertainty of conflicts in Ukraine and Gaza. However, after the minutes were released, it plummeted to $1287.8 per ounce and broke the $1292 support. We may need a little more time to see the confirmation of this bearish crossover.

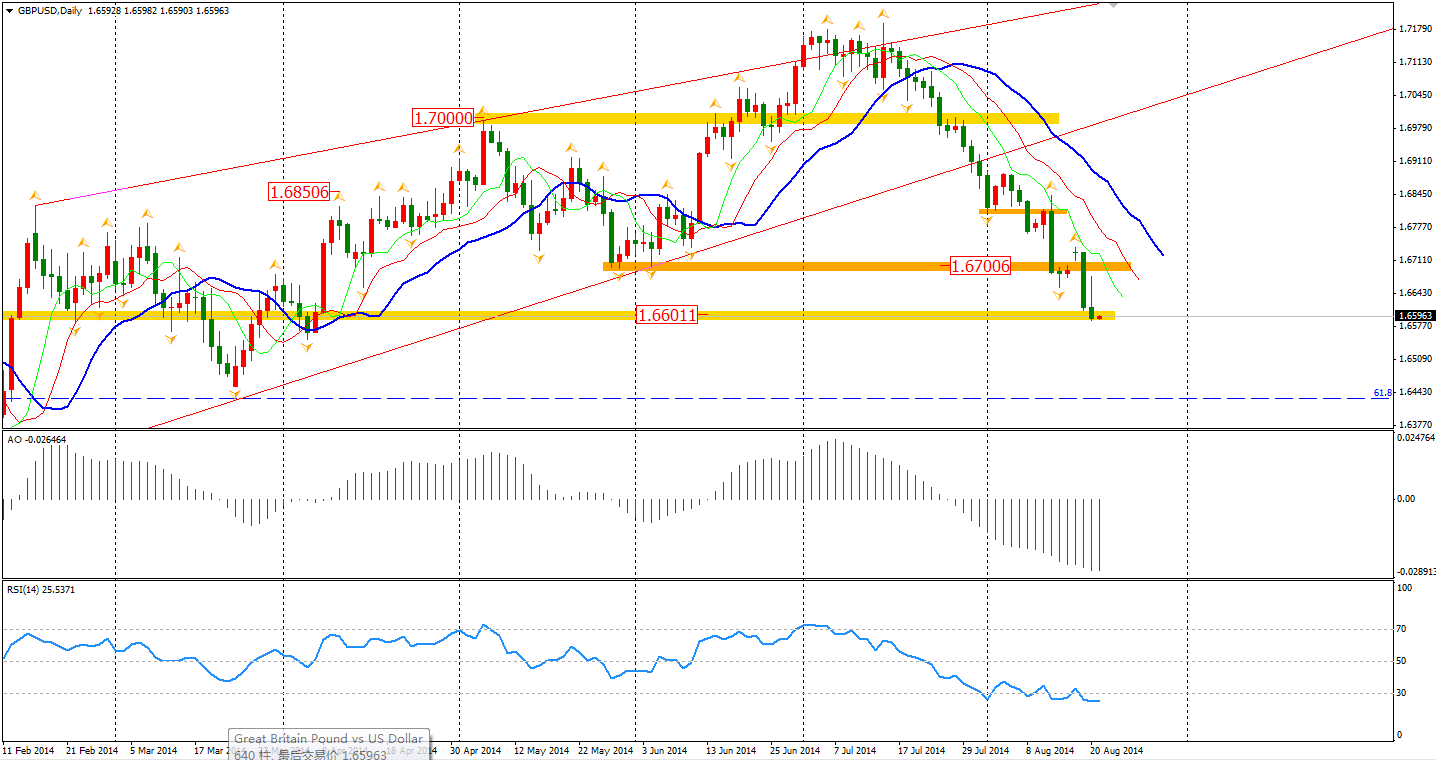

Today was a big step towards the Bank of England raising the interest rate. According to the MPC August meeting minutes, two out of nine members in the committee supported raising rate by 25 bps. This is the first time since 2011 that this option has gained support. After the report, the Sterling surged 50 pips to 1.6670 against the Dollar. However, the pair then slid back to 1.66 after the FOMC meeting.

