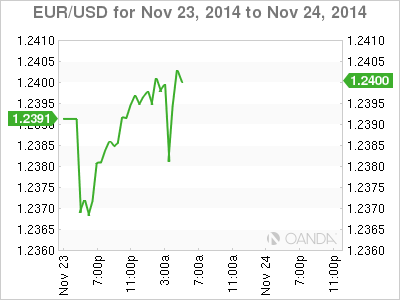

EUR/USD is stable on Monday, as the pair trades at the 1.24 line in the European session. On the release front, there was good news out of Germany, as Ifo Business Climate improved to 104.7 points in November. Later in the day, we’ll get a look at Belgian NBB Business Climate. In the US, it’s a quiet start to the week, with just one release on the calendar, Flash Services PMI. No change is expected in this reading.

The euro hasn’t had much to cheer about lately, and the currency took a tumble on Friday, losing over 150 points. This was a result of remarks from ECB head Mario Draghi, who warned that that inflation expectations were declining to levels that were very low and said the ECB is ready to expand its stimulus program. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank.

Eurozone and German PMIs softened in November, underscoring weakening activity in the manufacturing and services sectors. German Flash Manufacturing PMI dipped to 50.0 points, the separator between contraction and expansion. This marked the first month that the key indicator has failed to show expansion since June 2013. Eurozone Flash Manufacturing followed course, dipping to 50.4 points. This was the lowest reading recorded since June 2013.

In the US, there was a flurry of releases on Thursday. Consumer inflation met expectations, as CPI came in at 0.0% and Core CPI posted a gain of 0.2%. Unemployment Claims were almost unchanged, with a reading of 291 thousand. Philly Fed Manufacturing Index soared to 40.8 points and US Existing Home Sales improved to 5.26 million.

EUR/USD 1.2408 H: 1.2414 L: 1.2372

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.