Analysis for January 27th, 2014

GBP/USD

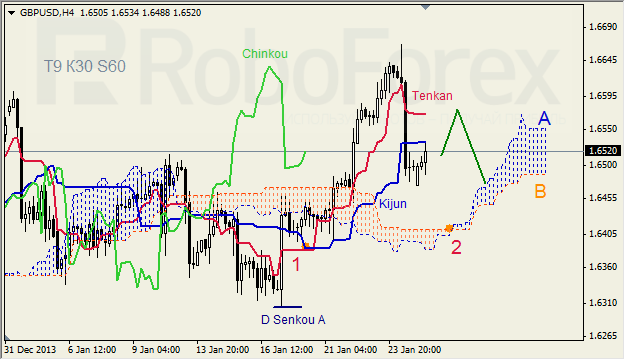

GBPUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); both lines are very close to each other. Ichimoku Cloud is still going up (2); Chinkou Lagging Span is close to the chart. Short‑term forecast: we can expect resistance from Tenkan-Sen, and decline of the price.

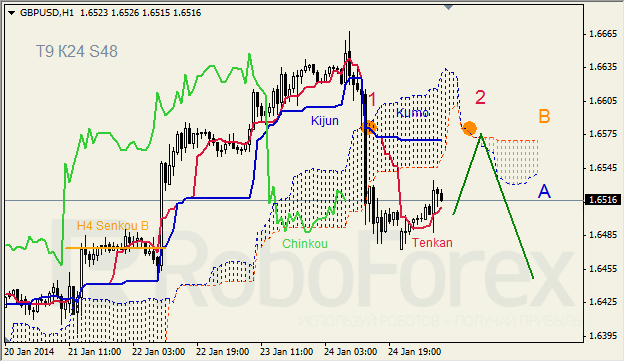

GBPUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1); Tenkan-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going down (2). Short‑term forecast: we can expect support from Tenkan-Sen and resistance from Kijun-Sen – Senkou Spans A and B.

GOLD

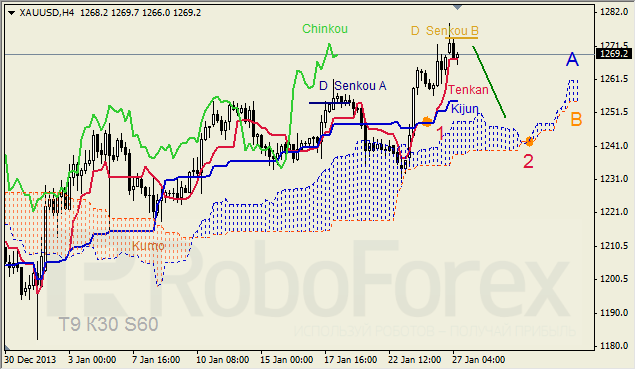

XAUUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). D Senkou Span B is resistance level; Ichimoku Cloud is going up (2); Chinkou Lagging Span is above the chart, and the price on Tenkan-Sen. Short-term forecast: we can expect decline of the price.

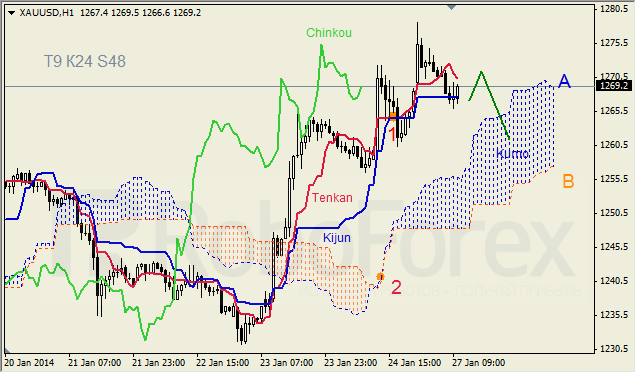

XAUUSD, Time Frame H1. Tenkan-Sen and Senkou Span A are directed downwards. Ichimoku Cloud is going up (2), Chinkou Lagging Span is close to the chart, and the price is inside Tenkan-Sen – Kijun-Sen channel. Short‑term forecast: we can expect resistance from Tenkan-Sen, and attempts of the price to stay inside Kumo.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold pulls away from record highs, holds above $2,400

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.