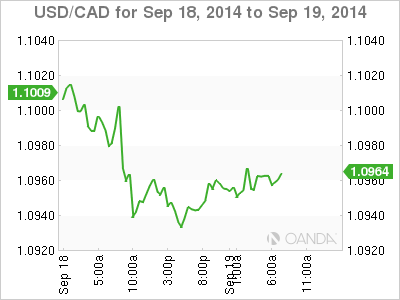

USD/CAD pushed closed to the 1.10 level on Friday, but has dropped sharply at the start of the North American session, as the pair trades slightly above the 1.09 line. The Canadian dollar has received help from a strong Canadian Core CPI release, with a gain of 0.5% in August. The news was not as positive from Wholesale Sales, which declined by 0.3%. Today's sole US release is the CB Leading Index, a minor event.

There was unexpected good news from Canada's inflation front, as Core CPI jumped 0.5% in August, compared to reading of -0.1% a month earlier. This beat the estimate of 0.2%. CPI improved to 0.0%, ahead of the forecast of -0.2%. However, Wholesale Sales slipped to a 4-month low at -0.3%, way off the estimate of +0.8%. Earlier in the week, Manufacturing Sales, a key release, jumped 2.5% in August. This easily beat the estimate of 1.1%.

Scottish citizens went the polls on Thursday in a historic referendum on whether to secede from the United Kingdom. The markets had expected a very close vote, based on polls leading up to the vote. However, at the end of the day, the No side won the vote in convincing fashion, with 55% of the vote, versus 44% for the Yes side. There had been predictions of a financial downturn in the UK if Scotland had voted for independence or if the vote was extremely close. As well, a vote for to secede would have raised thorny economic issues such as what currency would be used by an independent Scotland. So, the wee hours of Friday morning brought a tremendous sense of relief in British political and financial circles after the final votes were counted, as the United Kingdom will indeed remain united.

Over in the US, Unemployment Claims had looked sluggish in September, but that changed on Thursday, as the key indicator sparkled, dropping to 280 thousand, down sharply from 315 thousand in the previous reading. The estimate stood at 312 thousand. Building Permits was not as strong, dipping to 1.00M. This was shy of the estimate of 1.04M. There was disappointing news from the manufacturing front, as the Philly Fed Manufacturing Index slipped to 22.5 points, down from 28.0 a month earlier. The estimate stood at 22.8 points.

The Federal Reserve released a highly-anticipated policy statement on Wednesday. The statement reaffirmed that interest rates would remain ultra-low for a "considerable time" after the asset purchase scheme (QE) ends next month, but surprised the markets in hinting that once a rate hike was introduced, rate levels could move up more quickly than expected. As expected, the Fed trimmed QE by $10 billion/month, and the remaining $15 billion/month is scheduled to be phased out in October.

USD/CAD 1.0911 H: 1.0979 L: 1.0915

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.