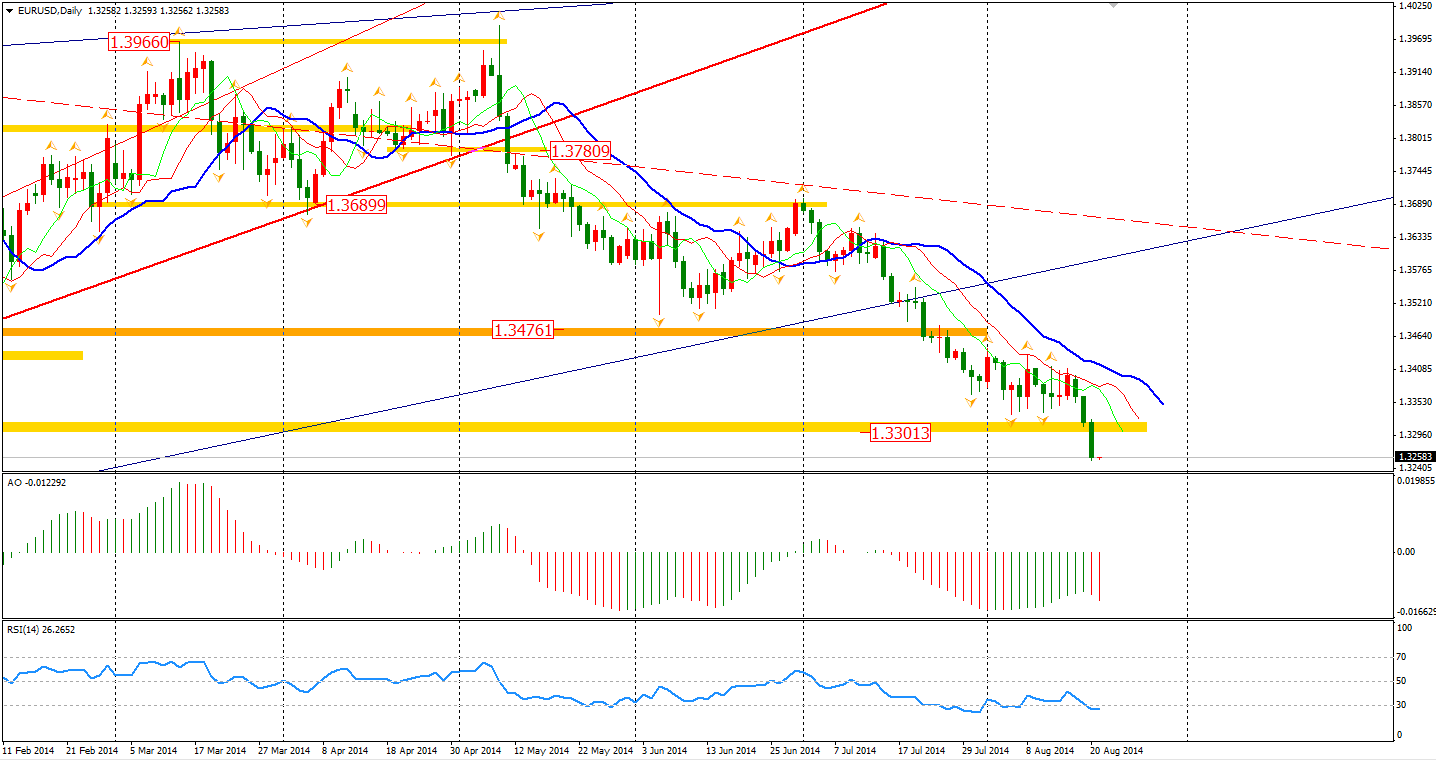

Euro/Dollar finally broke through the 1.33 integer level after the consolidation since the start of this month. Funds are being withdrawn from Europe as the economic outlook is pessimistic along with the Ukraine crisis. Growth is stagnating in the Eurozone with only 0.1% in Q2, while Germany experienced a 0.2% contraction. The 0.4% inflation level is a more worrying sign as it may mean that deflation is very close.

Asian stocks markets closed with little changes yesterday before the Fed meeting. The Shanghai Composite edged 0.23% lower to 2245. The Nikkei Stock Average closed flat. The Australian ASX 200 gained 0.19% to 5634, even though heavy weighted BHP Billiton dropped 4.1%. In European stock markets, the FTSE fell 0.35%, the German DAX lost 0.21%, and the French CAC Index fell 0.32%. U.S. stocks rallied slightly after the Fed minutes. The Dows gained 0.35% to 16979. The S&P 500 edged 0.25% higher to 1986 near record high, while the Nasdaq Composite Index was down 0.02% to 4526.

On the data front, China HSBC Flash Manufacturing PMI will be released at 11:45 AEST. Eurozone PMI data will also be out today at the beginning of European session. UK’s Retail Sales will be at 18:30 AEST. Also, we have U.S. Unemployment Claims at 22:30 AEST and Existing Home Sales at midnight.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, in an uneventful US session

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground while central bank officials fail to trigger some action ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.