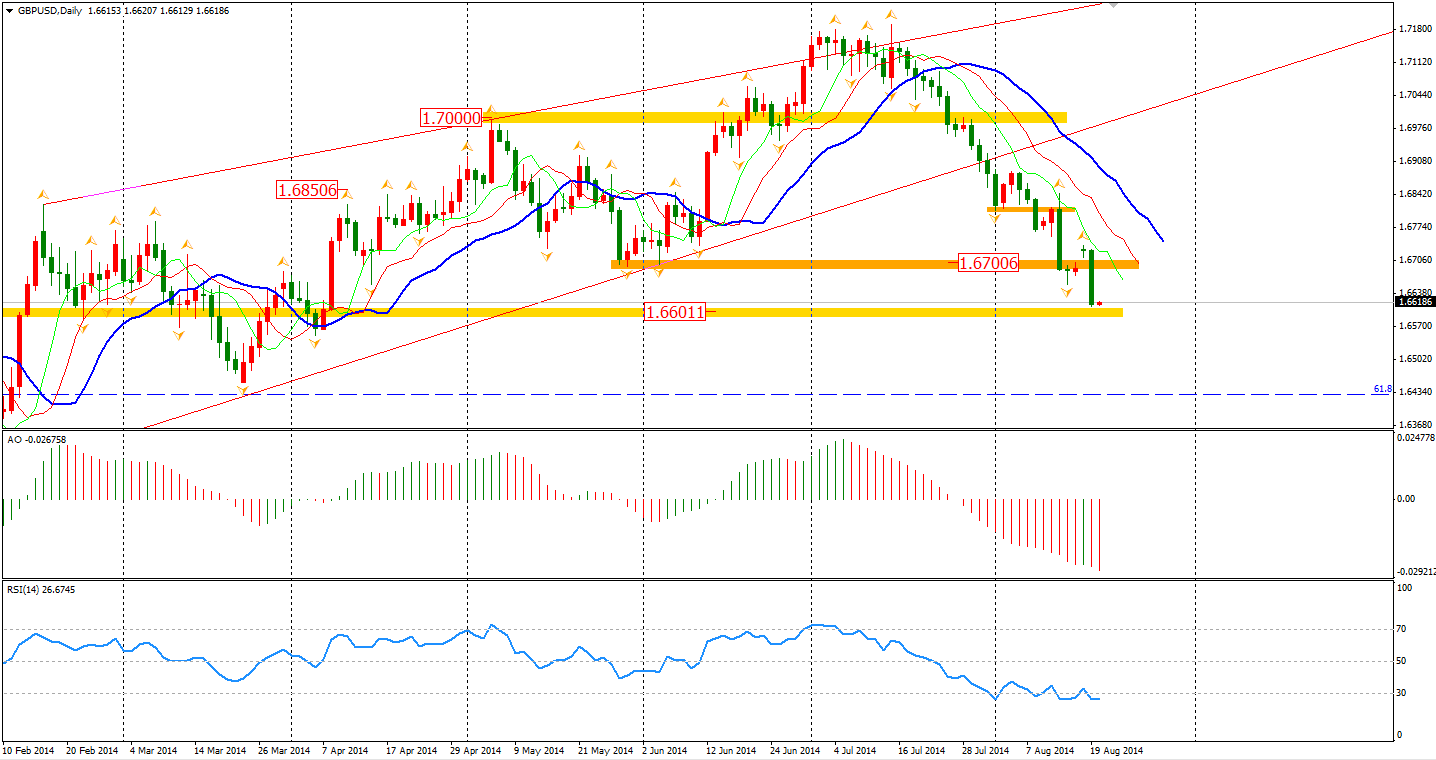

The Sterling plummeted to the 1.66 integer level as the inflation level was surprisingly lower than expected. CPI fell to 1.6% in July against the expected 1.8% and 1.9% in prior month. The July inflation rate further lowered speculation of a BOE interest rate rising, leaving the Sterling touching lows of the last four months. Traders seem to be waiting for the BOE Meeting Minutes for their next moves, as the voting may show members to be more hawkish this month.

