A strong U.S. jobs report today could set the tone for a dollar revival this month.

Year to date, the buck’s overall weakness would suggest that many of the speculative “long” dollar positions, built mostly on rate differentials, are now much lighter. If so, this would indicate that market condition are favourable for a data-led ‘big’ dollar correction.

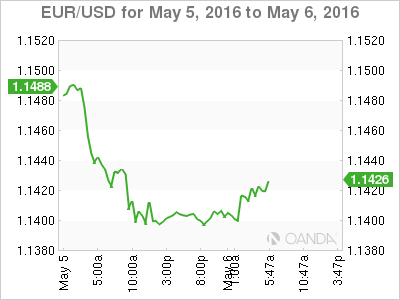

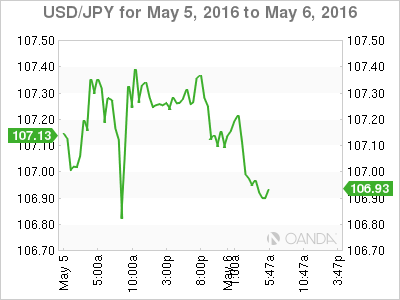

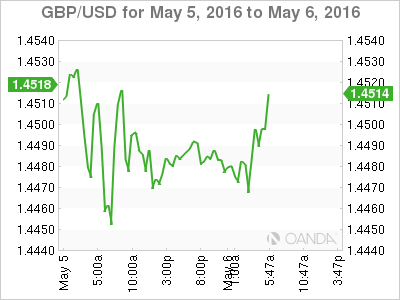

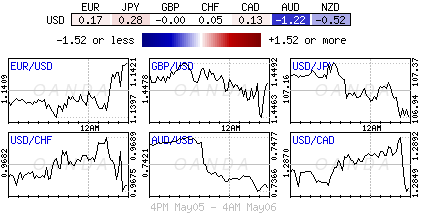

After this week’s early dollar meltdown, the USD comes into this morning’s job release broadly higher against most major developed currencies, while underperforming against emerging market pairs.

What to expect with non-farm payroll (NFP)?

Already this week’s jobs indicative reports could suggest a surprise in today’s release. Yesterday’s U.S weekly claims data (+274k vs. +260ke-biggest gain in 12-months) and April’s Challenger job cuts print (+65.1k vs. +48.2k-ytd layoffs the highest in seven-years) both saw surprising increases.

Combine them with Tuesday’s ADP data (+156k vs. +196ke) and the numbers signal a possible deceleration in the U.S job market. But will we see that reflected in today’s release?

It’s not all doom and gloom on the job front for this week. The market did see an improvement in the employment component of the ISM non-manufacturing survey released on Wednesday.

So, what should the investor be focusing on in today’s NFP?

Investors and dealers typically would be searching for clues for any re-pricing of Fed policy expectations. Recent Fed rhetoric has squashed U.S rate normalization occurring any time soon. To date, the market is pricing in only one rate hike and that’s in December, a far cry from the Fed’s original four dot proposal at the beginning of this year.

Dollar bulls require a U.S’s jobs report to show healthy job additions, higher wage growth and a labor participation rate showing some traction. However, with the U.S consistently ticking the job growth box for the past year, the market has naturally shifted its focus to wage growth. To date, the U.S’s impressive growth in jobs has generally not translated to meaningfully higher wages, at least until now. Any improvement in pay, along with a gradual recovery in the labor participation rate, is expected to lead to higher consumption.

The U.S still needs to move the needle on wages. Average hourly earnings need to show a monthly gain of +0.2% and then some. Anything on the “positive” side will have fixed-income dealers repricing current yield curves.

With non-farm payroll (NFP) ticking, or partially ticking off the first two requirements, the investor’s primary focus should shift to labor-force participation.

The U.S participation rate continues to hover near its historical lows – 62.6%. It’s healthy to see it edge higher even if it does happen to push the unemployment rate up (+5.0%). It would be considered a positive indicator of a healthier U.S economy.

If all the “stars” align, we should expect the gradual rate normalization message that the Fed seems to have muddled since last Decembers rate hike be back on the table.

When it comes to today’s report, do not just look at the headline print – the details and backwardation is just as important.

An NFP with a headline print of +200k or more will indicate that the Fed does not need to worry too much about the U.S’s labor market conditions just yet. A ‘big’ miss either side of expectations will only heighten market volatility. Anything close to expectations should be dollar positive now that positions have been pared.

Consensus

Despite this weeks job indicator misses, the market consensus is looking for a headline print of +210k and an unemployment rate to fall to +4.9%. Due to the positive calendar effects, many analysts are expecting average hourly earning to tick up +0.3% on the month.

Robust data will obviously favor the dollar – further support for the EUR, GBP or JPY will come from a much weaker headline or deeper revisions.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.