Yesterday's economic data in the U.S. caused mixed trends in the market. It happens quite rare. The ISM Manufacturing for March rose to 53.7 points from 53.2 points in February. This has had a positive impact on the stock market. As investors decided that the negative impact of extremely cold, winter weather on the U.S. industry has completely dried up, and the fundamentals are good. As a result, the S&P500 (SP500) closed at historical highs. Shares of Cisco Systems (CSCO) yesterday rose by 3.9% with large trading volumes and became the growth leader among the included in the index Dow Jones industrial average. We do not exclude a further increase in the stock prices for the company in case of successful IPO of its competitor, Arista Networks Inc.

The U.S. Dollar Index (USDIDX) fell on Tuesday. Currency market participants found the ISM Manufacturing increase not high enough because it was lower than the preliminary forecasts (54 points). Recall that the Fed chief, Janet Yellen noted that her department may extend the QE (monetary emission), unless the unemployment is decreased. Investors are reluctant to buy dollars before the U.S. labor market data release on Friday. Today at 14-15 CET we will see the preliminary U.S. employment review in March from the ADP. At 16-00 CET factory orders for February will strike out. The preliminary forecasts are positive, which can help strengthen the U.S. Dollar.

Japanese Yen (USDJPY) continued to weaken in line with our assumptions. It looks like a growth on the chart. Investors expect further easing of the monetary policy from the Bank of Japan and the negative impact of increasing the sales tax. Tomorrow night at 1-15 and 1-50 CET we will see the important data: PMI’s of business activity and investments in Japanese and foreign assets. In our opinion the projections are neutral, but it should be noted that most of market participants expect the yen to weaken down to 104-105 vs. the U.S. Dollar at the current stage.

The Euro (EURUSD) rose yesterday, as most of market participants do not expect rate cuts by the ECB meeting tomorrow despite the inflation slowdown in March to 0.5%, the lowest level during more than 4 years. An additional positive factor was a slight decrease in the number of unemployed in Germany in March and the PMI manufacturing growth in Italy and Spain. It rose in Spain to the maximum of the last 47 months. Today at 11:00 CET we will find out about the PPI in the Eurozone. We believe that the preliminary forecast is positive for the Euro.

The macroeconomic data in Canada on Tuesday were better than expected. This caused the Canadian dollar strengthening (fall on the USDCAD chart). Investors believe that the PPI growth increases the likelihood of hike in the interest rates. The PMI Manufacturing in March rose more than expected. This was an additional positive factor for the Canadian currency. Recall that the important economic data will be released in Canada tomorrow (Trade Balance) and Friday (Unemployment).

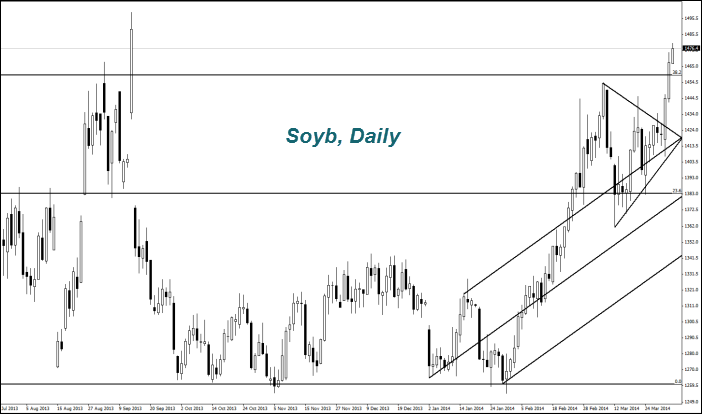

As we expected, the agricultural futures proceeded their movement according to the initial market reaction after the USDA report release. The Soyb and the Corn powerfully rose when the Wheat fell. Brazilian exports increased in March to 6.23 million tons from 2.79 million tons a month earlier, but this did not affect the quotes. But the news of the country contributed to the fall in the Sugar and Coffee prices. Brazil, had the rainy weather established, which reduces the potential crop losses of these cultures observed during the earlier drought. Note that yesterday's drop in the Sugar prices was maximal for a month. In previous reports we have already noted that it is in the medium-term downtrend

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.