There were no special price movements observed on Friday as most financial markets were closed due to Good Friday. For the same reason, the currency markets in the UK, Germany, Australia, New Zealand and Hong Kong do not work at present. Today at 15-00 CET, we will see the Leading Indicator for March. In our opinion, the preliminary forecasts are positive. Since it is assumed to grow to the maximum since last November.

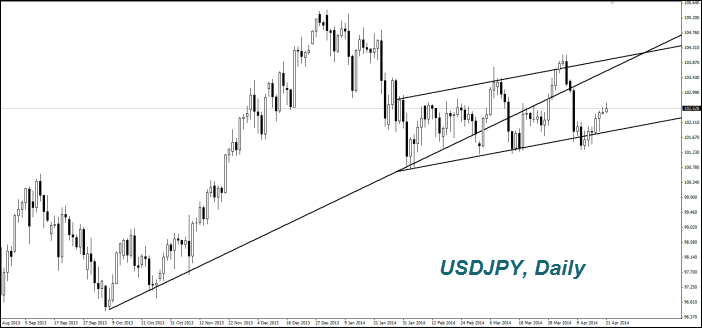

Today, there were the negative macroeconomic data coming out in Japan. Exports grew only by 1.8% in March, while imports rose by 18.1%. As a result, the trade deficit for the fiscal year (March to March) was the highest since 1979 and amounted to 13.75 trn. Yen. In our opinion, the outpacing growth in imports is due to increase in purchases of hydrocarbons after the Japanese nuclear power plant closure caused by the accident in Fokusime. This trend may be weakening the Japanese Yen (USDJPY). The next significant economic data for this week will come out only on Thursday. The important BOJ meeting is expected to be held next week.

Ukraine suffers from worsening in the political situation, this time it is in the South-Eastern part of the country. We do not exclude that it may cause weakening of the Euro (EURUSD). Since Ukraine is located in Europe and shares borders with the EU countries. Recall that there was a coup in this country at the end of last year. The politicians that came in power, announced the general elections on May 25th, where the president is to be elected. We believe that the situation in Ukraine may influence the EURUSD till that time comes.

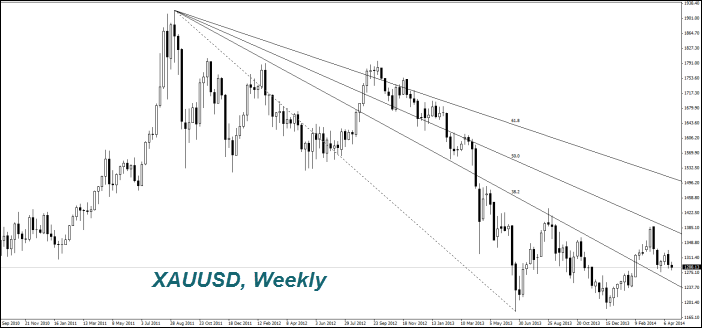

The Gold price (XAUUSD) reduced for the fourth consecutive day on the rising U.S. stock market. The Gold is considered as a safe heaven. The world's largest fund SPDR Gold Trust reported an outflow of 9.3 tons of Gold from its assets within the week. This had a negative impact on investors' sentiment. Meanwhile, there is a positive news for Gold. Chinese authorities have given the permission to another city (Beijing) for the Gold import. Previously, the Gold was allowed to be imported in the country only through Shenzhen and Shanghai. Usually, this is performed from Hong Kong. According to the World Gold Council, the increase in the in land points for the Gold import in China may signal about the desire of the People's Bank of China to increase the yellow metal volume in its foreign exchange reserves to diversify investments in the U.S. government bonds. Last time the Bank of China disclosed the information of the Gold reserve in 2009, when it amounted to 1.054 tons. In our opinion, if the People's Bank of China announced growth in stocks for the past time, the metal can get significantly more expensive. As market participants will decide that buying the Gold is a long-term plan of the Chinese authorities. This is a very powerful factor for the market. Recall that the fall in gold prices in 2012-2013 began with rumors that Cyprus has decided to sell most of its metal reserves. As a result, the quotes have fallen almost by 30%.

The Copper price has been within the enough wide neutral corridor for almost a month. We believe that its dynamics this week may affect the manufacturing activity index in China (Manufacturing PMI), which will be released on Wednesday morning.

Today, there is a decrease of agricultural futures observed in the U.S. amid improved weather conditions. The ministry of Agriculture of Egypt only slightly downgraded the Wheat forecast for this year from 9.5 million tons to 9 million tons. While market participants had expected the forecast decline to 7 million tons. This was an additional factor for drop in the Wheat prices.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.