Fed favors prudent, but steady approach to rate hikes

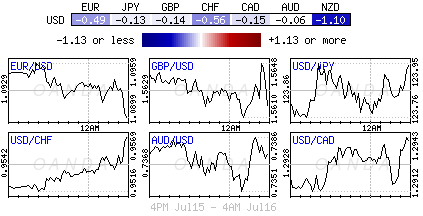

Dollar aided by diverging G7 monetary policy expectations

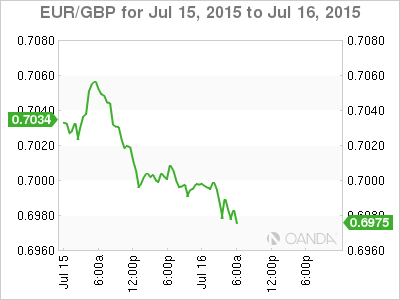

Hawkish BoE pressures EUR/GBP longs

- Loonie bulls looking to crude prices for support

It’s anticipated to be another action-backed day in Capital Markets, again dominated by rhetoric from Central Bankers. Fed Chair Yellen takes to the Hill for her second day of testimony on the semi-annual monetary policy report, this time in front of the Senate Banking Committee. While ECB’s Draghi is expected to be grilled in his Q&A session over Greece and its liquidity issues.

Ms. Yellen’s conversation in front of the House Financial Services Committee yesterday was at times a testy exchange. Nevertheless, the Fed Chair signaled to investors that the recent turbulence in Greece, China was not threatening the U.S economy enough to dissuade the Fed from plans to raise short-term interest rates for the first time in nine-years.

It’s prudent that U.S policy makers “proceed slowly with rate hikes, rather than to wait a long time and move aggressively if the Fed finds itself behind the curve.” Rate markets again are leaning towards a September hike. The prudent, but steady approach is expected to allow the Fed to be more flexible in unforeseen circumstance.

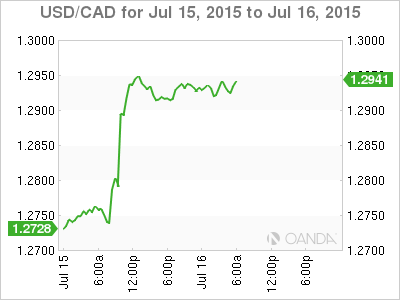

Ms. Yellen’s defiance, coupled with yesterday’s upbeat Fed Beige Book has the greenback printing multi-week highs versus most G10 currencies. With respect to commodity currencies like the loonie and kiwi, the dollar is encroaching on multi-year highs. The USD/CAD ($1.2950) has spiked to a six-year high after the Bank of Canada (BoC) cut overnight rates by -25bps, while the NZD/USD (0.6515) plummeted on the back of another weak Fonterra dairy auction. Investors should expect today’s public “tete a tete” with the Fed Chair to be closely monitored for any subtle surprises.

ECB’s Draghi to be grilled on Greece

This morning’s European Central Bank (ECB) monetary policy meeting will be very much affected by recent developments in Greece. In the overnight session, the Greek Parliament voted in favor of reforms mandated by their creditors that are expected to unlock more bailout funds and unfreeze the nation’s banking system.

For Greece, voting in favor averts an immediate disorderly default and Grexit. Nevertheless, risks do remain for Europe. Greece’s financial institutions are weak and there remains substantial Greek political skepticism on the bailout conditions. For investors event risk will remain heightened as there is uncertainty that Greece and its creditors can reach a final agreement on a third bailout program in time, as per the original demand.

With no additional deflationary risks on the horizon, coupled with a broadening eurozone economy, the ECB has no need to make any monetary policy adjustments. Instead, the market will focus intently on the post rate announcement press conference, where Draghi is expected to reveal how the central bank will proceed with the emergency liquidity assistance (ELA) for Greece.

It’s no surprise that the EUR is taking a beating across the board. Widening rate divergence arguments (hawkish BoE, dovish ECB) has EUR/GBP (0.6976) plummeting to a seven year low, opening up the EUR bear’s technical November 2007 target of €0.6920. Outright, the single unit has breached the €1.0900 handle for the first time since June 1, and the low May print of €1.0819 is expected to be the next major target.

Poloz Goes It Alone

The Bank of Canada’s (BoC) Governor Poloz could not rely on the Fed to do work for him. Higher U.S rates would weaken the loonie and support the Canadian export market, which has been obliterated by weak commodity prices. However, the fixed income market is finding it difficult to fully price in a Fed rate hike by year-end.

Yesterday, the BoC went alone and cut overnight rates by -25bps to +0.5%. Canada’s lower growth profile from a disappointing H1 of this year sealed the BoC’s positive actions. In its quarterly monetary policy report, the BoC forecasted that Canada would enter a recession in Q2. Governor Poloz now sees Q2 growth shrinking by -0.5%, down significantly from the +1.8% growth that it previously forecasted.

This would be the second consecutive decline of quarterly growth. “Real GDP in Canada is now estimated to have contracted modestly in H1 of 2015, resulting in a marked increase in excess capacity and additional downward pressure on inflation.” The cut and wait and see telegraphed message from the Governor is expected to show growth to pick up in Q3. This is the second time that the BoC has cut rates this year, and at +0.5% there still is room for the Canadian policy makers to do more if need be. The OIS market is currently pricing in a 50% chance that the BoC will cut rates again at its September meeting, and a 33% chance that the Bank will cut in again in October.

However, any ‘wait and see’ approach could leave USD/CAD with a small ‘dovish’ bias; potentially capping the loonies fall within striking distance of its multi-year lows (CAD$1.3035). Despite the USD in demand on pullbacks, loonie bulls will be looking to crude oil prices for some support.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.