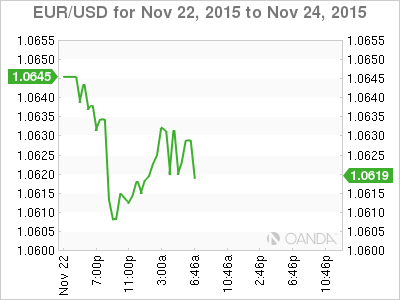

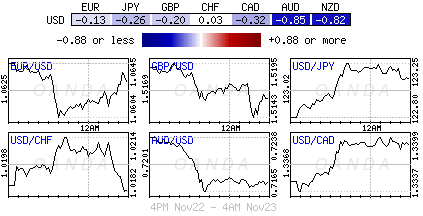

Despite the holiday shortened trading week, dealers and investors continue to prep for next months two-day FOMC meeting. Divergence in monetary policy remains the theme in FX ahead of several December important central bank meetings. Not surprisingly, the dollar remains on the offensive across the major pairs as short-term U.S rates continue back up in anticipation of the likely liftoff. Rate divergence has managed to push the EUR (€1.0603) to print a new seven-month intraday low, especially now that Draghi has pledged to “raise inflation as quickly as possible.”

Currently, it’s considered a forgone conclusion that the Fed will begin their rate normalization policy in December. The market event risk now is that the Fed fails to deliver. Aside from the Fed damaging their own credibility, many other central bankers have been waiting for the Fed to do their work for them and tighten. If the Fed happens to skip a beat, a plethora of G10 central banks will be expected to be rather proactive in Q1 of next year.

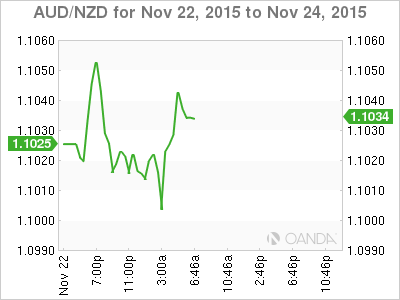

Down-under adjusts their yield curves: The Aussie (A$0.7175) is the weakest of the G10 pairs in the overnight session as dealers and investors focus on the weakness in commodity prices. Iron ore, the country’s biggest export continues to weigh heavily on the currency. Despite the RBA recently signaling that while low inflation gives it scope to cut rates again, Governor Stevens mentioned that they see evidence of strength in their own economy. Nevertheless, the RBA cannot ignore the impact of the weakness in the commodity sector, hence why the market seems to be unwinding the possibility of a “no” cut next month. Futures indicate that dealers are now pricing in a +15% chance of lower rates by the RBA. Not to be left behind, the Kiwi dollar (NZD$0.6497) is also being dragged down as the market focuses on the possible “underpriced” expectations of an RBNZ rate cut in a few weeks (Dec 10). The possibility of a double rate whammy, further easing by the RBNZ and a rate increase by the Fed (Dec 16), will certainly keep investors busy during the latter half of an illiquid holiday period.

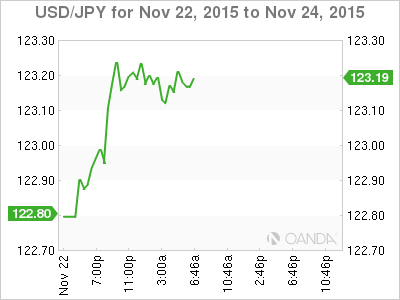

Japan’s Abe busy on holidays: It was not a surprise that the BoJ stood pat last week, but new government budget details are believed to be in the works. It’s thought that PM Abe’s cabinet has prepared a draft plan to deal with low inflation (announcement likely tomorrow). It’s expected that Abe intends to raise minimum wage by +3% next fiscal year and support CAPEX by rewarding companies that invest in equipment that improve energy use. The BoJ’s current QE program is conditional and subject to adjustment, nevertheless, further fiscal spending is a necessity for the BoJ to achieve its +2% inflation target. Technical traders continue to focus on the dollar’s key resistance level at ¥123.75, through here, the dollar will be expected to gather strong momentum (¥125.00, ¥127.50 and ¥130.00)

Eurozone PMI rises should not deter Draghi from QE: Data this morning would suggest that last months solid performance in the regions composite PMI (53.9e vs. 54.4) will provide some solid support for Q4. This is certainly a pleasant surprise for the ECB, especially after the previous quarters slowdown. The composite breakdown shows that both the manufacturing output and services indices increased, while there were encouraging gains in the employment and new-orders components. The regional breakdown revealed a third consecutive rise in the German composite (54.1). By contrast, the French PMI fell back to a three-month low (51.3), which raises the possibility of a renewed economic slowdown in Q4. The general consensus is that eurozone GDP growth of even +0.5% will not be sufficient to eat into spare capacity that still exists and help to boost inflation and hence why the market is expecting further easing by the ECB ahead of the Fed next month (December 3).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.