On Wednesday, the U.S. Dollar Index has been in sideways for the second day in a row. The Fed Chairman, Janet Yellen tries to be cautious in her statements. Previously, her words evoked strong currency fluctuations. Yesterday Janet Yellen said nothing about the timing of possible rise in interest rates in the United States, noting that the decision will depend on the situation in the U.S. labor market and the inflation increase rate up to 2%. She noted that low inflation is more dangerous to the economy. These words caused a rise in the S&P 500 (SP500), Dow (DJI) and Nasdaq 100 (Nd100). The U.S. Dollar Index, reduced this morning on the contrary. As measures to increase inflation suggest the monetary policy easing, in other words, the U.S. Dollar emission continuation for redemption of government bonds and maintaining low rates. Yesterday's U.S. macroeconomic indicators were positive. Today at 13-30 and 15-00 CET we will see the U.S. labor market weekly data and the production index of the Federal Reserve Bank of Philadelphia (Philly). In our opinion, the preliminary forecasts are neutral. The number of unemployed people should slightly increase. Recall that tomorrow, financial markets in the U.S., Germany, UK, Australia, New Zealand, Hong Kong and Singapore will be closed due to Good Friday.

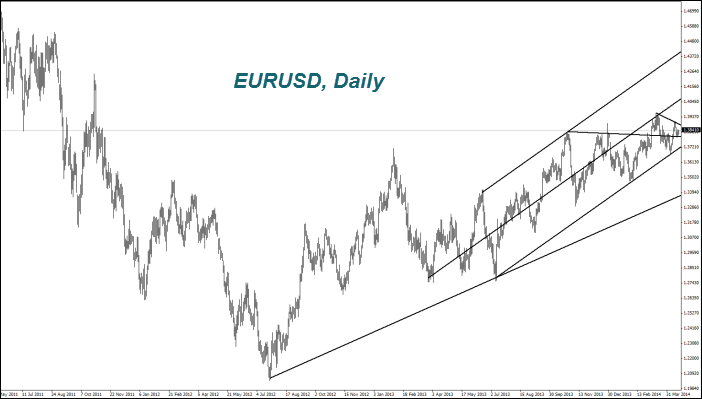

Inflation in the EZ for March was 0.5%. The core inflation (excluding energy, food, alcohol and tobacco) fell to 0.7% from 1%. Thus, the CPI has been in a dangerous zone of the ECB within six months. Besides that, individual inflation rates have tendencies of reduction. Thus, the EU and the U.S. have similar economic problems associated with the threat of deflation. They are intended to be solved the same way, such as money printing and low interest rates. At the same time the Fed has been performing the QE narrowing and considering raising the interest rates, since the end of last year, along with the U.S. economy recovery. The ECB, in contrast, only plans to start the QE. The discount rate is the same in both countries, at 0.25%. We believe that the expected contrary steps by the Fed and the ECB may lead to the EURUSD long-term downtrend formation. However, we would wait for the technical reversal signals by the current trend. The Euro rose by 2.3% against the U.S. Dollar and by 6% against the Yen within 6 last months. The next significant macroeconomic data from the EZ will come out only on April 22nd.

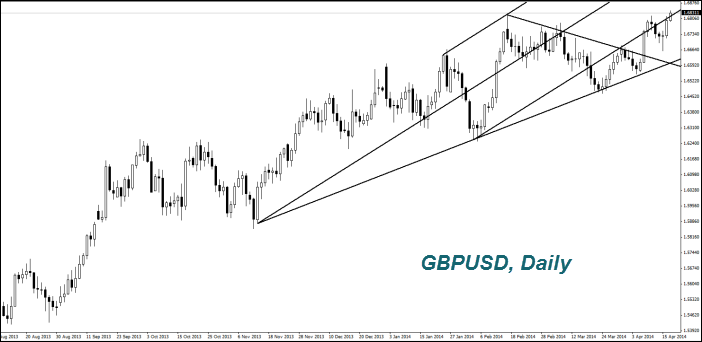

The British Pound (GBPUSD) reached its maximum since November 2009 due to positive economic indicators. The unemployment in February fell to 5-year low and amounted to 6.9%. This is much better than the preliminary forecasts. The Bank of England links the increased interest rates to the lower unemployment rate below 7%. Now it could theoretically make such an increase at the next meeting, held on May 8th. However, now most market participants believe that the current discount rate level of 0.5% will continue until the end of the year.

The Bank of Canada kept interest rates yesterday at 1%, for 29th time in a row. At the same time, it noted that it can be both increased and decreased over the next six months. The Bank of Canada has cut its economic growth forecast for this year to 2.3% from 2.5% in January. After that, the Canadian Dollar has shown a significant weakening, which looks like a growth the USDCAD chart. Today at 13-30 CET, we will find out about inflation in Canada for March. It is expected to increase, which may cause a further Loonie growth on the chart.

China refused to buy the U.S. genetically modified Corn worth of $2.9B. Note that this contains the Viptera MIR 162 gene, allowed to be eaten by people in the United States, as well as in some other countries. We do not rule out that the current situation could lead to the grain volume increase in the U.S. and reduce the Corn futures prices.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.