Analysis for June 25th, 2014

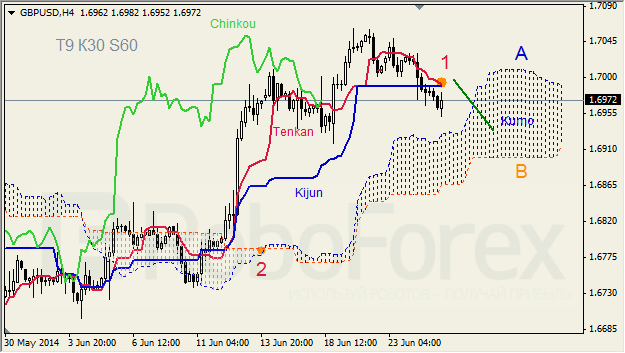

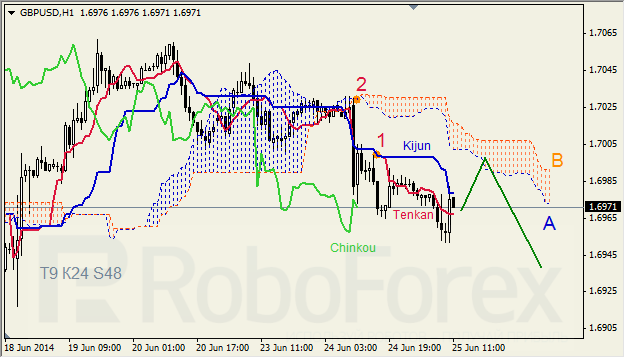

GBPUSD, “Great Britain Pound vs US Dollar”

On H4 chart Tenkan and Kijun have closer above Kumo and may cross via «dead cross» (1). Ichimoku cloud is going up (2). Lagging line of Chinkou indicator is located along the chart, price is located below Tenkan-Kijun, above Kume. Kijun can provide resistance and price may try to hold within a cloud.

At H1 Tenkan and Kijun are moving apart via «dead cross» below Kumo (1). Chinkou is on the chart, Ichimoku cloud is going down (2) In short-term perspective we can see resistance from Senkou A and further decline.

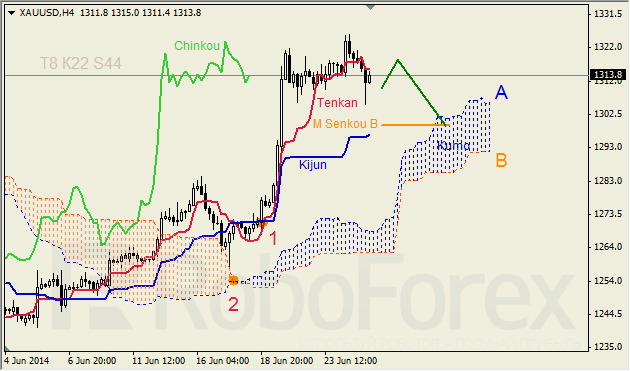

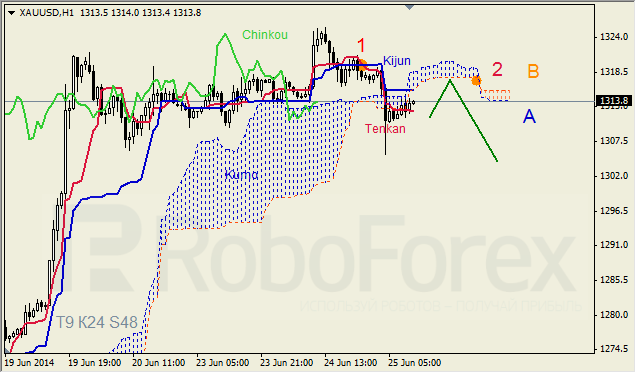

XAUUSD, “Gold vs US Dollar”

Tenkan and Kijun are influenced by the «Golden сross» (1). Ichimoku cloud is going up (2). Chinkou is coming closer to the chart, price is in the channel Tenkan-Kijun. In short-term perspective we can expect further decline of price after resistance from Tenkan.

At H1 chart we see that Tenkan and Kijun are moving apart via «dead cross» (1), Ichimoku cloud is going down (2), Chinkou is below the chart. In short-term perspective we can expect resistance from Senkou B and further descending trend.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.