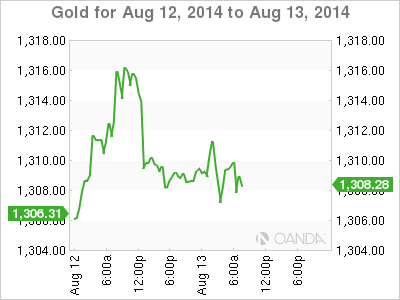

Gold is listless on Wednesday, continuing a week with little movement. The spot price stands at $1308.60 per ounce in the European session. On the release front, attention shifts to US retail sales data, with the release later today of Core Retail Sales and Retail Sales. The markets are expecting no change from last month's releases, but any surprises could affect the US dollar.

Gold hit a high of $1322 late last week, and has remained above the $1300 level since that time. The precious metal has benefited as the crises in Ukraine and the Middle East continue and could worsen at any time. The US has accused Russia of massing troops on its border with Ukraine, and tensions are high as the EU has slapped stronger sanctions on Russia, while Moscow has retaliated by banning many food imports from the West. In Iraq, Islamic State militants, who continue to make gains in Iraq, have attacked and displaced thousands of ethnic Kurds, which has resulted in a growing humanitarian crisis. US President Barak Obama has authorized air strikes against the militants in order to protect the Kurds and safeguard US interests. The situation in Iraq is volatile and could quickly destabilize even further. In Gaza, nerves are on edge, with a 72-hour ceasefire set to expire on Wednesday night.

In the US, employment indicators are under the market microscope, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate hike is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a rate move. There was positive news on Tuesday, as JOLTS Job Openings continued to improve and climbed to a 13-year high. We'll get a look at Unemployment Claims on Thursday.

13-year high. We'll get a look at Unemployment Claims on Thursday.

XAU/USD 1308.60 H: 1311.31 L: 1306.19

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.