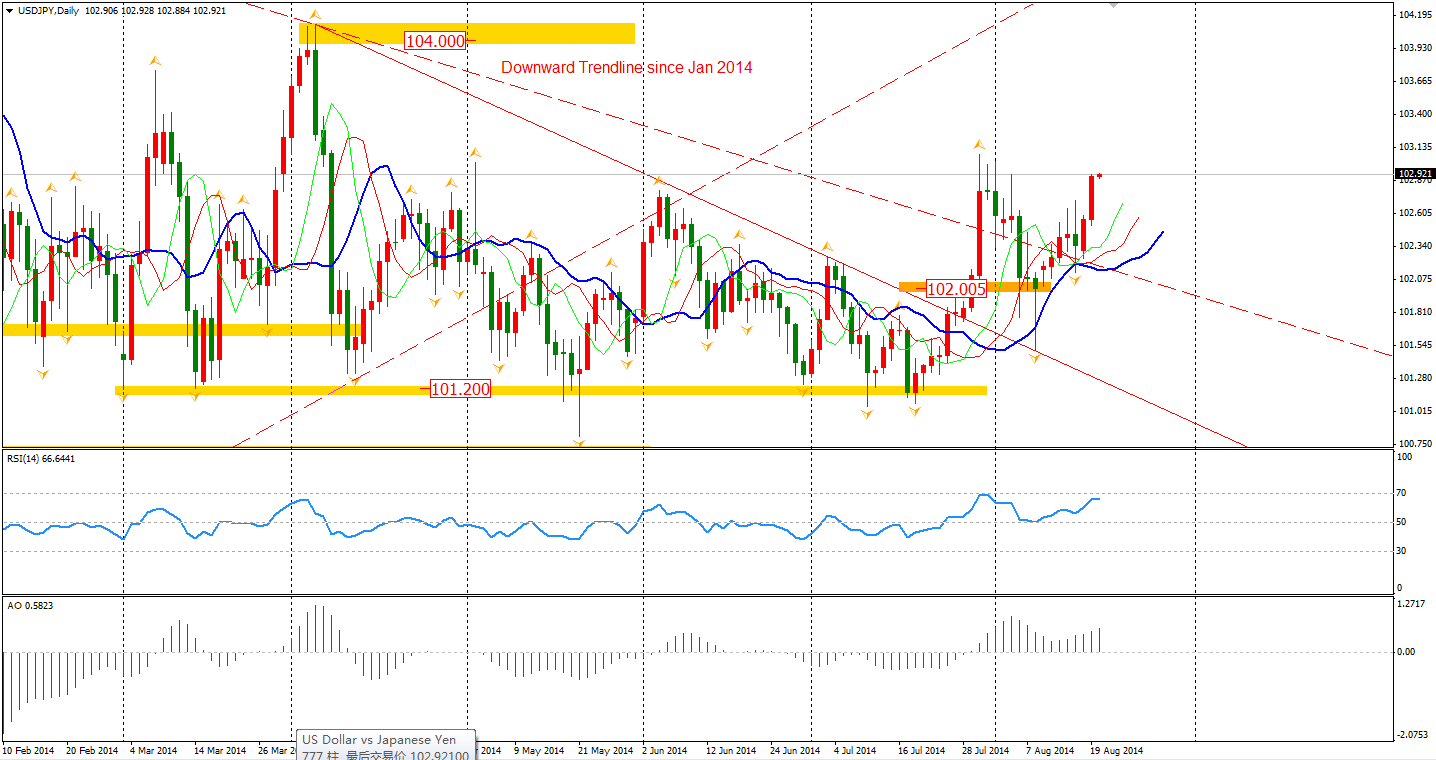

Following soon after the U.S. trading hours open, the US Dollar showed up stronger across the board as U.S. housing data proved more optimistic than the forecast. Furthermore, the need for safe-haven assets eased with the news of Russian President will meet Ukrainian government Leader next Tuesday. The Dollar/Yen rose to 102.90 level, near the former high at the end of last month. Will we see a new round of Yen depreciation?

