European stocks have continued their Friday growth driven by two factors: stabilizing economy in Greece after bailout extension and emission of the euro by European central bank, estimated in the current month. Euro Stoxx 50 has jumped 15% since early January showing the best new-year start ever. Estimated overall surge in earnings among Stoxx 600 companies in 2015 can be 3 times as much as among enterprises on S&P 500 list. Besides, Markit and BME issued Manufacturing PMI in Germany today. It has marked an increase for the first time over 5 months. In 11:00 CET Consumer Price Index for February and Unemployment for January will become public in eurozone. The forecast is positive.

Nikkei expanded today underpinned by European stocks and the weakening yuan (Chinese central bank has reduced the rate). Against this background Nikkei has hit its 15-year high. Japanese Government Pension Investment Fund sold government bonds last year in the fourth quarter and bought domestic stocks worth $15 billion. That was another positive factor for Nikkei. The Pension Fund is going to continue replacing bonds with domestic stocks this year.

Rate cut in China boosted commodity futures since market participants believe it will support Chinese economy and pump up the demand for commodities. It should be pointed out that reduced rate weakened the Australian dollar because from now on most investors expect Central bank of Australia to do the same during the tomorrow meeting.

Oil prices added after OPEC reported production declining from 30.27 million barrels daily in January to 29.92 million barrels in February (the production has fallen to its weakest since June, 2014). This is below the introduced quota of 30 million barrels per day. Contraction in supply was caused by declining exports from Iraq and Libya.

Gold edged higher. The Indian finance minister offered to keep custom taxes on imported gold. Earlier they were expected to be reduced 10% before wedding season in May. Premium on gold in India has risen to $5 per ounce. Significantly, the demand on precious metals expanded after Chinese rate cut. According to Commodity Futures Trading Commission (CFTC), hedge funds have reduced their net long positions for gold and silver for 4 consequent weeks. However, the last week contraction has been the lowest in 6 weeks.

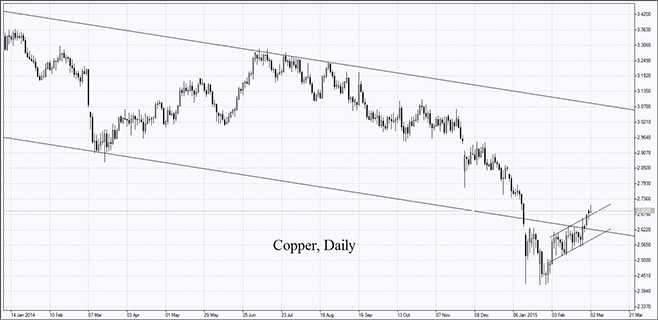

Copper posted a 6 week high with net short position still prevailing according to CFTC. UBS investment bank raised next year copper cost forecast from $5500 to $6700 per ton. To be mentioned, copper already costs $5947 at London Metal Exchange and 43280 yuan ($6900) at Shanghai Futures Exchange. We do not exclude that hedge funds will place net long positions this week.

Cold weather in US pushes wheat prices up despite wheat futures position (net short) increased the last week at CBOT. We suppose that weather may dramatically affect the quotes.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.