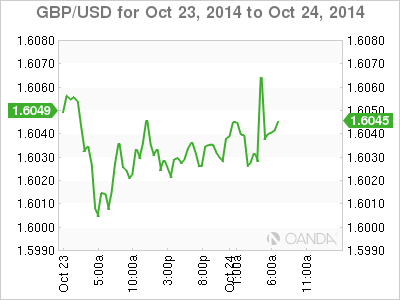

The pound is showing little movement for a second straight day, as GBP/USD trades in the mid-1.60 range in the European session. On the release front, British Preliminary GDP posted a gain of 0.7% in Q3, compared to 0.9% in the Q2 reading. The Index of Services came in at 0.8%, meeting expectations. Over in the US, today’s sole release is New Home Sales. The markets are expecting the indicator to soften this month, with an estimate of 473 thousand.

British Preliminary GDP is one of the most important economic indicators and is closely watched by the markets. The indicator dipped to 0.7% in Q3, down from 0.9% in the previous quarter, revised from 0.8%. This figure matched the forecast, so there was little reaction from the pound. Still, the drop in GDP is a cause for concern, coming on the heels of weak UK data from several sectors on Thursday. Retail Sales, the primary gauge of consumer spending, declined by 0.3%, its worst showing since May. BBA Mortgage Approvals dropped for a third-straight month, slipping to 39.3 thousand. CBI Industrial Order Expectations rounded out the bad news with a reading of -6 points, its worst showing since June 2013.

In the US, jobless claims were softer than expected. Unemployment Claims rose to 284 thousand last week, much higher than the previous reading of 264 thousand, and above the estimate of 269 thousand. However, the markets were not too concerned, as the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low. Meanwhile, weak inflation levels continue to point to slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI rose to +0.1%, an improvement from the previous reading of -0.2%. The estimate stood at 0.0%, so the markets clearly did not have high expectations. It was a similar story from Core CPI, which also posted a 0.1% gain, up from 0.0% a month earlier. This was shy of the forecast of 0.2% but still within expectations.

GBP/USD 1.6040 H: 1.6072 L: 1.6018

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.