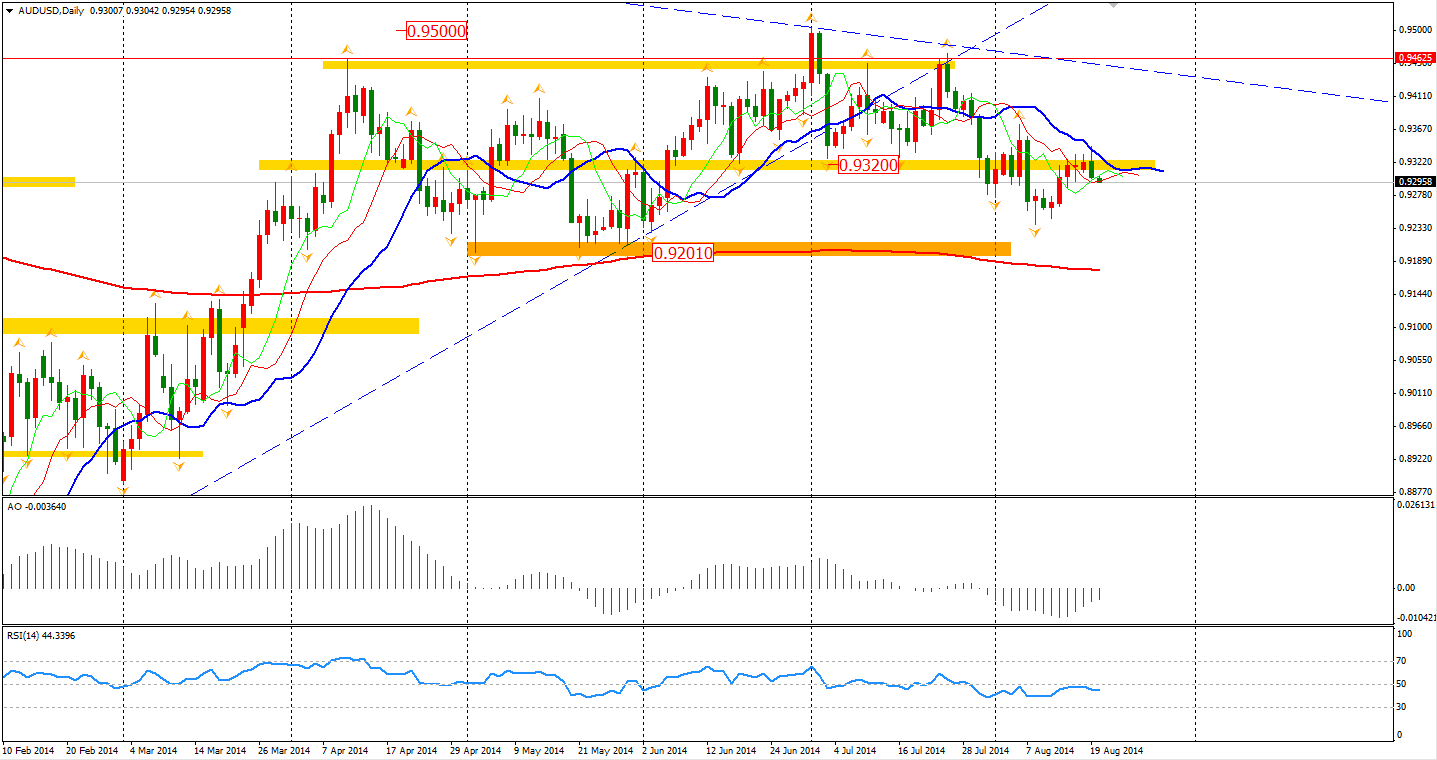

Back to commodity currencies, the Aussie surged to 0.9340 after the release of RBA Monetary Policy Meeting Minutes during the Asian trading hours. Although the minutes pointed out as usual that the current foreign exchange level is too high and are dragging the exports, the RBA has not changed the monitory policy and is not considering further easing. However, the strength of the Aussie collapsed in the U.S. session finally closing at 0.9300 earlier this morning. As long as the head-and-shoulders top is effective, we can maintain the bearish outlook for the Aussie Dollar.

The Asian stocks markets closed higher yesterday with easing of fears and expectations of a lower interest rate in mainland China. The Shanghai Composite edged 0.26% higher to 2245. The Nikkei Stock Average rose 0.83%. The Australian ASX 200 gained 0.66% to 5624. In the European stock markets, the FTSE rose 0.56%, the German DAX surged 0.96%, and the French CAC Index advanced 0.56%. U.S. stocks rallied for the second day, as investors are speculating a dovish Fed meeting in next morning. The Dows gained 0.48% to 16920. The S&P 500 rippled 0.43% higher to 1982, while the Nasdaq Composite Index was up 0.43% to 4527.

On the data front, the minutes of MPC monitory decision will be the focus of markets; and that will be at 18:30 AEST today. Also, stay on for Canada Wholesale Sales at 22:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.