Again, the FX market is back to its previous status of low volatility, even as world leaders are still arguing over who should be responsible for the MH17 crash and the death roll of Gaza conflicts are raising fast.

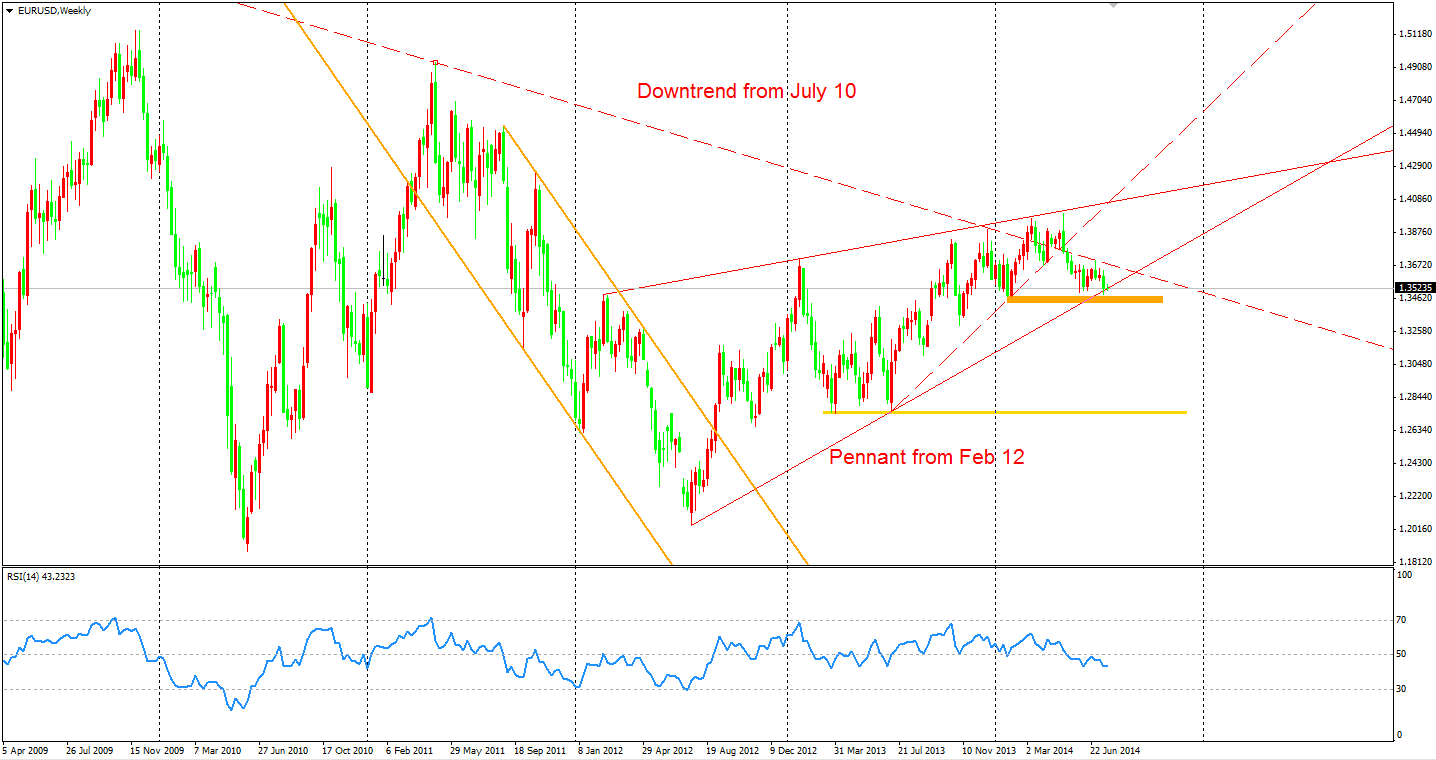

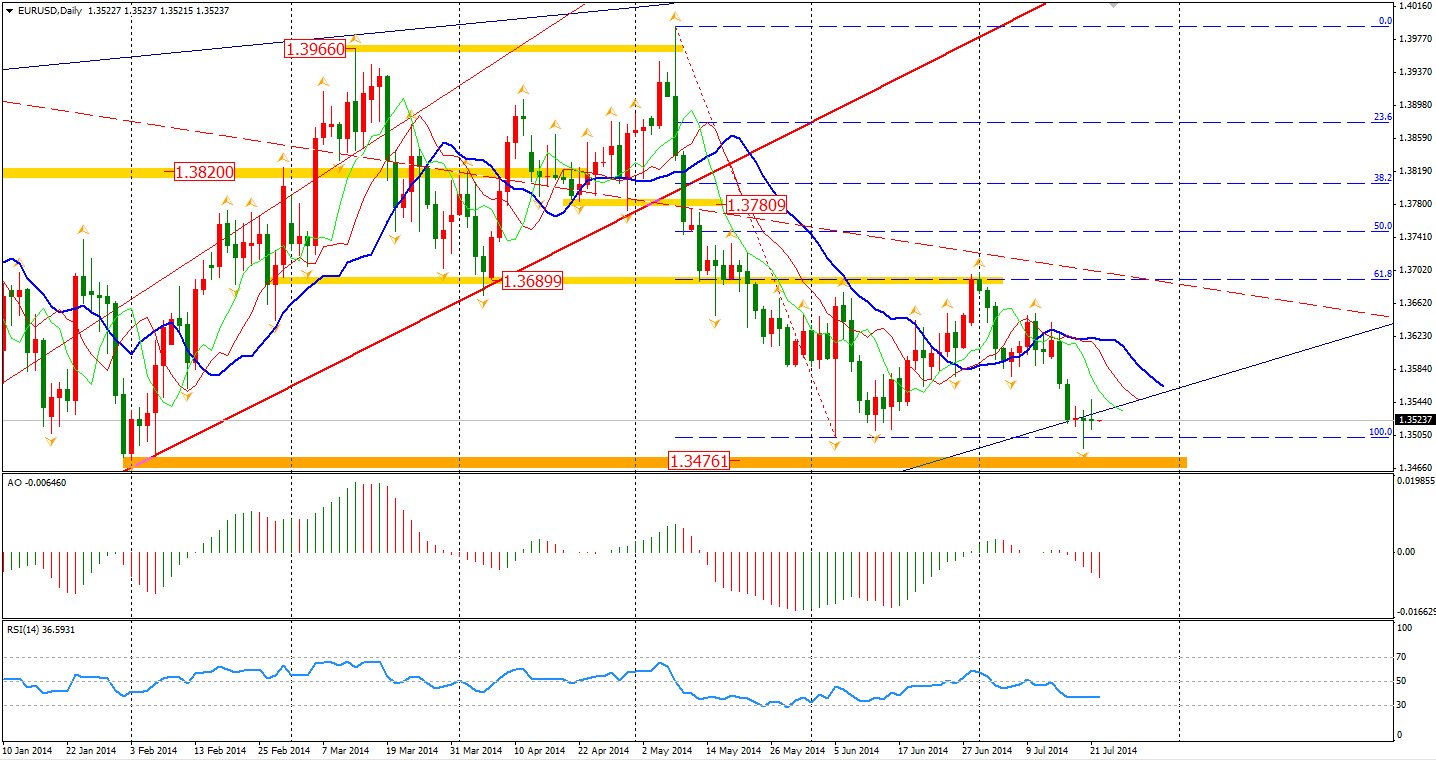

Euro/Dollar closed as a doji for the third straight session yesterday, with the price falling to the essential support level at the prior low of 1.3476 from back on the 1st February. When we are looking at the weekly chart of this pair, the Pennant pattern starting from February 2012 seems to be close to a breakout. If this becomes true, then we may witness a significant fall in the Euro in the mid-term.

