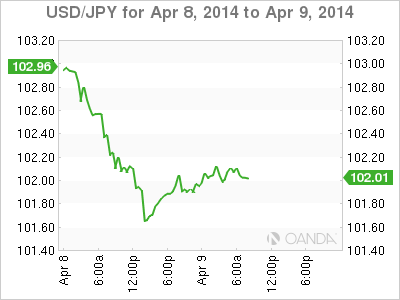

The Japanese yen is steady on Wednesday, as the pair just above at the 102 line in the European session. The Japanese yen posted huge gains on Tuesday, gaining over 100 points, as USD/JPY dipped below the 102 level. On the release front, Japan releases Core Machinery Orders later in the day. In the US, today's highlight is the minutes of the Federal Reserve's last policy meeting.

The Federal Reserve is back in the spotlight on Wednesday, as the markets await the releases of the minutes of its most recent policy meeting. Last week, Fed chair Janet Yellen sounded dovish in her outlook on the US economy, saying that inflation and employment levels needed to improve and monetary stimulus would continue for some time. So it shouldn't be a surprise if the minutes state that the US still has a long way to go on the road to recovery. If the minutes don't paint an upbeat picture of the US economy, the dollar could lose some ground. Currently, the Fed is purchasing $55 billion in assets each month under its QE scheme. There have been three tapers to QE so far, and Yellen plans to wind up the program in the fall, provided that the US economy does not run into any serious turbulence, which would possibly force the Fed to delay further tapers. As the tapers are dollar-positive, any delay would be bearish for the greenback.

The BOJ ended its policy meeting on Tuesday, and as expected, the central bank stated it was maintaining its monetary base at an annual level of 60-70 trillion yen each year. The government raised the sales tax last week, which will help reduce the country's massive debt but is likely to slow down the economy. However, BOJ Governor Haruhiko Kuroda said that there is no need to add stimulus at present, and the yen responded by continuing its rally. There is a strong likelihood that the Bank could introduce further easing in July, when the government is expected to introduce measures to stimulate the economy.

Late last week, US Nonfarm Payrolls improved in March, climbing to 192 thousand, compared to 175 thousand a month earlier. However, the markets were looking for more, with the estimate standing at 199 thousand. The Unemployment Rate also fell short of the estimate, as it remained unchanged at 6.7%. Although these numbers were not as strong as hoped, the Federal Reserve is expected to continue trimming QE when it meets at the end of April. These tapers mark a vote of confidence in the US economy by the Federal Reserve, and are dollar-positive.

USD/JPY 102.06 H: 102.16 L: 101.84

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.