Investors eye EU summit for direction

Don’t expect any clear cut decisions from Europe today

RBA takes a pass on rate change

Loonie bulls press panic button

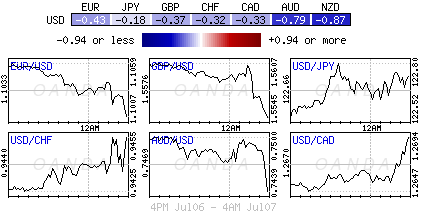

Due to the importance of today’s impromptu EU summit of eurozone leaders, major currency pairings have managed to keep to a relatively tight range amid low turnover in the overnight session.

However, it’s the U.S. dollar that continues to exhibit broad strength against major and commodity-related pairs due to concerns over possible Greek contagion and the impact of China’s equity market sell-off. Due to the significance of today’s meeting outcome, many investors and traders are prepared to sit the sessions out, waiting for some clarity from Euro leaders rather than being held hostage to dividing political rhetoric which can be costly.

With so many Greek ultimatums coming and going is proving rather expensive to the majority, and hence their preference to wade to the sidelines. Again the market must adjust to the incremental price changes across the various asset classes as optimism on a quick resolution is gradually being eroded. With direct financial contagion now perceived to be limited for now (periphery yields trading in an orderly fashion), it’s the political ramifications that are harder to predict and price.

Yet, market consensus does not see a clear-cut decision being delivered later today. The ‘ask’ is enormous for the future of the European Union – should EU leaders decide to resume bailout negotiations with Greece or prepare for Grexit? Be forewarned, words rather than actions could prove more costly throughout today’s session.

Reserve Bank of Australia (RBA) Takes a Pass

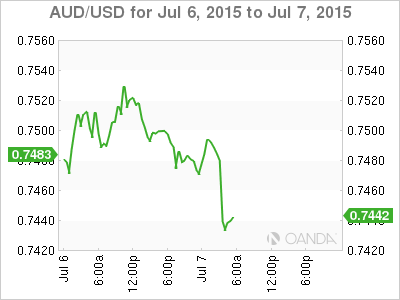

In today’s low interest rate environment, Central Banks are carrying the “big stick” and influencing the relative value of their domestic currency more so than fundamentals. The Reserve Bank of Australia (RBA) has been at the forefront in guiding its “overvalued” currency lower with Governor Stevens prepared to talk down the AUD at every opportunity. The RBA did not disappoint, it repeated its mantra that further AUD ($0.7430-six-year low) depreciation seems both “likely and necessary.”

Earlier this morning at their scheduled policy meeting, the RBA passed up an opportunity to strengthen fixed income expectations of a pending rate cut. Stevens left the cash rate target unchanged at a record low of +2%. The governor gave very little away during his press conference and is currently not rattled by Euro/Greek or China developments. Stevens acknowledged the regional problems, but did not go out of his way to highlight the issues. In retrospect, it’s probably more damaging to highlight the specifics of a troubling few weeks rather than that of a trend.

Money markets continue to price in a further rate cut by the RBA before year-end. Expect slow growth, weak inflation and soft business investment to be cited as the trigger.

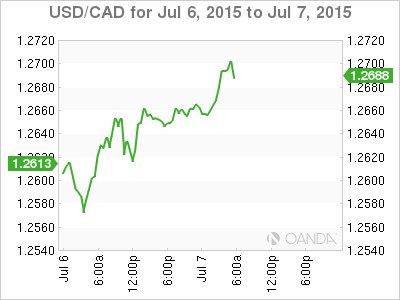

Loonie Self Destructs as BoC does not inspire

Petro currency shorts are all the rage after yesterday’s dramatic oil drop. Crude prices suffered their biggest one day loss in three-months Monday, falling -7% on the back of a delayed reaction to an inventory build up stateside last week and on hopes of a deal with Iran to lift sanction. This will create more of a crude supply glut.

The loonie in particular remains at the forefront of most traders minds ahead of the Bank of Canada (BoC) meet next week where Governor Poloz is eyed taking more dovish lines akin to the RBA and RBNZ.

Yesterday’s Bank of Canada (BoC) business outlook survey has not been able to inspire the loonie directly (CAD$1.2716). The general takeaway from the BoC’s quarterly business outlook survey was that “it could have been worse.” Analysts noted that there were only some marginal improvements on some of the forward looking indicators that measure sales, investments and hiring’s from the last go-around.

More importantly, the current and projected levels were well below recorded levels from one-year ago. The CAD, like other commodity and interest rate sensitive currencies (AUD, NOK and NZD), has been under immense pressure from the flight to quality trading strategies. The loonie has also been dragged lower by softer crude and gold prices. Currently, fixed income traders are pricing in a 100% chance of a -25bp cut by the BoC in October (51.3), and is now starting to price in another cut in December (47.5), albeit a small chance.

With the USD well supported across the board, expect better buying of USD/CAD on pullbacks. Significant market resistance remains at CAD$1.2750 opening up to a new “handle” relatively quickly. Investors will look to this morning’s Trade numbers for some guidance.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.