EUR/USD has taken a breather on Wednesday following gains a day earlier. The pair is sitting above the 1.39 line in the European session. On the release front, French and German indicators both posted declines and were off expectations. In the US, there are no major releases, but all eyes will be on Janet Yellen, who testifies before Congress on Wednesday and Thursday.

Eurozone manufacturing data was a disappointment on Wednesday. German Factory Orders slipped 2.8% last month, its sharpest decline since October 2012. This was nowhere near the estimate of 0.3%. French Industrial Production didn't fare much better, posting a decline of -0.7%, short of the forecast of 0.3%. This was the indicator's worst showing since last July. There was some good news from Eurozone Retail PMI, which came in at 51.2 points, its first reading above the 50-point level in three months. This line is a separator between contraction and expansion.

Weak inflation continues to weigh on the Eurozone. Eurozone PPI posted its third straight decline in April, coming in at -0.2%. Last week, German Preliminary CPI did no better, also declining by 0.2%. Will the ECB announce any action at Thursday's policy meeting? ECB head Mario Draghi has stated that negative deposit rates or even QE are on the table, but the markets have heard this often before and these remarks have not had much effect, as the euro remains at high levels against the US dollar. However, with EUR/USD approaching the 1.40 line, Draghi will be under pressure to show that he is serious about tackling low inflation.

The Federal Reserve will be at center stage on Wednesday as Janet Yellen testifies before the Joint Economic Committee of Congress. Although recent employment data has been positive, Yellen has sounded cautious about the health of the economy, and if she reiterates these sentiments before Congress, we could see the dollar lose some ground. Meanwhile, the Federal Reserve trimmed its QE program by $10 billion last week. This marks the fourth cut since December, reducing the asset purchase scheme to $45 billion/month. The tapers are no longer creating headlines as they did just a few months ago, and the dollar didn't get any lift against its major rivals. What interested the markets more was the Fed statement that interest rates would remain low for a "considerable time" after QE ends. The markets expect QE to wind up before the end of the year, so we could see a rate hike in early 2015, depending of course, on the strength of the US economy and the job market.

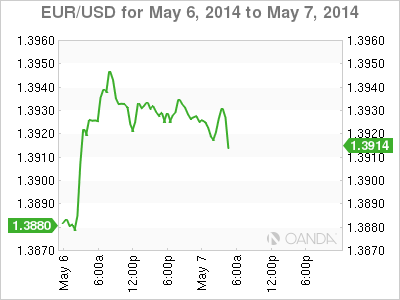

EUR/USD 1.3918 H: 1.3936 L: 1.3916

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.