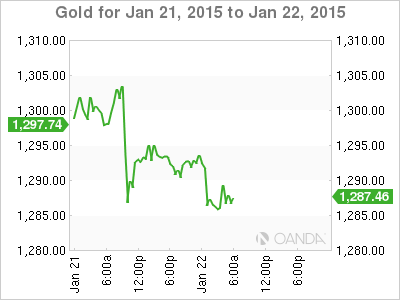

Gold is steady on Thursday, with a spot price of $1287.64 per ounce in the European session. The metal is in a holding pattern as the markets await a likely QE announcement from the ECB later in the day. There is also concern about the Greek elections on Sunday, as the Syriza party, which has promised to tear up Greece’s bailout agreement, leads in the polls. In the US, today’s highlight is Unemployment Claims, with the indicator expected to dip to 301 thousand.

Gold has taken a breather from its impressive run as it trades close to the $1300 level. Gold has been a winner from the recent volatility in the currency markets, as investors have looked to gold as a safe haven in recent weeks. The metal has posted strong gains since the SNB announcement last Thursday, when the SNB suddenly abandoned its cap that set EUR/CHF at 1.20, sending shock waves across global markets. This resulted in the euro recording sharp losses against the Swiss franc and the US dollar.

As the markets nervously eye the ECB policy meeting on Thursday, is this the calm before the storm? On Wednesday, French President Francois Hollande stated flat out that the ECB will announce a quantitative easing package at the ECB meeting. However, now that a QE is likely priced in, the question remains what will be the size of the program? The markets are anticipating QE of between EUR 500-600 billion, but some market players are saying that the ECB could go as high as EUR 800 billion. Will the euro take a hit on Thursday? The likelihood is yes, unless the ECB surprises with a “QE lite”, such as EUR 300 billion, which would be well below expectations.

XAU/USD 1291.75 H: 1303.38 L: 1290.15

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.