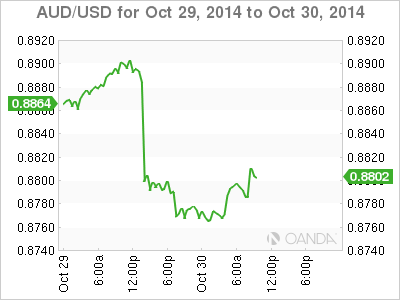

AUD/USD has posted gains on Thursday, as the pair trades in the low-0.88 range. On the release front, Australian Import Prices posted a second straight decline, coming in at -0.8%. In the US, GDP posted a strong gain of 3.5% in Q3, while Unemployment Claims showed little change, coming in at 287 thousand.

It was another solid performance from US GDP, which posted a strong gain of 3.5% in Q3, ahead of the estimate of 3.1%. Although this was short of the Q2 reading of 4.0%, the two readings mark the strongest six-month gain we’ve seen in ten years. Unemployment Claims increased slightly to 287 thousand, slightly higher than the previous reading of 284 thousand. However, the four-week average remains at multi-year lows, pointing to an improving labor market.

The US dollar posted strong gains on Wednesday, boosted by a hawkish Federal Reserve policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected the Fed completed the taper of its QE3 program. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

In the US, durable goods looked dismal in September. Core Durable Goods Orders dropped 0.2%, its second decline in three months. This was well short of the estimate of 0.5%. Durable Goods Orders followed suit with a decline of -1.3%. This was the indicator’s second straight decline and missed the estimate of 0.4%. There was much better news from CB Consumer Confidence, as the indicator climbed to 94.5 points, up sharply from 86.0 points. The easily beat the estimate of 87.4 and marked a 7-year high.

AUD/USD 0.8821 H: 0.8824 L: 0.8756

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.