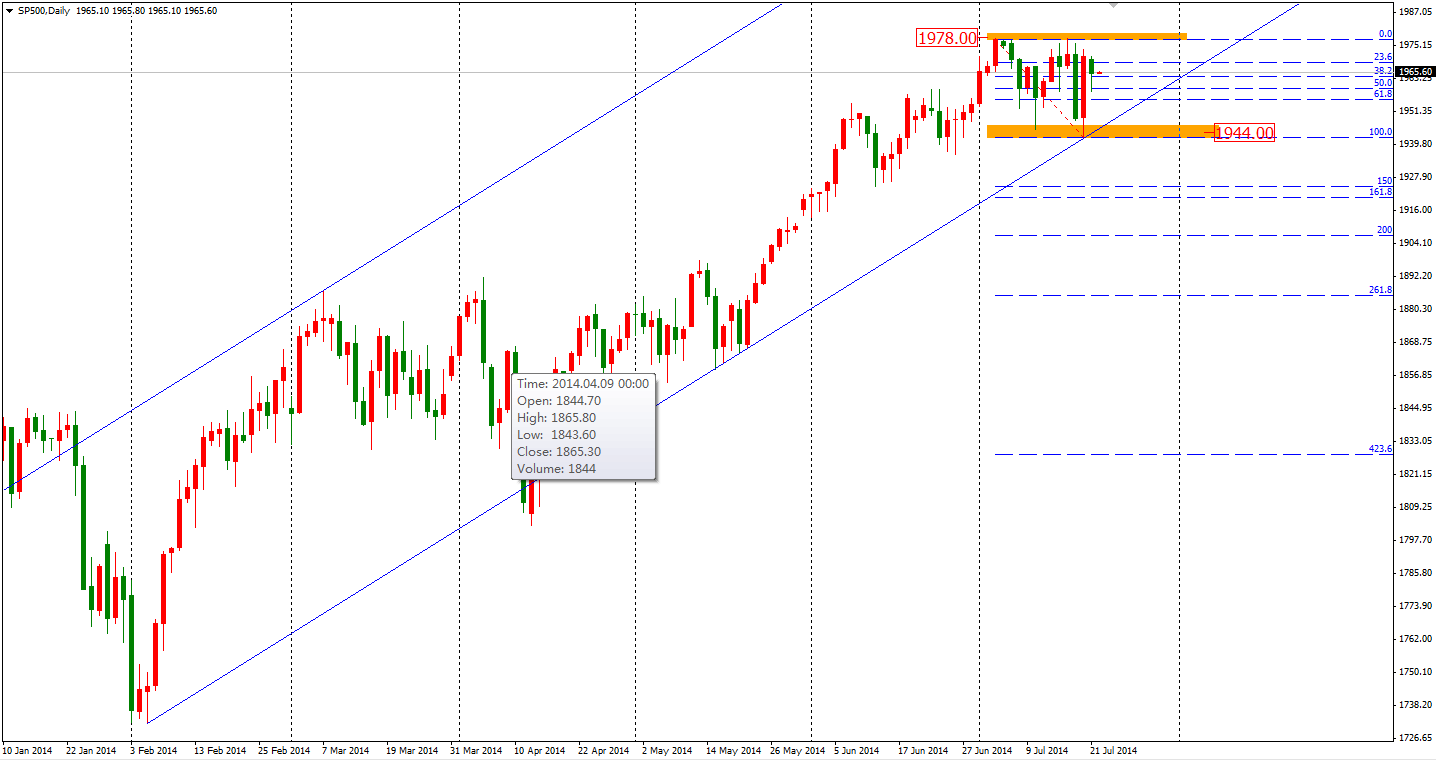

In the Asian markets yesterday, the Australian stocks closed at a six-year high. The ASX 200 rose by 0.15% to 5540. The Shanghai Composite closed 0.22% higher to 2054. The Nikkei Stock Average closed for holiday. In European stock markets, the FTSE closed 0.31% lower, the DAX lost 1.11%, and the CAC was down 0.71%. U.S. stocks were traded cautiously yesterday after the big rally last Friday. The Dows lost 0.28% to 17052. The S&P 500 edged 0.23% higher to 1974, while the Nasdaq Composite Index fell by 0.17% to 4425.

It looks like a potential double top to me if the S&P500 falls below the previous lows of June – near 1944. The breakout of this level will confirm the termination of the bullish trend and will lead to a middle term reverse.

On the data front, local investors should pay attention to RBA Governor Stevens’ speech at 13:00 AEST. Eurozone CPI will be at 19:00 AEST and the U.S. CPI will be out at 22:30. Finally, Existing Home Sales will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.